OVERVIEW

U.S. stocks kept rolling last week, as the S&P 500 Index rose 0.4%, its fourth straight week of gains. The tech-heavy Nasdaq’s streak has been even better, with last week’s 0.14% gain good for its seventh straight week of gains. The Dow also notched a 0.34% weekly gain.

While growth stocks were essentially flat for the week, value stocks managed to gain about 1.08%. Small-cap stocks also had a strong week, increasing roughly 1.7%.

Foreign markets were also positive for the week, with emerging markets gaining 1.83% and developed markets rising 0.61%.

A slight rise in the 10-year Treasury rate to 3.7% resulted in modest losses for Treasuries. Intermediate-term Treasuries lost 0.18%, and long-term Treasuries fell 0.03%. Investment-grade corporate bonds were also down around 0.3%, whereas high-yield (junk) bonds increased 0.31%.

Real estate had a decent week, climbing 0.88%. Commodities were also up broadly by about 1.14%. Oil dipped 1.9%, and corn fell nearly 9%, but gold increased 0.4%. The U.S. dollar weakened by around 0.3%.

KEY CONSIDERATIONS

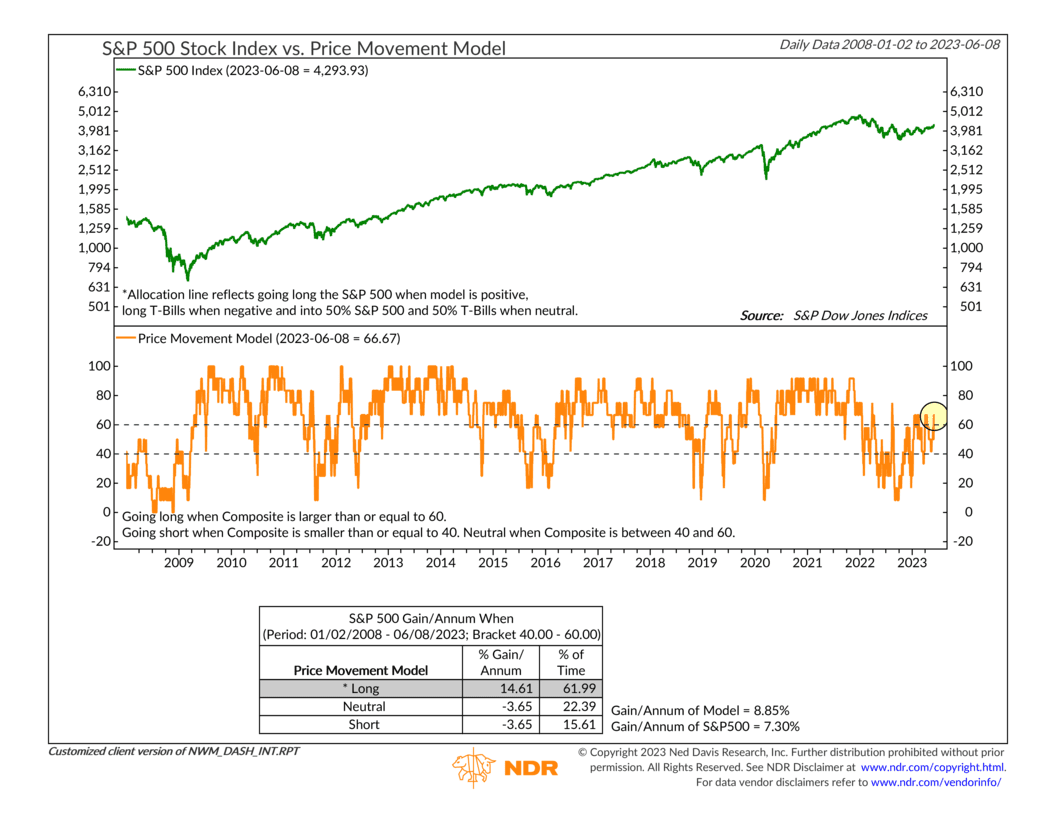

All About Price – The core idea behind our investment philosophy—Risk Aware Investing—is that we focus on three key market areas to measure risk: price movements, investor sentiment, and the economic environment. When combined, these categories help determine the overall risk level in the market, which helps us effectively manage portfolio risk.

Generally, a market rally is more likely to be sustained if all three of these areas are clicking together. However, we are only seeing one area do most of the work right now: price movements.

