As investors, we’re constantly looking for ways to maximize our returns while minimizing risk.

This often means we’re making an allocation decision between a safe investment, like bonds, and a riskier investment, like stocks.

To understand why one would choose one versus the other, it’s worth exploring the concept of the equity risk premium.

What exactly is the equity risk premium? I like to think of it as the price of the opportunity that comes with investing in stocks. Simply put, it’s the extra return investors expect to earn from holding stocks over safer investments like bonds. This additional return is meant to compensate investors for the added risk of investing in the stock market since stocks tend to be more volatile than bonds.

Generally speaking, the equity risk premium is calculated by subtracting the expected return on bonds from the expected return on stocks. This means that the equity risk premium will go up when the expected return on stocks rises relative to the expected return on bonds and vice versa.

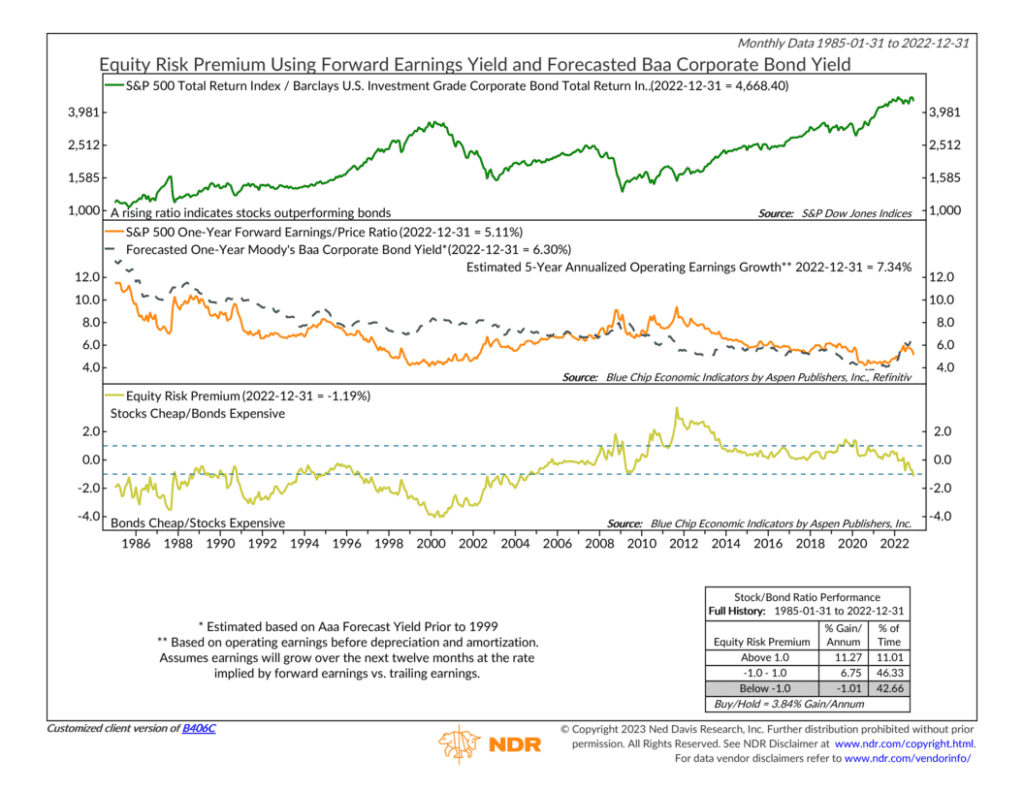

For our indicator above, we use a forecast of the Moody’s Baa corporate bond yield in one year as the expected bond yield and the one-year forward S&P 500 earnings yield as the expected return for stocks. These two measures are shown in the middle clip of the chart. The equity risk premium is then calculated and displayed in the bottom clip.

Historically, we’ve found that an equity risk premium higher than a reading of 1 has translated into strong returns for the ratio of stocks to bonds, shown as the green line on the top clip. In contrast, readings below -1 have resulted in the worst returns. Readings between -1 and 1 have generated average returns. To put it simply, the historical record says that a rising equity risk premium is good for stocks relative to bonds, whereas a falling equity risk premium means bonds are a better bet than stocks.

The takeaway? We’re always told that it pays to hold stocks long-term. And while that is generally true, it’s because investors demand compensation for holding riskier stocks in the form of an equity risk premium.

However, as our indicator shows, the equity risk premium is a moving target; it’s constantly changing. Additionally, there’s an opportunity cost that comes along with investing in stocks. In other words, sometimes, the math implies that bonds are a better value than stocks due to their more attractive yields.

So, in the end, a tool like this can ultimately help investors make better decisions when determining their overall stock/bond allocation mix.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.