OVERVIEW

The Thanksgiving holiday brought a shorter trading week but plenty of market gains. The S&P 500 climbed 1.06%, the Dow added 1.4%, and the Nasdaq rose 1.13%.

International stocks were mixed, with developed markets gaining 1.82% while emerging markets slipped 0.8%. The U.S. dollar also retreated, falling 1.6%.

Bonds had a strong showing as the 10-year Treasury yield dropped to 4.18%, boosting the aggregate U.S. bond market by 1.5%.

Commodities, however, stumbled, declining 0.8% overall, weighed down by a 3.6% drop in oil prices and a 2% fall in gold.

KEY CONSIDERATIONS

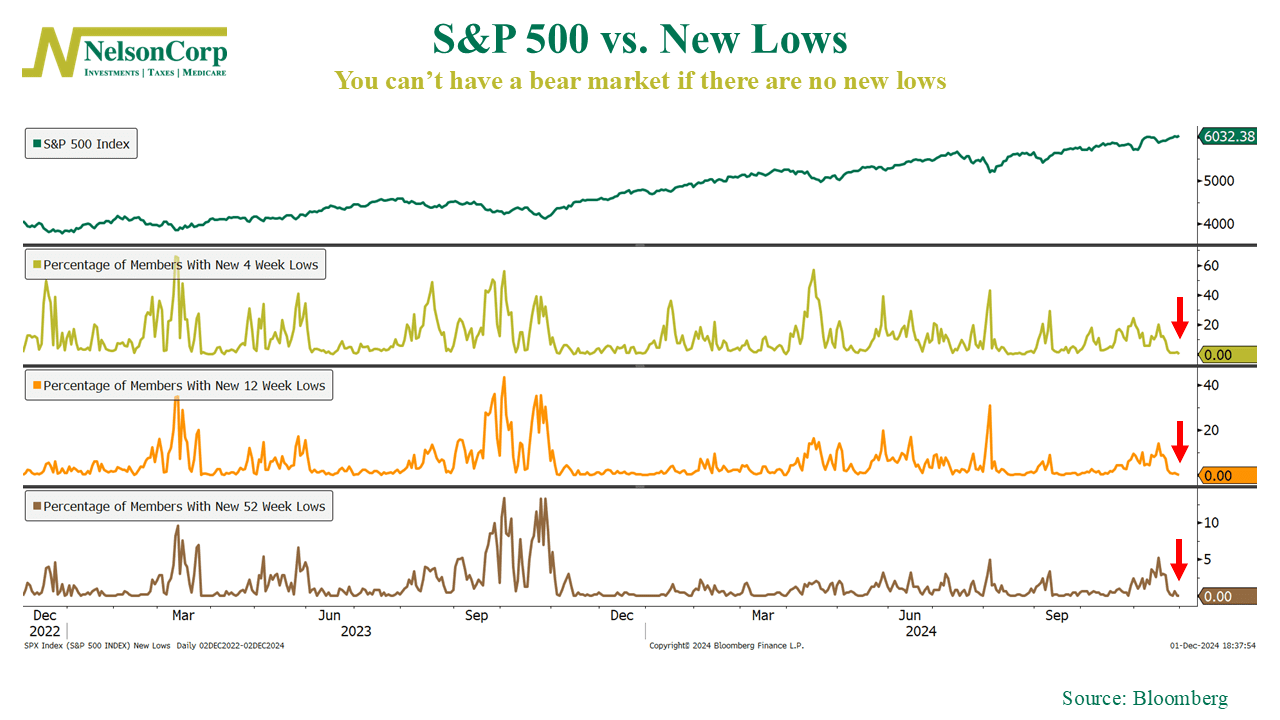

No Lows, No Bear – This week’s commentary highlights a simple yet crucial point: bear markets need new lows, and right now, there aren’t any.

