Industrial production is one of those unglamorous economic statistics that not many people think about on a regular basis. But it is an important statistic nonetheless, as it measures how much physical “stuff” we are producing in vital economic sectors like manufacturing, mining, and utilities.

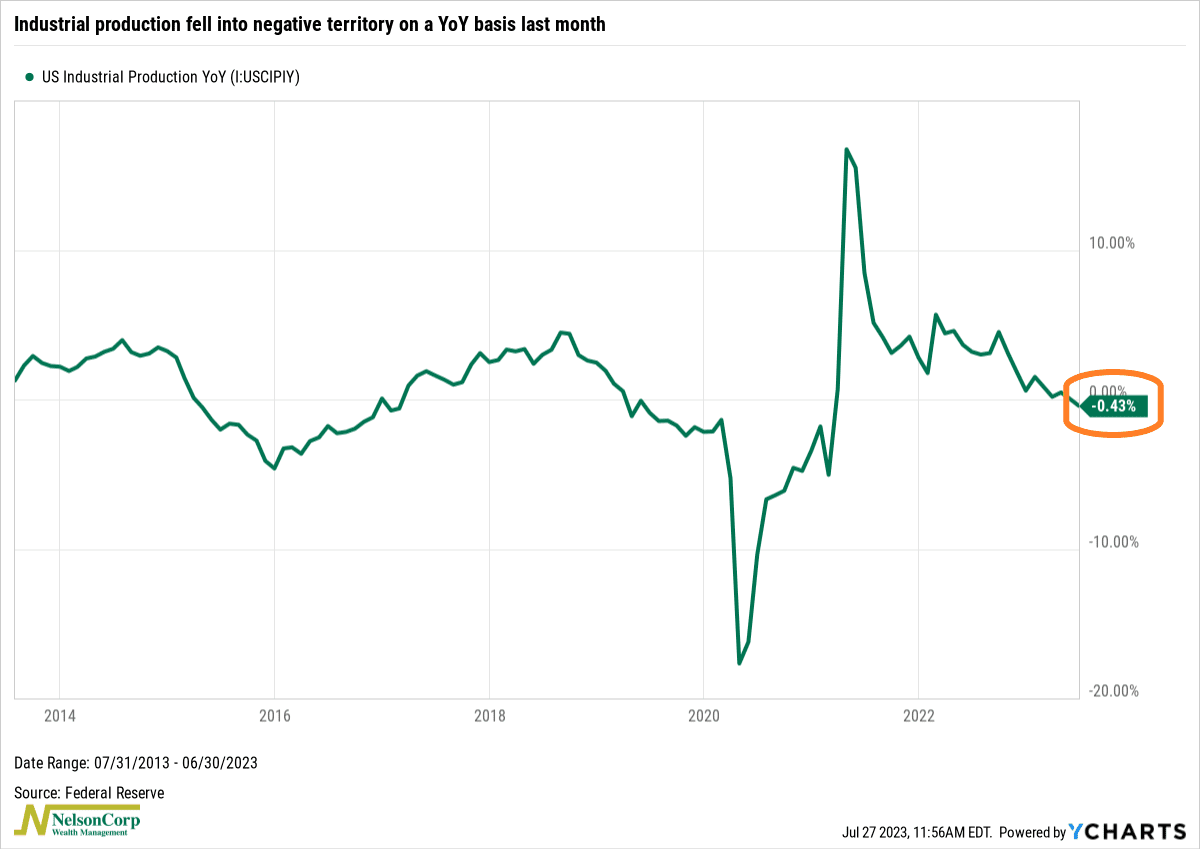

As the chart below shows, the year-over-year growth rate in industrial production has been slowing for some time now. And last month, it dipped into negative territory.

At first glance, that might seem like it’s bad news. However, we analyze industrial production differently as it relates to the stock market.

