Everything is relative. Sure, you’ve probably heard that before. But it holds true in the stock market, too. Relative strength isn’t about measuring something in isolation. It’s about how it performs compared to something else—a benchmark.

Think of it like this. Maybe you can bench press 200 pounds. That sounds impressive. But if everyone else at your gym is pressing 250, your strength looks weak relative to everyone else.

The same idea applies to this week’s indicator. In this case, we’re looking at the relative strength of cyclical stocks versus defensive stocks. In other words, which side of the market is in control? Are investors favoring offensive, growth-driven sectors like tech and consumer discretionary, or are they retreating to defensive strongholds like healthcare and utilities?

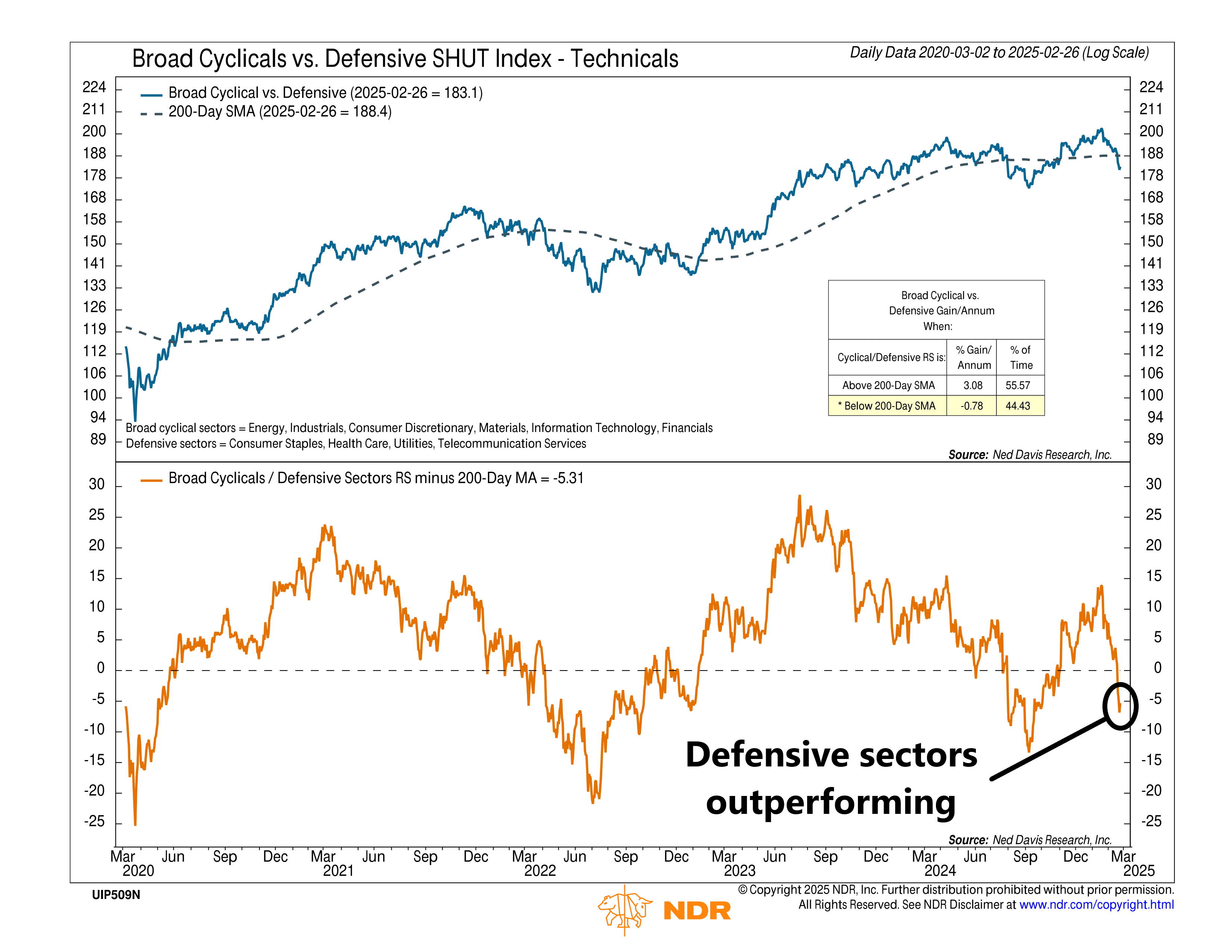

To measure this, we take the ratio of cyclical stocks to defensive stocks, shown as the blue line on the top clip. The black dashed line represents the 200-day moving average of this ratio—a key level that helps separate strength from weakness. The orange line at the bottom of the indicator measures how far the cyclical vs. defensive ratio is from that 200-day average.

When the ratio is above the 200-day moving average, cyclicals are leading, signaling confidence in growth. When it falls below, defensive stocks are in charge, meaning investors are shifting to safety.

Right now, the indicator has shifted to safety. The latest reading shows the cyclical vs. defensive ratio at 183.1, slipping below its 200-day moving average of 188.4. Historically, that’s an important distinction. When this ratio is above the 200-day average, the cyclical-to-defensive ratio tends to see solid annual gains of about 3 percent per year. When it’s below, returns turn negative.

Currently, the spread between the ratio and the moving average sits at negative 5.31. This means that cyclical stocks—including tech, consumer discretionary, and financials—are underperforming, while defensive sectors like healthcare, utilities, and staples are taking the lead. That’s a classic risk-off signal. Investors are playing defense, not offense, and that’s not the kind of setup that fuels a strong bull market.

For things to turn around, cyclicals need to regain their footing. That means stronger performance from tech and consumer-driven stocks—areas that typically lead in a true growth environment. Until that happens, the message from the market is clear: risk appetite is low, and defensive positioning remains the dominant trend.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.