This week’s indicator is all about central banks. What is a central bank? In simple terms, it’s a government agency that controls a country’s money and helps keep the economy stable. It does this by controlling interest rates, either cutting (decreasing) or raising (increasing) them.

The Federal Reserve—the United States central bank—made waves recently when it announced it would finally cut rates. But what’s interesting is that they aren’t alone. The rest of the world seems to be moving in a similar direction.

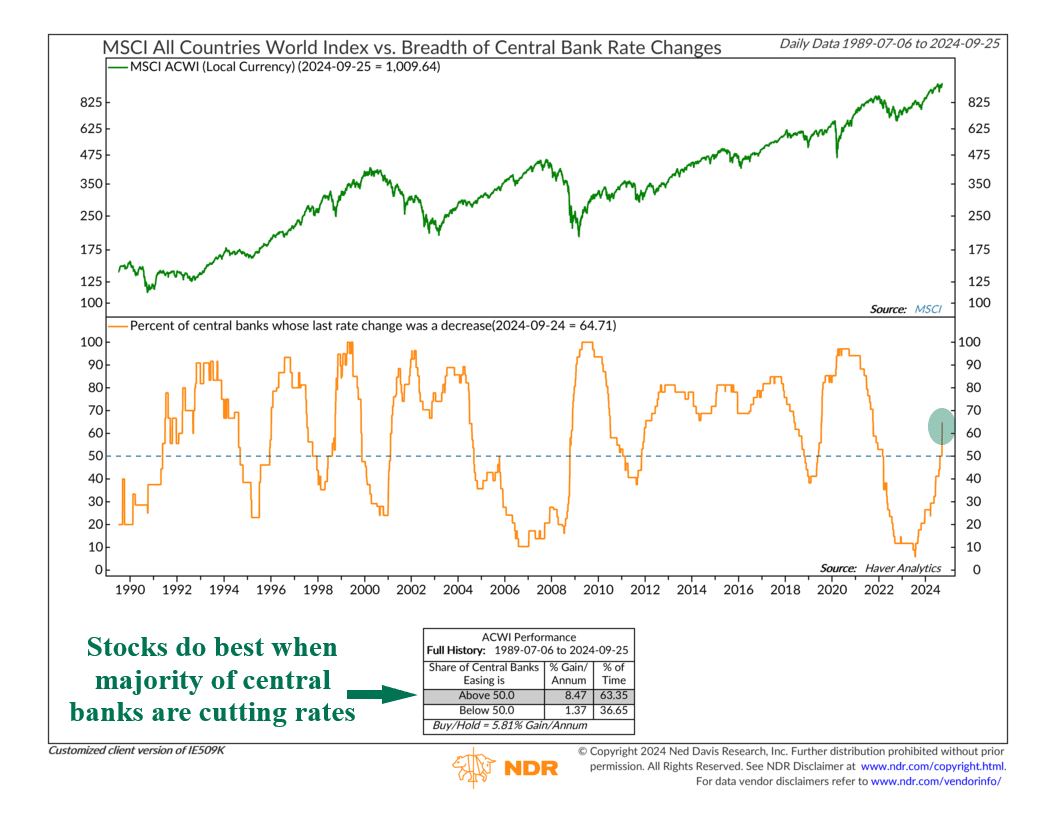

Our featured indicator above shows the percentage of central banks worldwide cutting rates (orange line). As you can see, it recently surged above 50%. Currently, nearly 65% of the world’s central banks are cutting interest rates. This is quite a big increase compared to last year when that number was virtually zero.

The key insight, though, is that this is very bullish for global stocks. Historically, whenever more than 50% of the world’s central banks are in cutting mode, global stocks—as represented by the MSCI All-Country World Index (green line)—have increased at an 8.45% annualized rate. When less than 50% are cutting, however, the annualized rate drops to 1.37%.

So basically, we’re going through a pretty significant shift in monetary policy—and it’s happening on a global scale. We’re still in the early stages, but investors should pay attention to these trends because the stock market tends to gain momentum when monetary policies are becoming more accommodative.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,935 constituents, the index covers approximately 85% of the global investable equity opportunity set.