This week’s featured indicator looks at banking liquidity and how it affects stock market performance over time.

The core idea is that a rising trend in liquidity is bullish for the stock market because it reduces pressure on interest rates. Falling liquidity, by contrast, is bearish for stocks due to the upward pressure it exerts on interest rates.

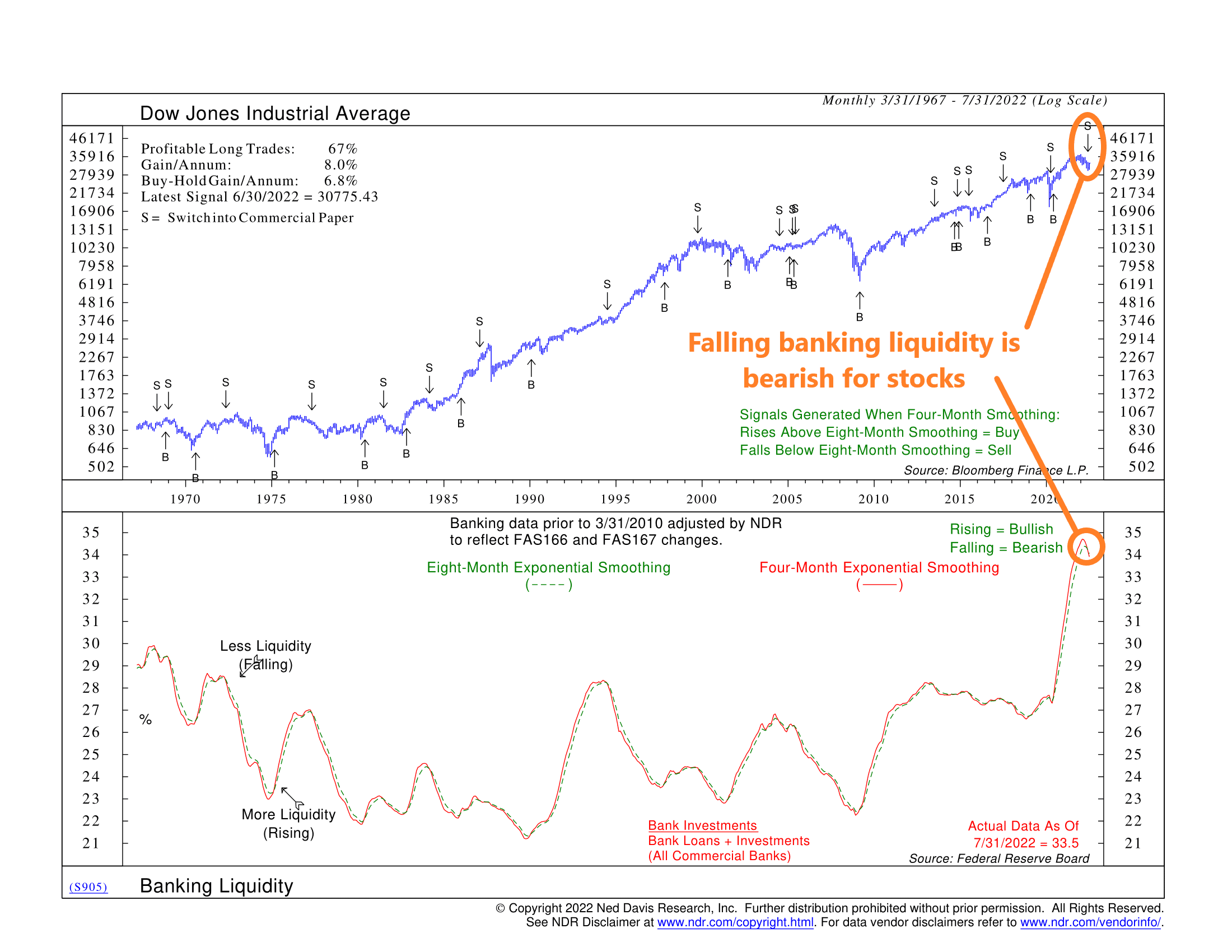

To get liquidity, we take the ratio of bank investments (usually U.S. Treasuries and municipal bonds) to bank credit (investments plus loans). We then use a pair of moving averages of this ratio to smooth out fluctuations.

When the 4-month average of the ratio (red line, bottom clip) falls below the 8-month average of the ratio (green dashed line, bottom clip), it triggers a sell signal for the Dow Jones Industrial Average (blue line, top clip). Conversely, a buy signal is generated when the 4-month average rises above the 8-month average.

Why does this work? Because when loan demand is high, banks sell their investments (i.e., bonds) to fund their loans. Banks like to do this because, in general, loans generate more income than bonds. But this means that money that normally would have gone into financial assets gets loaned out instead. Consequently, the selling of investments exerts an upward pressure on interest rates.

The same works in reverse. When loan demand is lower, banks pour more money into investments and less into loans. This increased banking liquidity raises bond prices and lowers interest rates. Lower rates, in general, are bullish for the stock market.

The analysis reveals that if you had followed the buy and sell signals from the strategy employed on the chart, you would have had a slight edge in performance versus just buying and holding the stock market via the Dow Jones Industrial Average.

Roughly 67% of the time, this strategy resulted in a profitable trade. The average gain per year of the strategy is 8% versus a buy-and-hold gain of 6.8% per year.

So, the key takeaway is that liquidity matters for the stock market.

Liquidity can mean many different things, but in this instance, we make the case that banking liquidity is an essential factor. Banks create liquidity in the system when they make loans, but their balance sheet actions can also affect interest rates, which in turn affects stock prices.

Accounting for this dynamic is vital to any stock market risk model.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.