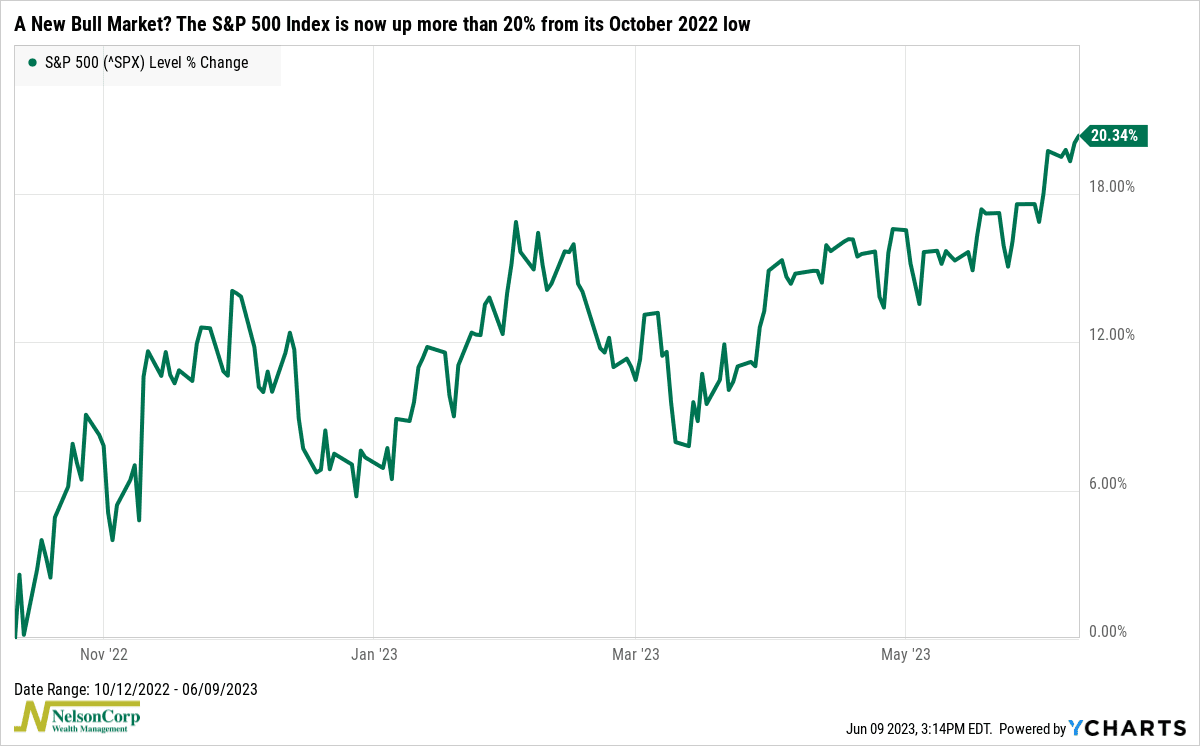

Our Price Movement model, shown above, is currently hovering in its bullish zone, with a reading of about 67%. This makes sense, given the extent to which we’ve seen momentum accelerate lately. Plus, as the chart below shows, the S&P 500 Index is now up more than 20% from its October 12, 2022 low—a milestone many believe signifies the start of a new bull market.

