OVERVIEW

It was a mixed week on Wall Street last week. While the S&P 500 gained 0.96% and the Nasdaq rose 3.34%, the Dow fell 0.6%. Similarly, growth stocks rose roughly 3.45% overall, while value stocks dipped around 1.8%.

Foreign markets, on the other hand, saw consistent gains. Developed markets rose 1.7%, and emerging markets increased nearly 2.5%. The U.S. dollar strengthened about 0.27%.

Bonds had a positive week, with the benchmark 10-year Treasury rate falling to 4.17%. In aggregate, the bond market rose about 0.13%.

Real assets, however, saw declines for the week. Real estate fell 2.6%, and commodities dipped 0.7% broadly. Oil fell 1.9%, and gold decreased about 0.8%. Corn, though, rose 1.6%.

KEY CONSIDERATIONS

Happy Place – Wall Street has been riding high lately. Corporate earnings are strong, inflation and interest rates are easing, shoppers are spending, and the U.S. dollar is climbing.

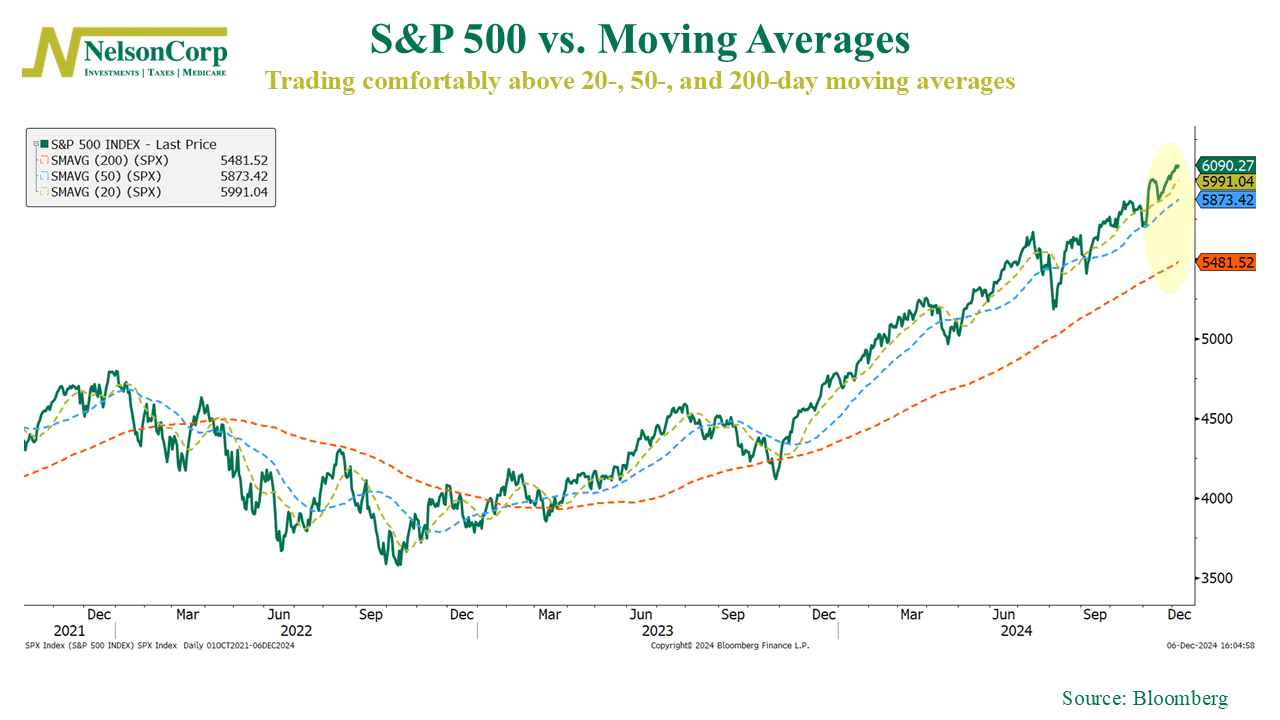

In other words, the stock market is in its happy place. The S&P 500 has closed higher in 12 of the last 14 sessions and is trading comfortably above its 20-, 50-, and 200-day moving averages, as shown below.

