The unemployment rate is the one economic indicator most people are likely familiar with. To state the obvious, we don’t like a high unemployment rate; it means people are out of a job, and that’s not good for anyone. But this week’s featured indicator shows that the stock market reacts differently to the unemployment rate than you’d probably think.

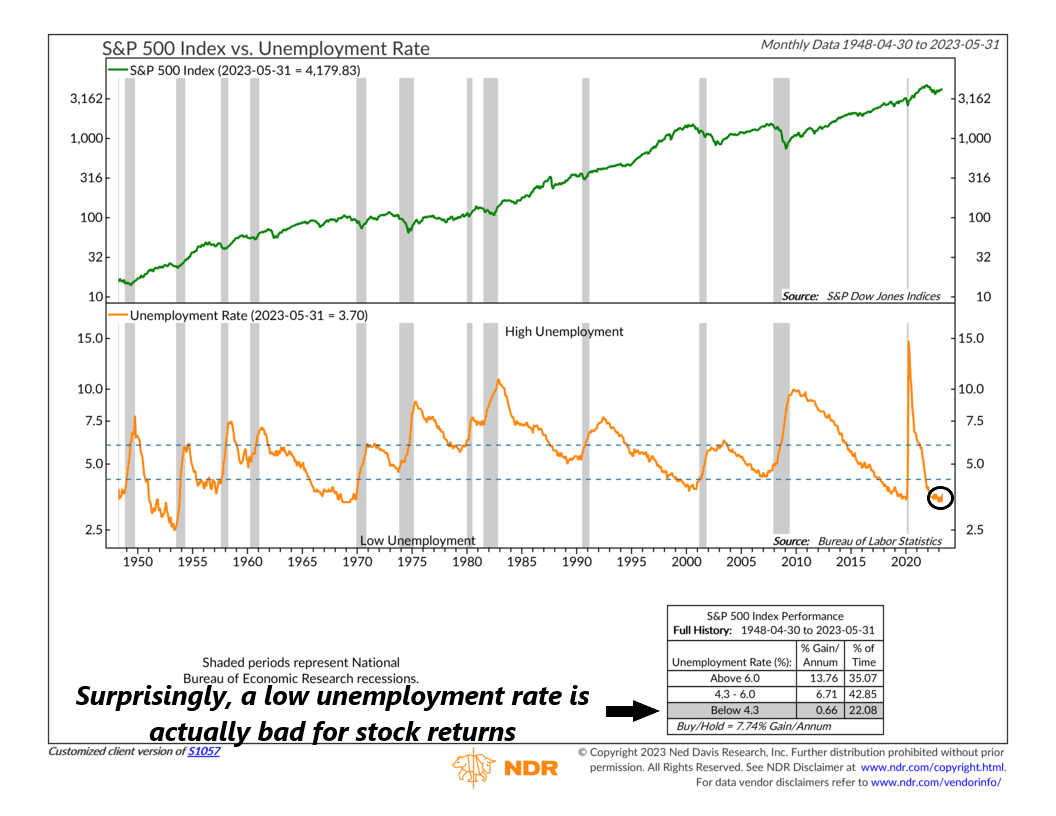

The chart above compares the S&P 500 stock index (green line) with the unemployment rate (orange line) since 1948. Historically—and surprisingly—the S&P 500 has performed the best when the unemployment rate has been high (greater than 6%), and it has performed the worst when the unemployment rate has been low (less than 4.3%). An unemployment rate between 4.3% and 6% has produced average stock market gains.

A couple of reasons explain this counter-intuitive result, but it all boils down to the fact that the economy is cyclical, and the stock market is forward-looking. Periods of high unemployment (i.e., recessions) are often followed by significant stimulus from the Fed and other expansionary government policies. The stock market tends to rally in anticipation of this juicy stimulus. On the other hand, low unemployment can lead to inflationary pressures in the economy, typically leading to more restrictive government policies that hurt the stock market.

This is essentially what happened recently in the economy. The unemployment rate dipped below 4.3% near the end of 2021. At the same time, headline inflation was around 7%. The Fed had to jack up interest rates to fight inflation, and the stock market suffered big declines in 2022.

The strange thing about that bear market, however, is that we never saw a sharp rise in the unemployment rate—because a recession never happened. Maybe this time is different. Perhaps we don’t see unemployment spike and a recession this time around. That’s possible. Or maybe it’s still coming. We don’t know for sure. But the bottom line is that while it’s possible we see the market rip higher with unemployment less than 4%, that’s probably not the base case.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.