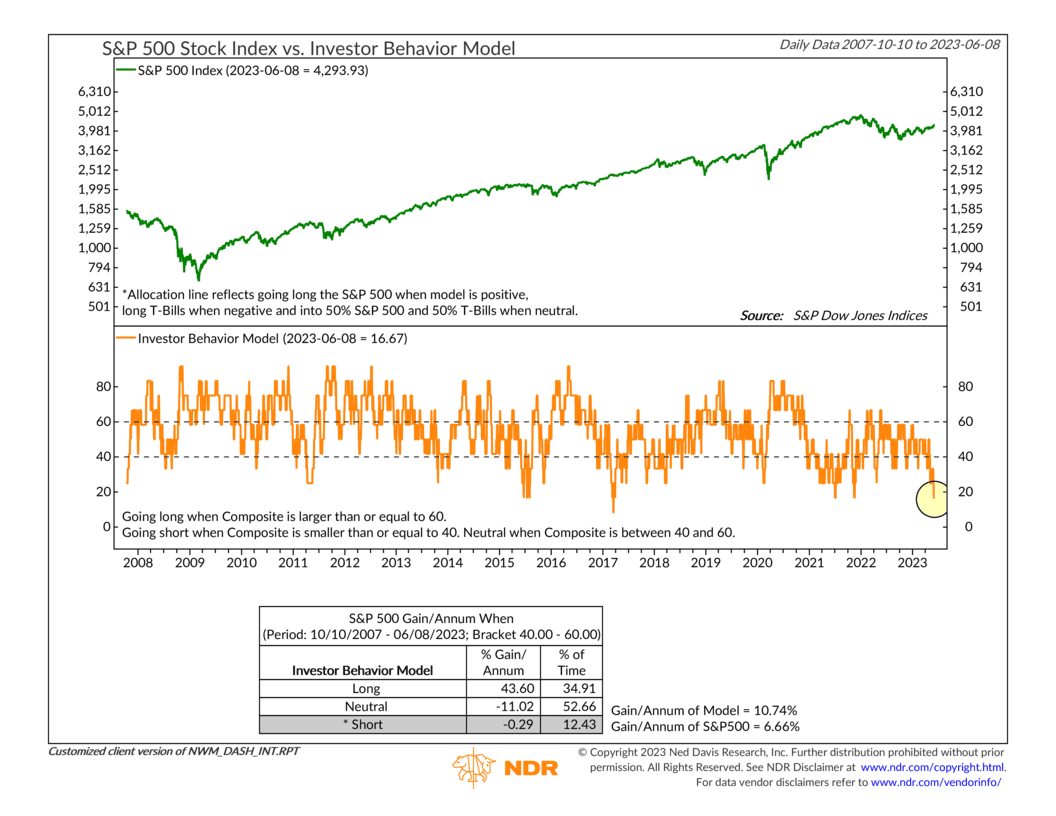

But if we look at investor sentiment, things are less favorable. Our Investor Behavior model, shown below, has dipped to near record-low levels.

In other words, optimism—in the form of sentiment and valuations—is too high right now to support a sustained market rally. This is because too much optimism tends to leave the market lopsided.

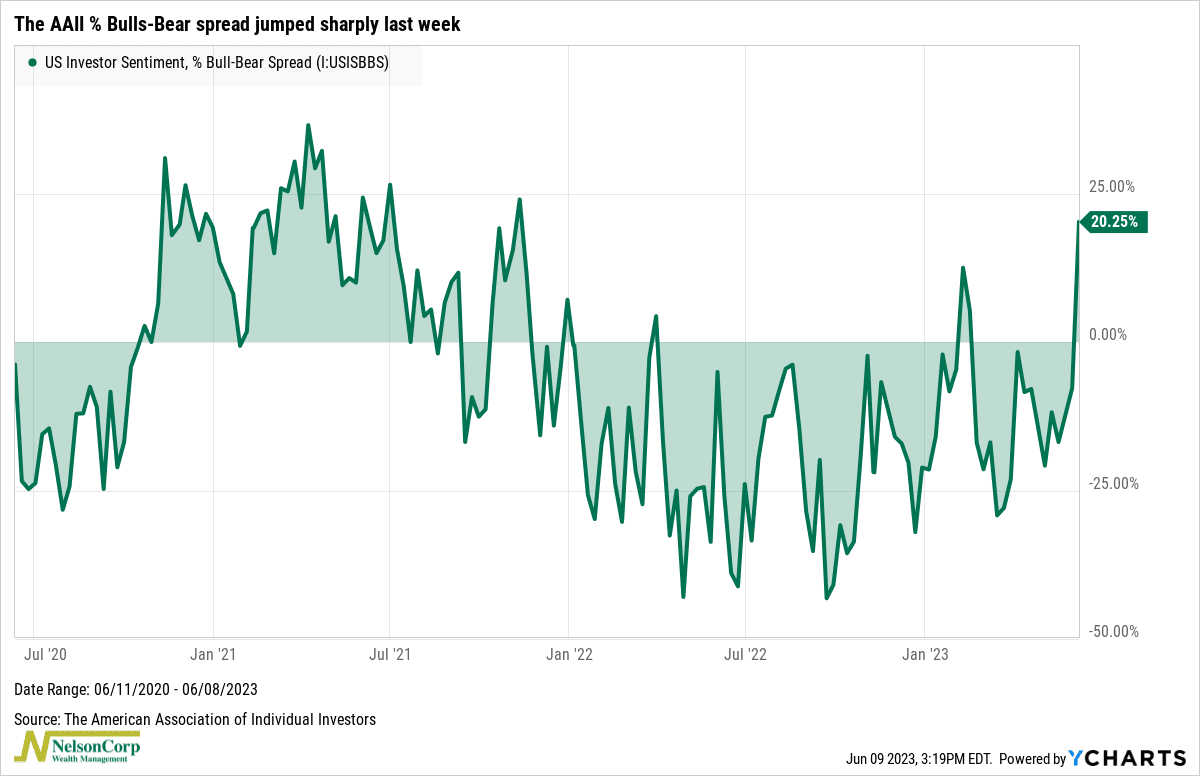

Another chart that helps illustrate this renewed investor optimism is the % Bull-Bear Spread, shown below.