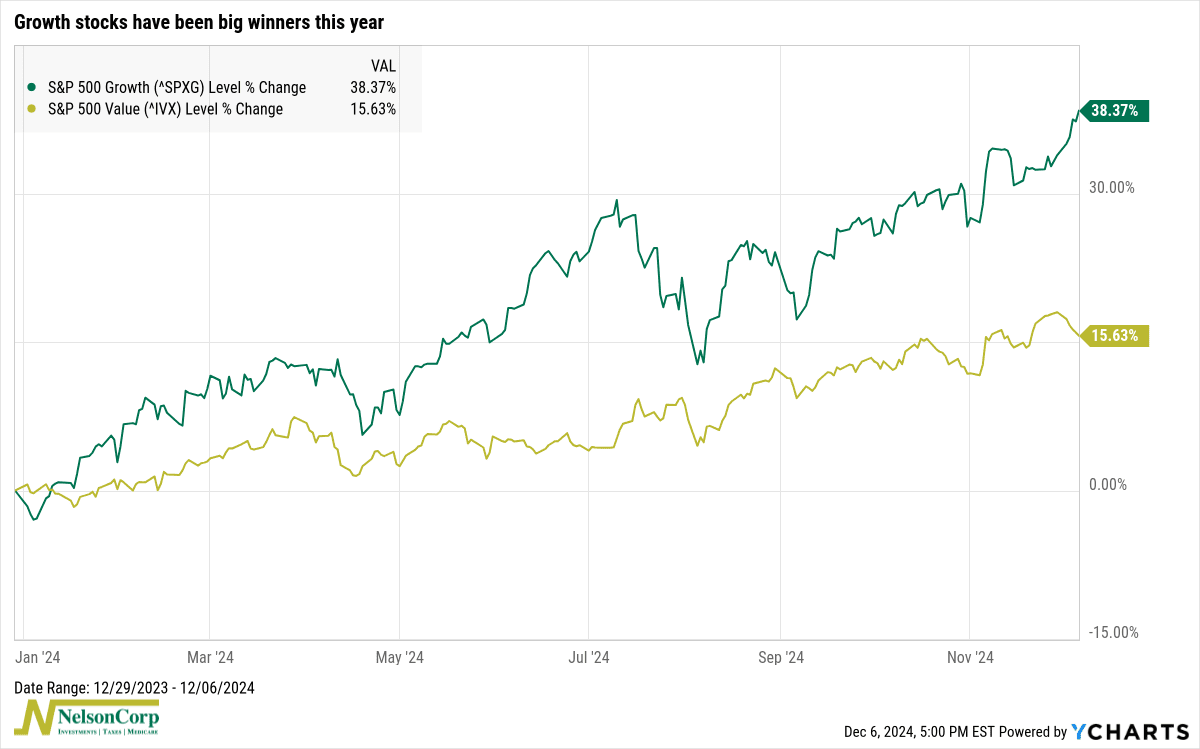

Looking deeper, we see that growth stocks have been the standout performers this year. As the next chart highlights, they’ve outpaced value stocks by a significant margin year-to-date.

Much of this strength stems from the Federal Reserve’s lower interest rates and expectations for more rate cuts, a narrative investors hope will continue.

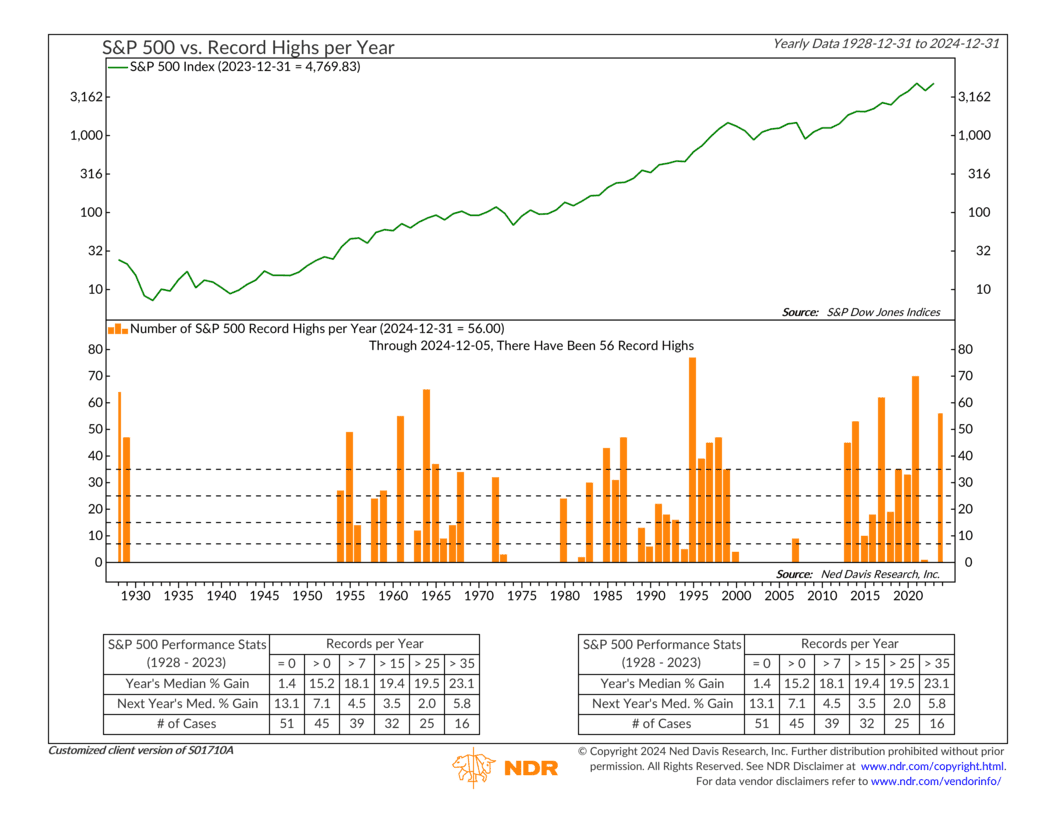

But, for the most part, yeah, the stock market has been feeling pretty good. So good, in fact, that last week the S&P 500 closed at its 56th all-time high for the year, shown on the chart below.

But here’s the rub. If we look closer at the chart, we see that when the S&P 500 achieves over 35 new all-time highs in a year, the median gain the following year drops to just 5.8%, below the long-term average of 8.1%. And in years with 50+ new highs, the index has risen only two of seven times, with a median loss of 6.2%.

That’s a bit concerning. History isn’t a perfect predictor, but it often provides clues. The takeaway? Celebrate this year’s gains but keep your guard up—markets don’t stay in their “happy place” forever.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.