The global economy is still running strong. That’s the message from our two indicators on display this week.

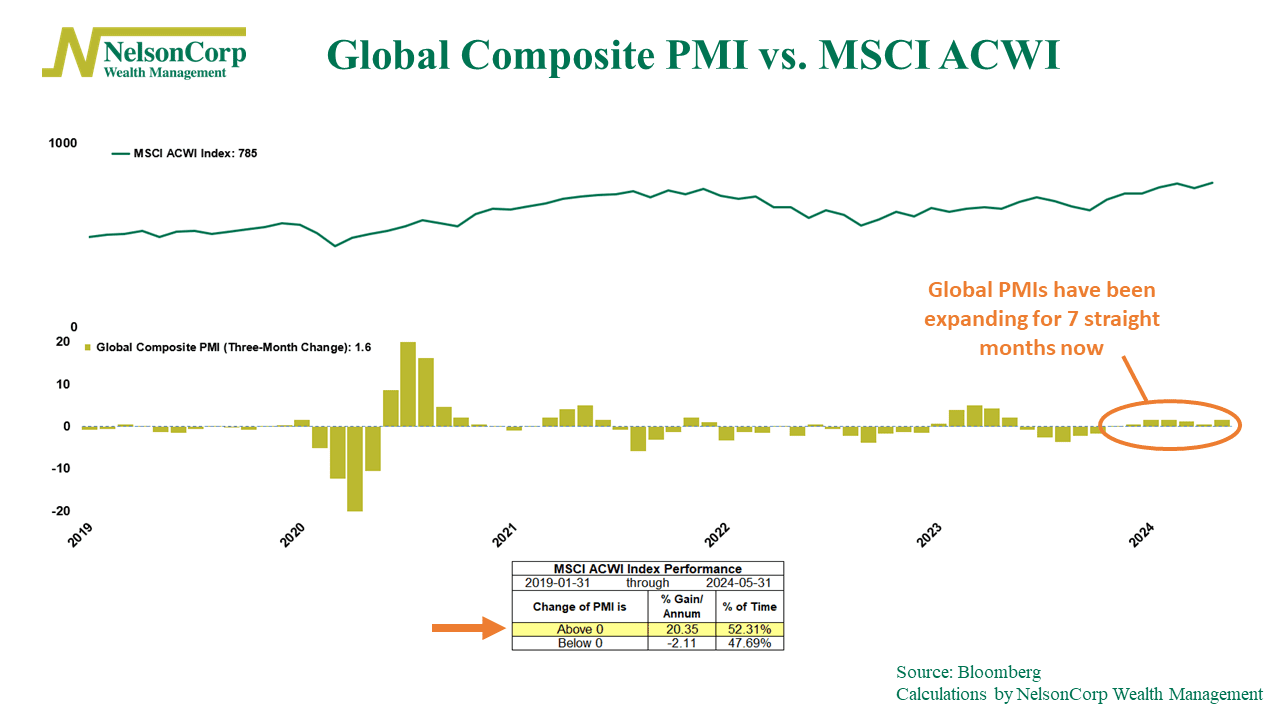

The first indicator, shown above, compares global stock market performance (top clip) to the 3-month change in the Global Composite PMI (bottom clip). The Global Composite PMI is an economic indicator that combines data from manufacturing and services sectors to give a quick snapshot of overall business activity.

The key insight of the indicator is that, historically, an acceleration in economic momentum (readings above zero) correlates with strong performance in the global equity market. Indeed, the performance numbers show that when the change in the PMI is above zero, the MSCI ACWI Index has risen at an above-average pace. The good news? After last month’s reading, the indicator has now been positive for seven straight months.

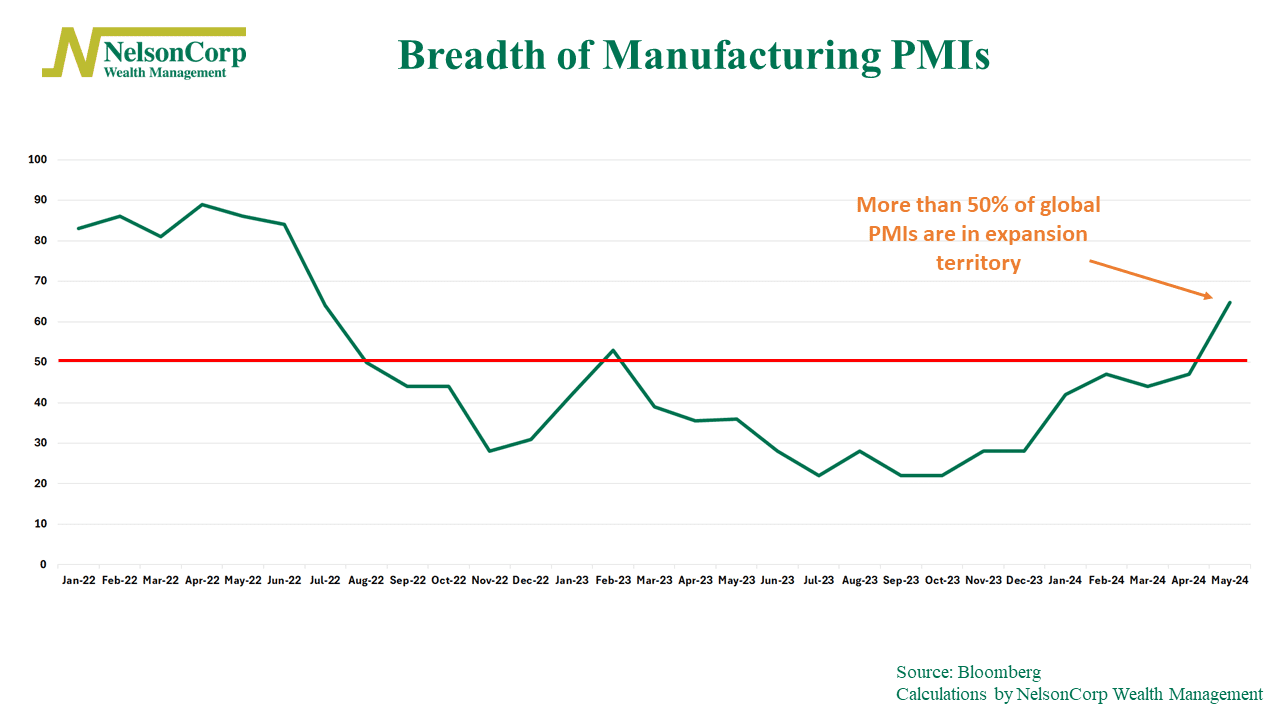

Additionally, our bonus chart below shows that due to continued improvement in May, the share of economies with manufacturing PMIs in expansion territory jumped to 65% last month, up from under half in April. This indicates a level of breadth that has historically aligned with ongoing global economic growth and robust equity performance.

So, the bottom line is that the global economy is maintaining a robust pace of economic growth. The slowdown from previous years appears to have turned a corner as global PMIs continue to push higher into expansion territory. If it can hold, this sustained global growth will go a long way toward supporting equity prices for the rest of the year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI is a widely recognized global equity index that includes stocks from both developed and emerging markets. The index is designed to measure the performance of large and mid-cap stocks across 23 developed and 27 emerging markets, providing a comprehensive benchmark for global equity market performance.