This week’s indicator focuses on the U.S. 10-Year Treasury Fair Value Model, a tool designed to gauge whether 10-year Treasury yields are too high, too low, or just right. With interest rates playing such a pivotal role in the markets, knowing when Treasuries are over or undervalued can be a game changer—especially for bond investors.

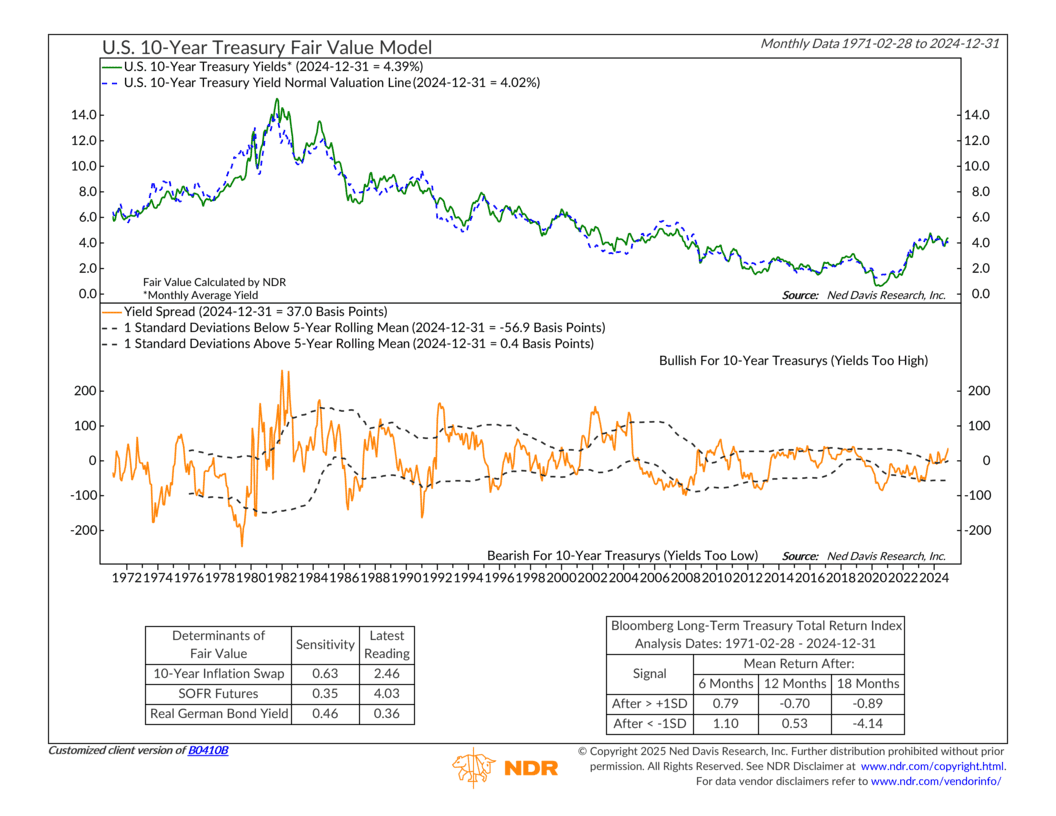

So, how does it work? The model compares the current 10-year Treasury yield (4.39% as of year-end 2024) to its “fair value,” which is calculated based on three key factors, or determinants, shown in the table at the bottom left.

The first is the 10-Year Inflation Swap. This measures inflation expectations over the next 10 years. This is key because inflation is a big driver of interest rates—higher inflation typically pushes yields up, and lower inflation brings them down.

Up next is SOFR Futures. This reflects short-term interest rate expectations. When short-term rates are expected to rise, long-term yields tend to follow suit, and vice versa.

And finally, we have Real German Bond Yields. Since the U.S. Treasury market doesn’t exist in isolation, global factors like the yield on German government bonds (adjusted for inflation) provide context for where U.S. yields might settle.

Combine these inputs into a fancy statistical tool called a regression to get the fair value line for 10-year Treasury yields. Finally, take the spread between the current 10-year rate and the fair value line, and we get the yield spread, shown as the orange line on the bottom clip of the chart.

When this line is above its upper standard deviation line, it’s a sign that 10-year yields are too high. That’s what’s happening now. The current yield spread is 37 basis points, well above the upper standard deviation line. Historically, this setup has often led to lower yields in the future, which is bullish for bonds.

Why is this bullish? Bond prices move inversely to yields. So, if yields fall, bond prices rise, rewarding investors who hold them.

Of course, the opposite holds true as well. When the yield spread drops below its lower standard deviation band, the model suggests yields are too low. This tends to be bearish (bad) for bonds, as rises in rates tend to hurt bond prices.

But the bottom line is that, right now, the indicator is pointing to overvalued 10-year yields. This suggests that yields are set to decline, making the outlook for bonds more promising. Of course, no model is perfect, but with over 50 years of data baked into this analysis, the signal is worth paying attention to.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.