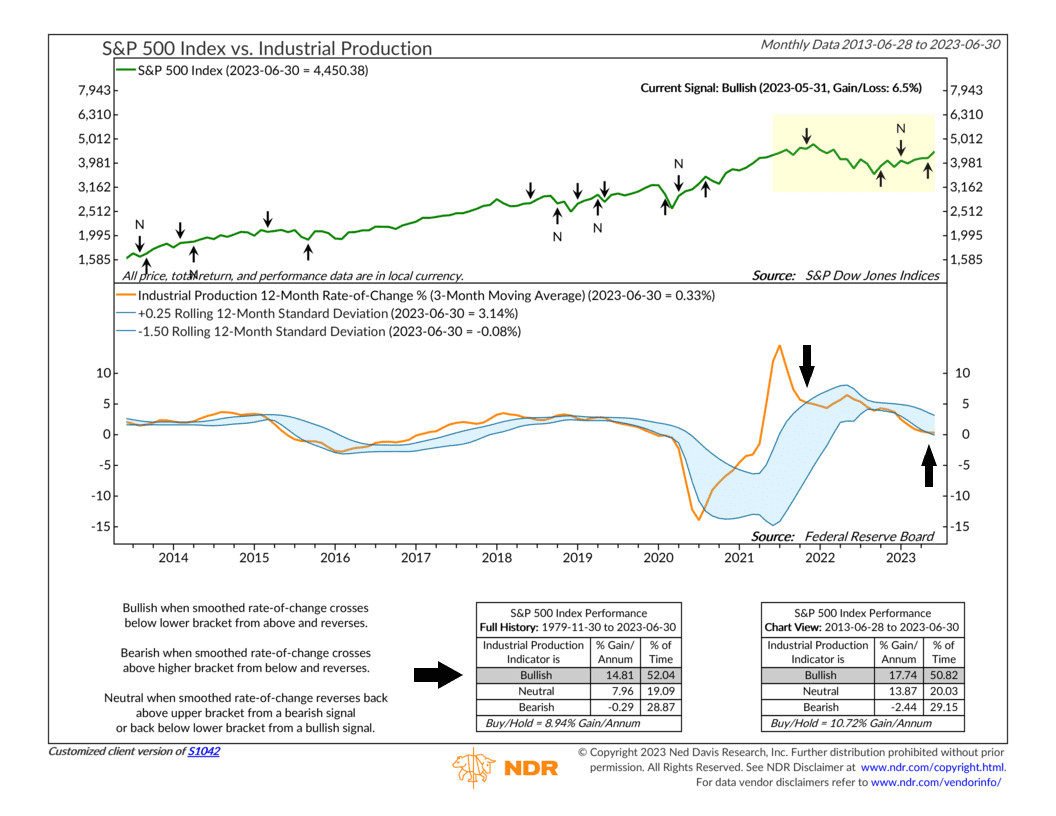

Our featured indicator below measures the same year-over-year (12-month) change in industrial production but also smooths it by three months and surrounds it with standard deviation bands.

Why the bands? Because we’ve found that when industrial production reaches excessive levels (above the upper band), it can lead to economic strain, meaning the economy soaks up most of the available liquidity (money), leaving less for financial markets. However, in the opposite case, when industrial production falls below the lower band, it means enough time has elapsed to correct whatever excessive production may have previously occurred. In other words, the manufacturing economy exerts very little demand on the available liquidity in the overall economy, leaving more room for stocks.

This is essentially what we’ve seen happen over the past year and a half. Industrial production growth peaked in mid-2021 and fell below the upper band in November 2021, triggering a “sell” signal for stocks. By October, however, the measure had shown signs that the decline in industrial production was slowing. A “buy” signal was generated, and after a “neutral” signal earlier this year, the measure is back on a “buy” signal for stocks.

The bottom line? Despite the gloomy headline that industrial production growth has reached negative territory, our analysis shows that much of the decline has already happened and that recent changes have actually been slightly positive. And that means that we’ve likely reached a point where growth in the industrial sector can positively influence stocks going forward.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.