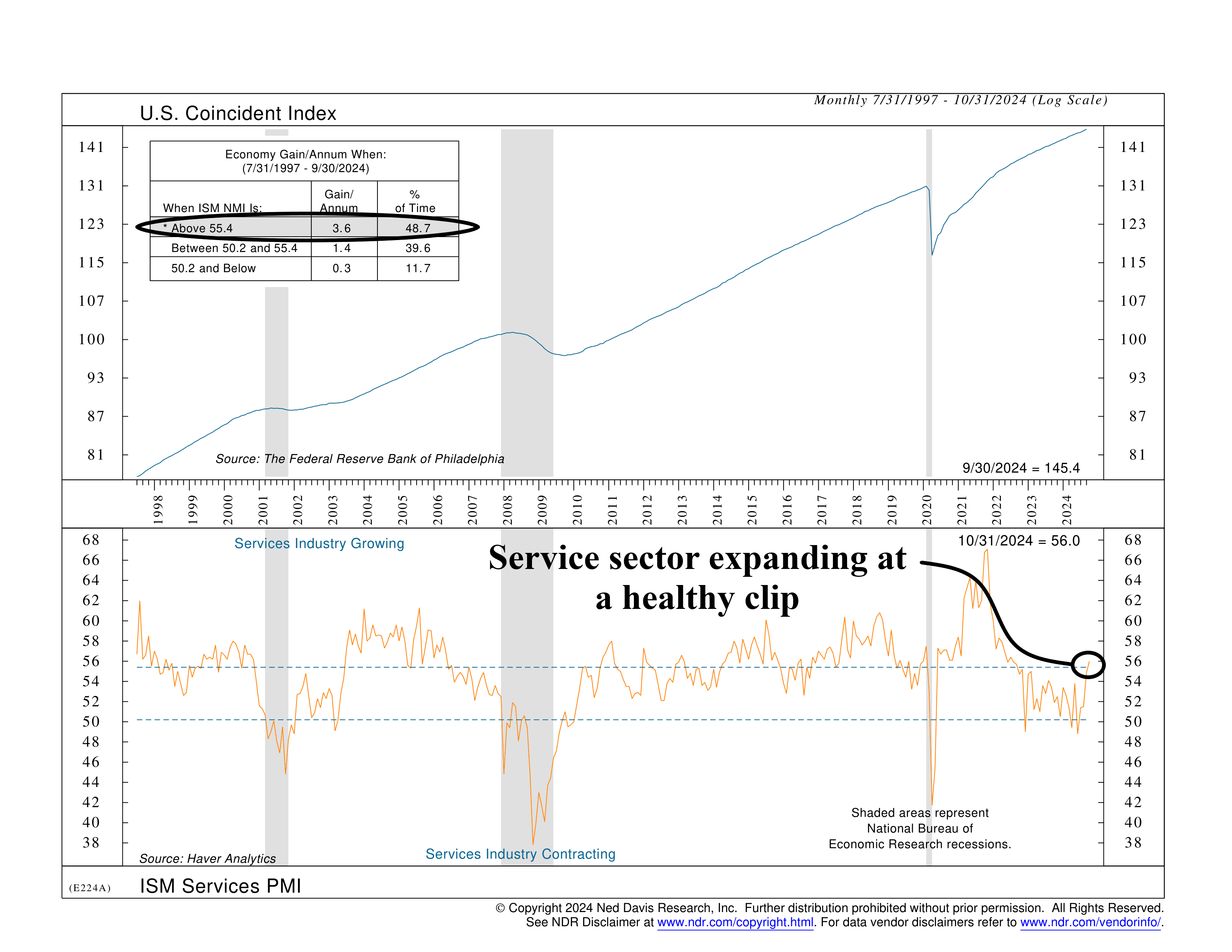

This week’s indicator is all about the ISM Purchasing Manager’s Index (PMI). It’s a monthly report that measures the health of the U.S. services sector. It’s based on surveys of managers in industries like healthcare, finance, retail, and more. Think of it like a thermometer for business activity. When it’s above 50, it means growth (more activity and optimism), and when it’s below 50, it means contraction (less activity and caution).

Last month, the PMI surged to 56.0, its highest level since July 2022 (orange line, bottom clip). This is big-time news because, as shown in the performance box on the chart’s top left, the economy typically grows at a 3.6% annualized rate when the PMI sits above 55.4.

But there’s more good news. While the service sector is booming, inflation seems to be sitting this one out. The ISM Prices Index—another part of the same report—has cooled off to pre-pandemic levels.

This is a rare combination: strong growth without rising prices. Normally, when demand picks up, prices follow suit. But right now, it’s like ordering a deluxe pizza that somehow stays calorie-free.

The takeaway? As long as services keep expanding and inflation remains under control, it’s good news for the broader economy.

For now, the data suggests we might avoid the worst-case scenarios—think recession or runaway inflation—heading into the new year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.