This week’s indicator is all about thrust.

In the physical world, thrust is the force that moves an object, such as a rocket, through the air. It takes a lot of force, generated in a short amount of time, to get something like a rocket into space. If the rocket fails to achieve this so-called “escape velocity,” it will fail to break free from the Earth’s gravitational pull and come crashing back to Earth.

Something similar happens in the financial world. When a large number of individual stocks are moving higher in concert—with a lot of momentum—we call it a “breadth thrust,” and it tends to be a positive sign for future stock returns. The absence of a breadth thrust, however, can be a warning sign.

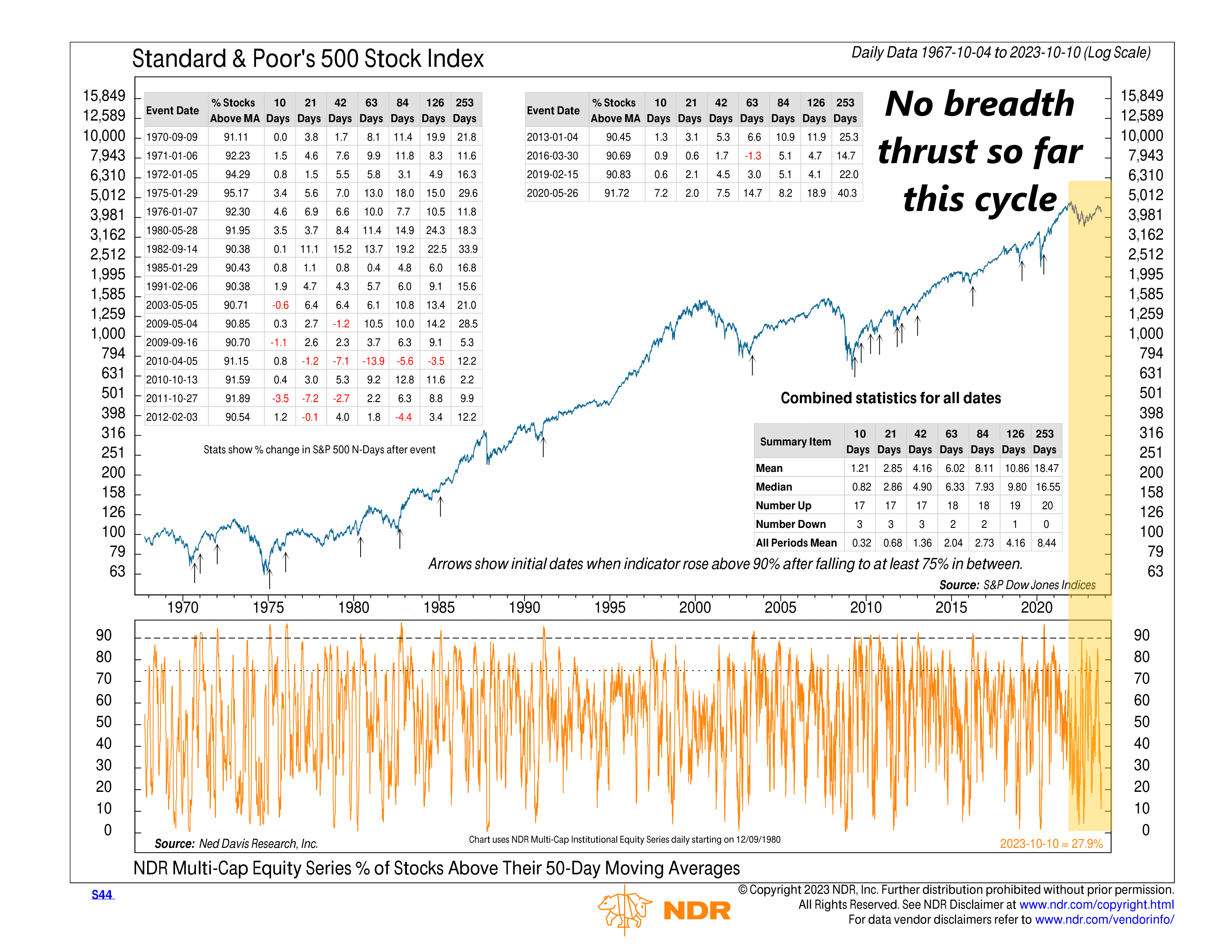

Our indicator above measures the stock market’s thrust by calculating what percentage of stocks in the S&P 500 stock index are trading above their average 50-day price (a little over two months of trading). If the percentage rises above 90% (after previously being below 75%), then a buy signal is generated.

The stock market loves these buy signals. Since the 1970s, the S&P 500 has never had a negative return one year after one of them. In fact, the S&P 500’s average return a year after a buy signal has been nearly 18.5%, compared to an average gain of 8.4% during all other periods.

Looking at the chart, you can see how these breadth thrusts have occurred during rallies off the bottom of nearly every major downturn in the stock market going back to the 1970s. And that’s why the current situation is a bit troubling. We never got a breadth thrust off this cycle’s bottom, which occurred in October 2022. It got close, and we got breadth thrusts from other indicators but never a buy signal from the percentage of stocks trading above their average 50-day price.

That’s not to say the stock market isn’t going to be fine here. As always, we consult many indicators—a weight-of-the-evidence approach—to answer that question. But we do think it’s worth noting that a “failure to launch” from this indicator in a bull market is a rare occurrence and something to be aware of.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.