We’ve received some good news about the state of the economy recently.

For example, the nonfarm payrolls report for January revealed that the U.S. economy added 517,000 net new jobs last month. This was way higher than the expected 185,000 jobs.

And on top of that, we also found out this week that retail spending by U.S. consumers grew 3% last month, the largest increase since March 2021.

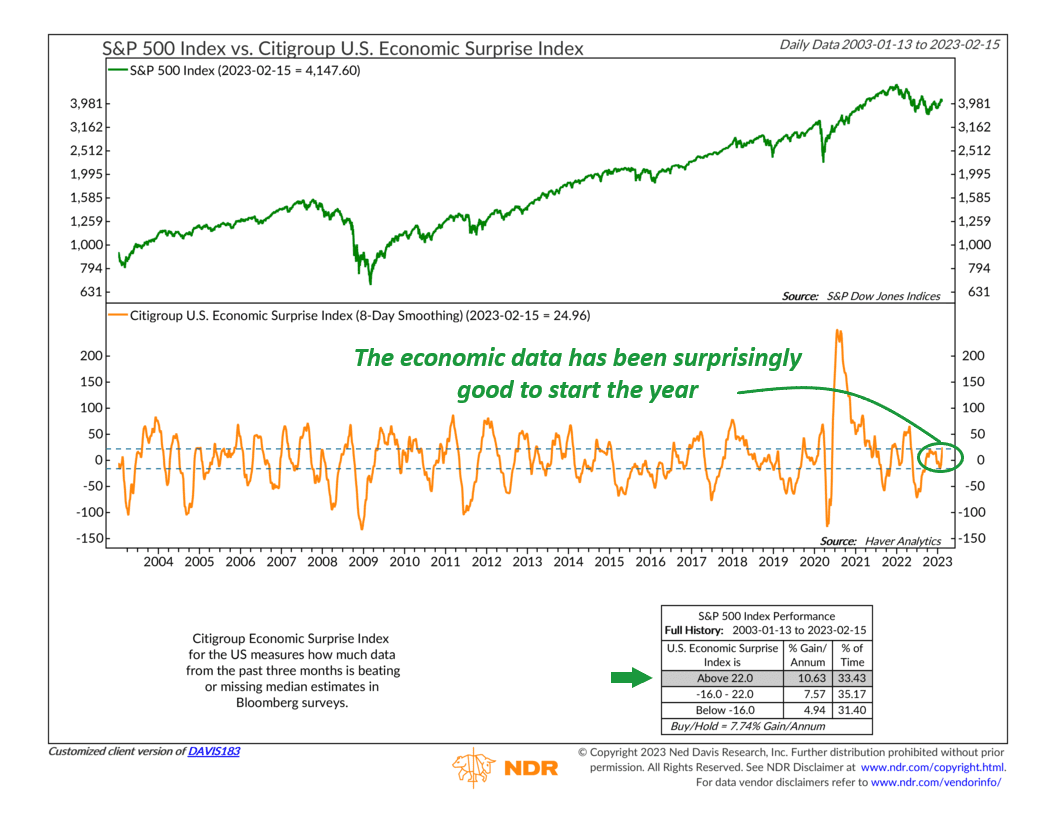

When the economic data comes pouring in better than expected, we like to look at a handy tool called the Citigroup Economic Surprise Index to help measure stock market risk.

We’ve talked about this indicator in previous blog posts. But as a quick refresher, this indicator looks at a bunch of economic data released over the past three months and then produces a measure that gauges whether the data are beating or missing analysts’ expectations.

This is useful because when the 8-day average of this measure is in the upper zone of the chart, the S&P 500 index has historically returned about 10.6% per year, on average. But stock returns tend to be much lower when the measure is in the lower zone.

As you can see on the chart, all the recent better-than-expected economic data has helped propel the Citigroup Economic Surprise Index into the upper bullish zone. This is the highest this indicator has been since May 2022.

The good news? The economy seems to be on a solid footing, even surprising to the upside, so a recession doesn’t seem like a big worry at the moment. Historically, stocks can do well in this type of environment.

The bad news, however, is that a more robust economy means the Federal Reserve will likely stay aggressive in its fight against inflation—with higher rates keeping a potential lid on stock price gains.

In other words, the economic environment could be best described as mostly neutral but maybe even slightly positive for risk assets right now.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.