The chart below shows the S&P 500 Index climbing steadily at the top. Beneath it, the three panels illustrate the percentage of S&P 500 stocks hitting new lows over 4 weeks, 12 weeks, and 52 weeks. As you can see, each of these measures currently sits at 0%, meaning no stocks in the S&P 500 are making fresh lows across these time frames.

This is significant. Bear markets require weakness to spread across the market, with more and more stocks hitting new lows. But without these cracks forming, the foundation remains solid.

Simply put, new lows are an early warning sign of trouble, and right now, that signal is absent.

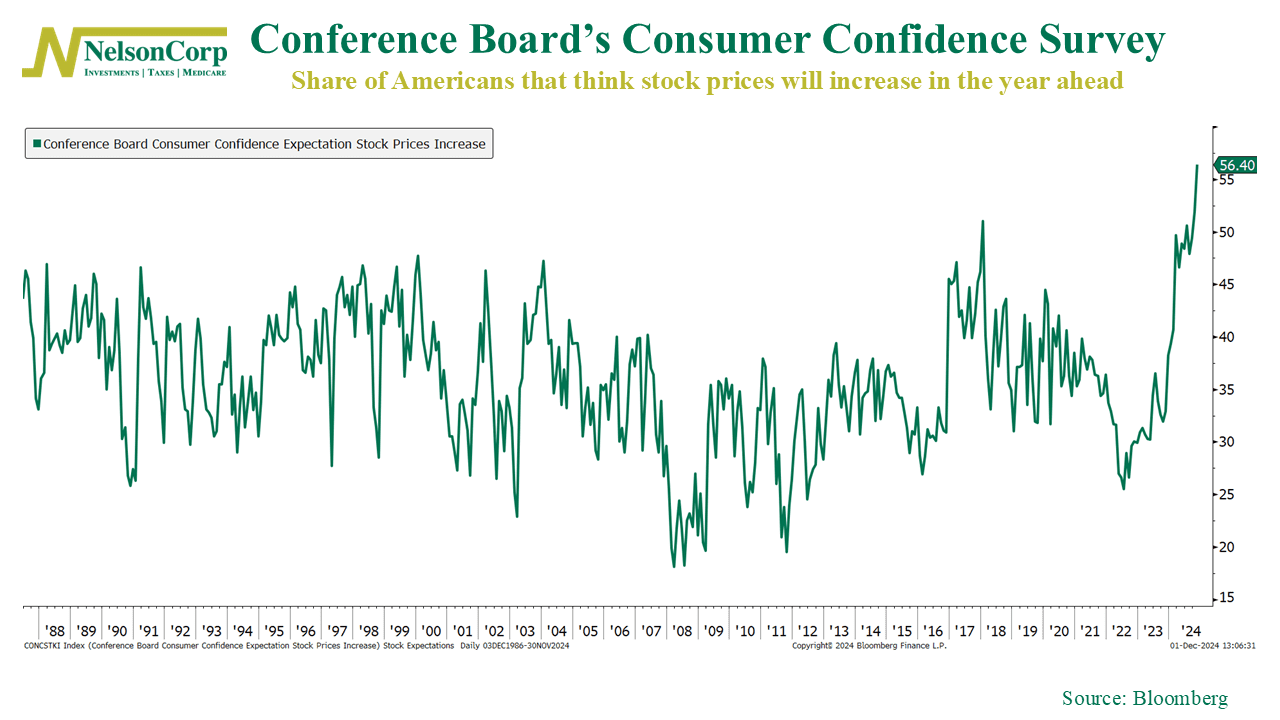

However, this doesn’t mean caution is unnecessary. Our Chart of the Week (shown below) highlighted that optimism is running extremely high in the market, with nearly 60% of investors expecting the market to rise in the coming year.

While confidence is often a driver of market gains, excessive optimism can signal complacency, which increases the risk of a pullback if expectations aren’t met.

The takeaway? The lack of new lows reflects solid market health, making a bear market unlikely in the near term. But with sentiment reaching elevated levels, it’s wise to remain vigilant.

As we often say, optimism is great, but in investing, balance and preparation are even better.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.