Short-term rates are on fire. The 2-year Treasury rate—a rough proxy for where the market thinks the Fed is headed with interest rates—rose to its highest level in 17 years this week.

This is significant because sharp increases in short-term interest rates have historically been bearish (negative) for stock returns.

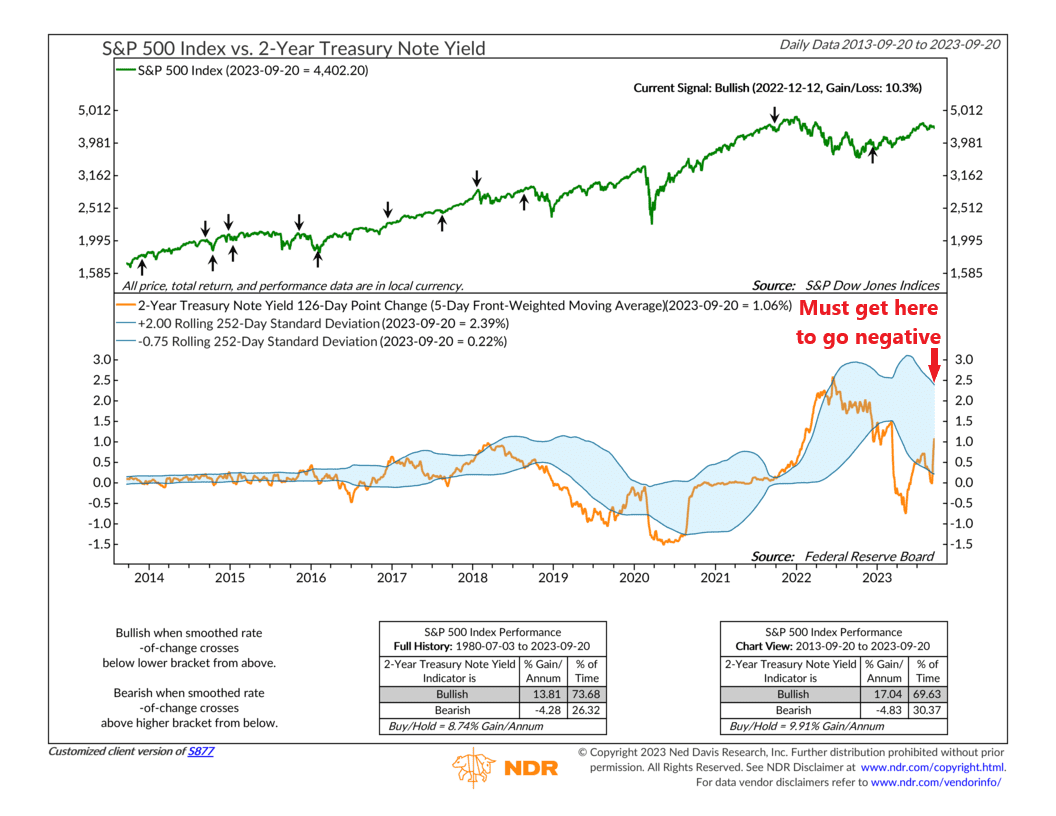

For example, this week’s featured indicator reveals that abrupt increases in the 2-year Treasury rate’s 6-month momentum (orange line, bottom clip) have typically coincided with negative returns for the S&P 500 stock index (green line, top clip).

But here’s the thing. The indicator also uses standard deviation bands to determine where the metric is trading relative to its recent history. And since the 2-year rate has been unusually volatile lately, the standard deviation “cloud” (blue-shaded area) is extremely wide, making the recent rate surge look less ominous.

In fact, as you can see on the far right-hand side of the chart, the 2-year rate’s momentum still has some distance to rise before it breaches the upper standard deviation band, which would trigger a sell signal for stocks.

That should provide a bit of comfort for stock market bulls. For the time being, the indicator remains on its bullish signal from last December, when the 2-year rate’s momentum fell below the lower standard deviation band. That was a timely signal, as the S&P 500 has been up roughly 10% since then.

Nonetheless, rates are still rising. And after the Fed’s meeting on Wednesday, the 2-year rate shows no sign of slowing down. At this rate, a negative signal could be right around the corner.

The bottom line? A negative signal at this juncture would be an unwelcome development for our models. We aren’t there yet, but we could be headed that way. All else equal, that would send our interest rate composite into negative territory—and that would be a sign that perhaps we aren’t entirely out of the woods just yet.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.