Inflation took center stage again this week as the Federal Reserve cut interest rates for the third time—exactly as expected. The real surprise, however, came with their announcement that they foresee fewer rate cuts next year than they predicted three months ago. They pointed to stronger-than-expected economic data and persistent inflationary pressures as the main reasons.

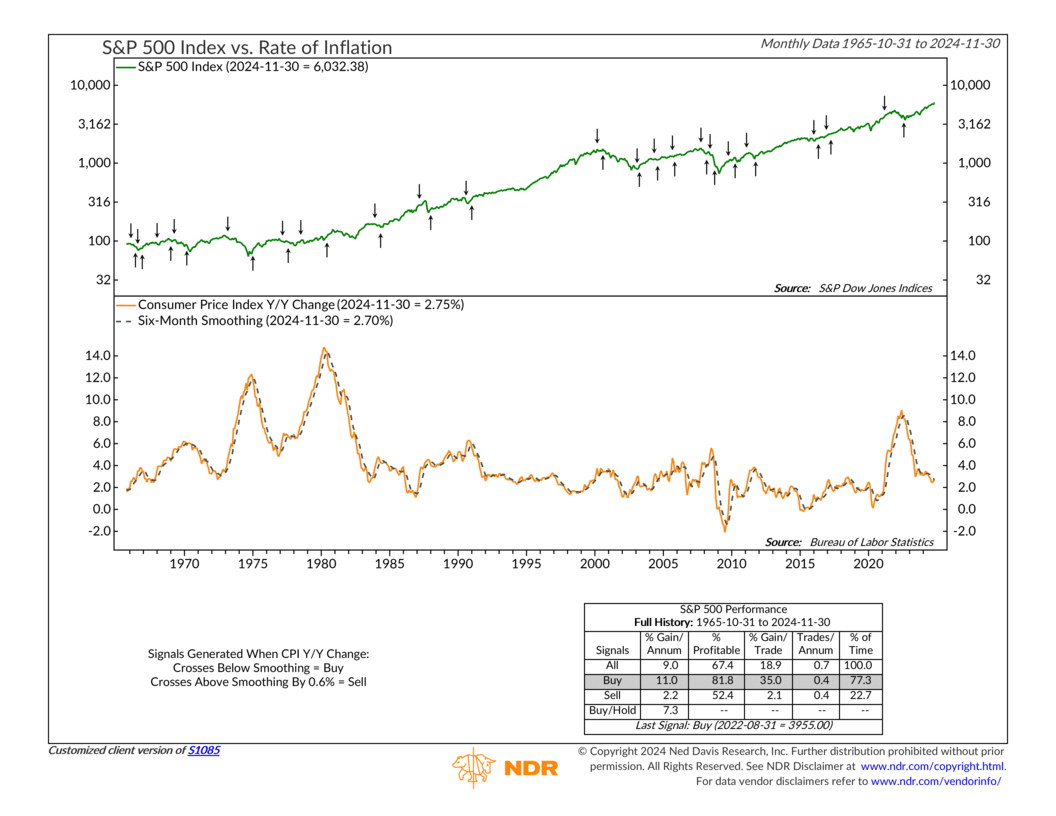

Given all this, it seemed like the perfect time to revisit one of our most reliable inflation indicators. This tool is simple but effective: it tracks the year-over-year change in the Consumer Price Index (CPI, shown as the orange line in the chart’s lower panel) and compares it to its six-month average (black dashed line in the same panel). The signals are straightforward—a buy signal occurs when the CPI falls below its six-month average, and a sell signal triggers when it rises above the average by 0.6% or more.

This indicator has proven to be a valuable asset. As the chart illustrates, its buy and sell signals have historically been accurate predictors of when inflation is likely to have a positive or negative impact on the S&P 500 Index (green line in the chart’s top panel). Since 1965, buy signals have aligned with 11% market gains, while sell signals coincided with about 2% gains—compared to a buy-and-hold average of 7.3%.

The last few buy and sell signals have been especially helpful in navigating the recent inflation surge and decline over the past few years. Right now, the year-over-year change in the CPI is 2.75%, slightly above its six-month average of 2.70%. It other words, it remains bullish towards equities.

However, the risk—and the point the Fed emphasized this week—is that inflation could resurge in the coming months. If it stays high enough, this indicator could flip to a sell signal, which would remove one of the bull market’s key drivers in this cycle.

So, the bottom line is that the Fed’s concerns are somewhat valid, making it essential to keep a close eye on this indicator in the months ahead. For now, it suggests inflation is under control, but staying vigilant will be key as the situation unfolds.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.