This measures the percentage of investors who say they are bullish minus the rate who say they are bearish. Last week, it jumped to a net reading of 20%, its highest since November 2021. From a contrarian standpoint, this isn’t a great sign for future stock returns. (However, I would note that the last time we saw a similar shift in optimism—November 2020—the S&P 500 kept trending higher for the next 12 months, so maybe this isn’t such a bad sign after all!)

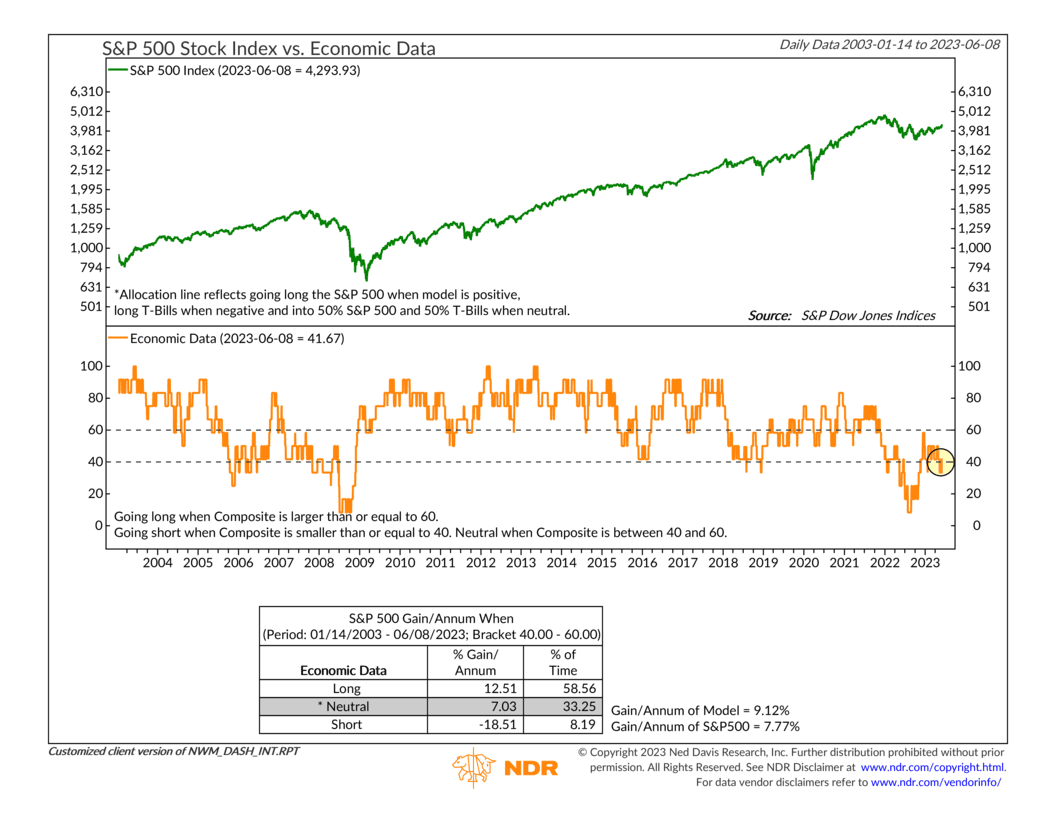

That leaves us with the final area: the economic environment. As our Economic Data model shows below, the weight of the evidence is mostly low-neutral right now. Although our economic environment indicators have improved from the depths of last year, they have deteriorated in recent months, and the composite reading is now just barely above negative territory.

So, the bottom line is that the stock market is being solely driven by price action right now. In fact, as some of our recent blog posts have pointed out, most of the price action is currently centered around just a few large, high-performing companies. This implies that the current price rally might stand on shaky ground, particularly given the above facts regarding the weak external factors (investor sentiment and economic environment).

Of course, we place the highest weighting on the market’s price action, so this may be the market’s way of telling the rest of the environment to play catch up. But until we see a significant shift in the weight of the evidence, all signs point to a cautiously neutral environment for risk assets.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.