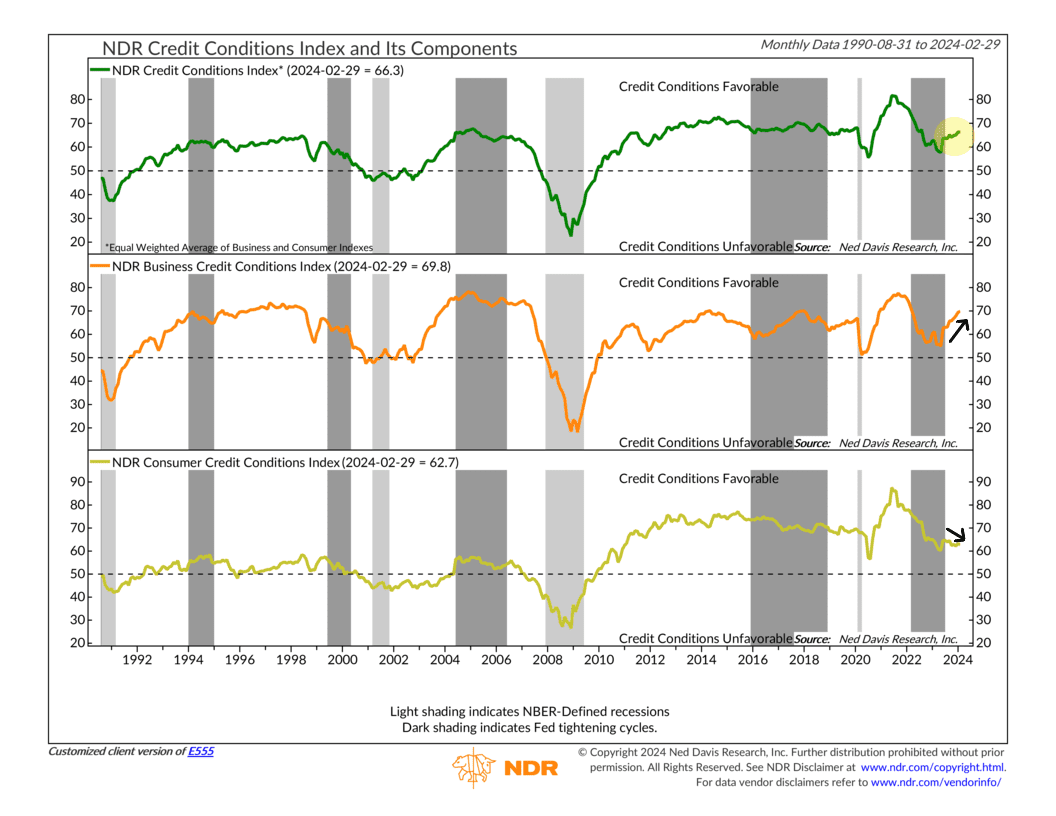

Good news on the financial front: credit conditions are on the upswing! According to the NDR Credit Conditions Index, our spotlight indicator this week, things are looking brighter for businesses and individuals looking to get loans or credit.

What are credit conditions? They’re basically a measure of how easily businesses or individuals can access credit or obtain loans from lenders in the economy. The NDR Credit Conditions Index (green line, top clip) gives us an overall view. It’s an average of two sub-component indexes.

The first sub-component is the Business Credit Conditions Index (orange line, middle clip). It looks at stuff like credit default swaps and asset/liability indicators to see how easily businesses can get credit. Then there’s the Consumer Credit Conditions Index (gold line at the bottom), which looks at things like mortgage-backed security spreads, delinquency rates, financial obligations ratios, and loan officer surveys.

Looking at the chart, you can see the most recent dark-shaded area that shows when the Fed started hiking rates in 2022 to tackle inflation. Credit conditions took a nosedive, making it tougher for both businesses and consumers to get loans or credit, which in turn put a damper on stock prices.

However, the good news is that the top-level credit conditions index bottomed out last year and is moving higher. Most of this is being driven by the surge in the Business Credit Conditions Index, a sign that businesses are finding it much easier to get financing. We think this will be a positive long-term underpinning for the economy and the stock market going forward.

One area of concern, however, is that the Consumer Credit Conditions Index has been trending lower since its initial turnaround last summer. Consumer spending accounts for roughly 70% of the economic growth in this country, so tighter credit conditions might create headwinds. It’s still above the “Unfavorable” cutoff line, which is a relief, but it’s something to keep an eye on.

Overall, though, the message from this indicator is clear: credit conditions are improving after taking a hit over the past few years. This positive trend should help support an already resilient economy, which many had thought would have slipped into recession by now.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S