When we think about what drives stock market returns, earnings come to mind. This makes sense. The stock market is comprised of businesses, and the goal of those businesses is to make money—or earnings.

On a stock exchange, buyers and sellers come together to determine what they think the price of those earnings should be. Of course, they don’t always agree, so prices constantly fluctuate. But over the long run, earnings basically determine the stock market’s return. And so for that reason, we incorporate earnings into our analysis when we measure stock market risk.

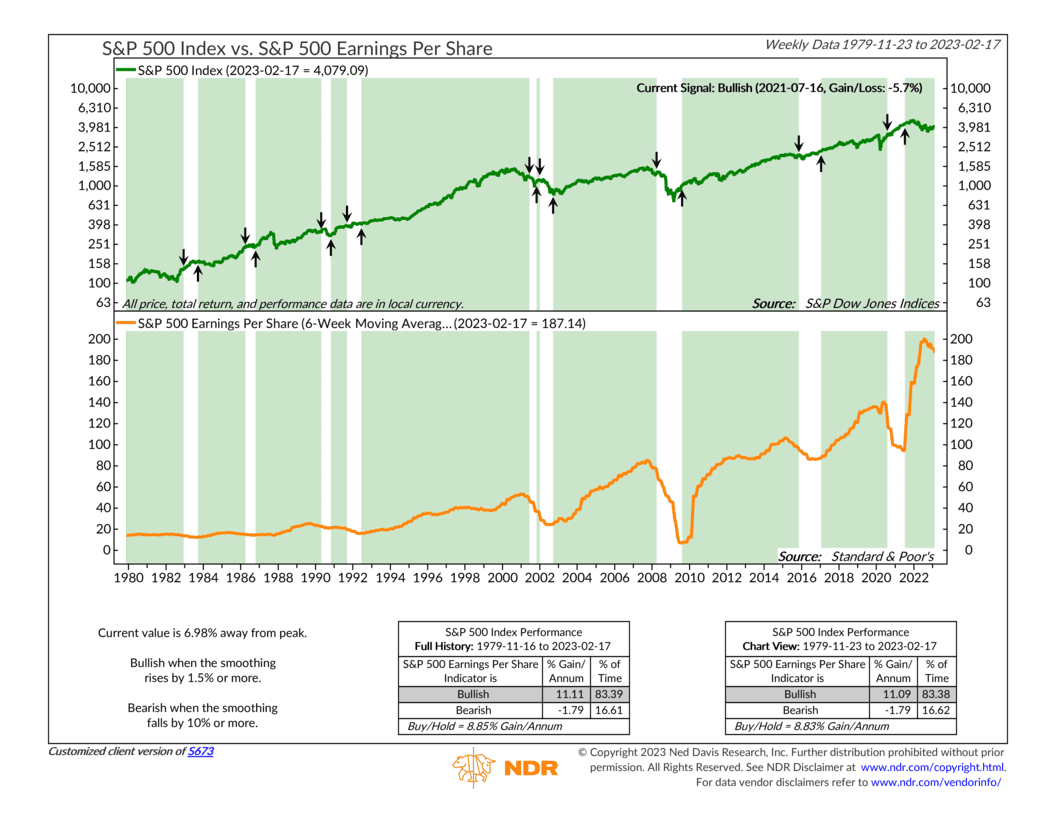

The featured indicator above is a great example of how we measure stock market earnings. In the bottom clip of the chart, the orange line shows the 6-week moving average of S&P 500 earnings per share, going back to the 1980s. The rules of the indicator state that when this measure of earnings rises by 1.5% or more, a bullish (buy) signal is triggered for the S&P 500 stock index. However, when the measure falls by 10% or more, a bearish (sell) signal is generated.

On the top clip of the chart, we have the S&P 500 Index along with the corresponding buy and sell signals. The green shading represents the bullish periods. According to the performance box (bottom of the chart), on average, the S&P 500 has returned more than 11% per year during the bullish periods. But during the non-shaded bearish periods, the index actually loses nearly 1.8% per year, on average.

One thing that stands out is that, since the 1980s, the indicator has been in a bullish period about 84% of the time. This is a good reminder that the stock market tends to grow earnings most of the time—which explains why the stock market tends to go up over time. But it’s also a good reminder that about 1/6th of the time, the market goes through a rough patch where earnings fall—and returns suffer. Knowing this, and having this little tool in your toolbox, can help manage risk when it’s needed the most.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.