OVERVIEW

U.S. stocks ended their 4-week losing streak last week. The S&P 500 rose 3.93%, its best week since last Halloween. The Nasdaq did even better, rising 5.3%, and the Dow brought up the rear, gaining 2.94%.

Foreign stocks did well. Developed countries rose 4.16%, and emerging markets gained 2.3%. The U.S. dollar weakened slightly, down about 0.6%.

Bonds were in the green as the benchmark 10-year Treasury rate edged lower to 3.89%. Overall, the bond market rose about 0.3%.

Real estate rose about 1% for the week, whereas commodities dropped about 0.9% overall.

KEY CONSIDERATIONS

Not Derailed – Financial markets were in a chipper mood last week. A string of better-than-expected economic data gave the stock market a nice little boost.

Here’s one example. The recent inflation numbers came in cooler than anticipated. On a year-over-year basis, the US Consumer Price Index (CPI) was up just 2.89% last month.

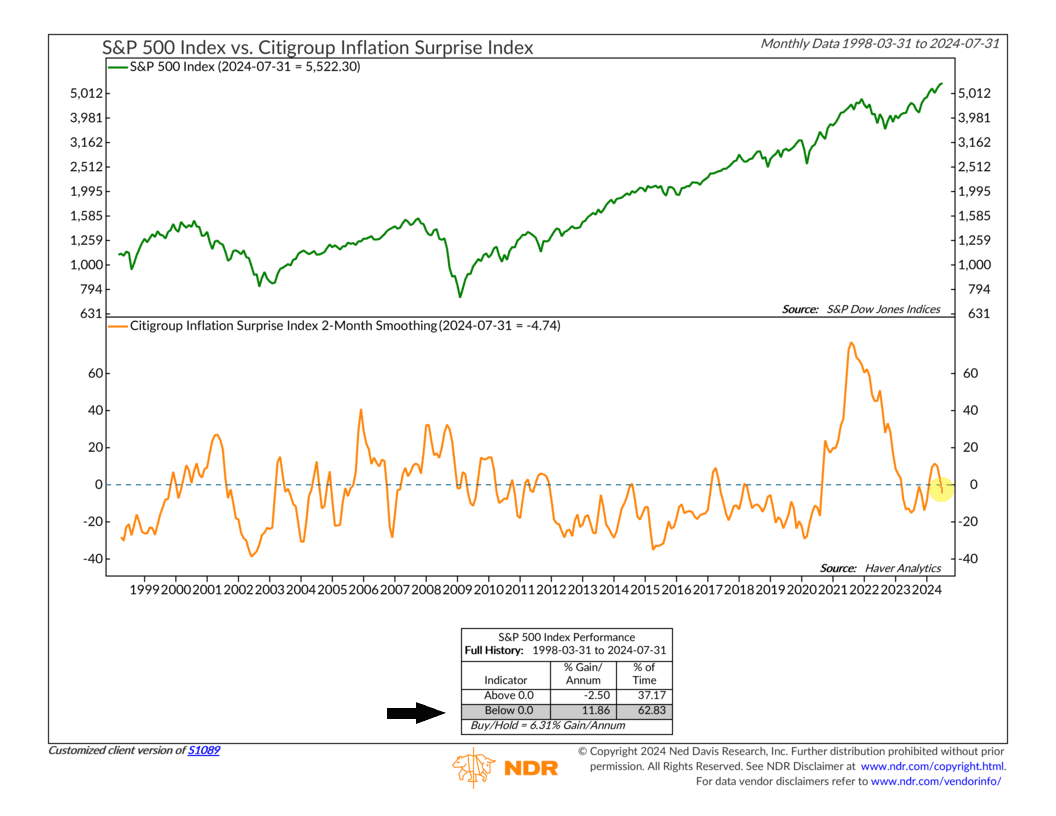

That dragged the 2-month smoothing of the Citigroup Inflation Surprise Index (shown below) into negative territory for the first time since February.

This probably means that those hot inflation readings that scared markets earlier this year are more than likely not coming back. That era is over. Kaput.

And as the performance box on the indicator shows, stocks love that. Historically, the S&P 500 Index has risen at an 11.86% average rate when the 2-month smoothing of the Inflation Surprise Index turns negative (versus a -2.5% loss when it’s positive).

This is important. The continued downward march in the inflation rate is perhaps the single biggest driver of the current bull market that started in the autumn of 2022. To see recent data confirm this message is a positive vibe.

What else? Well, speaking of vibes, let’s turn away from the economic environment for a second and look at sentiment. Typically, we view sentiment through a contrarian lens, meaning too much optimism is considered bad for stocks and too much pessimism is good.

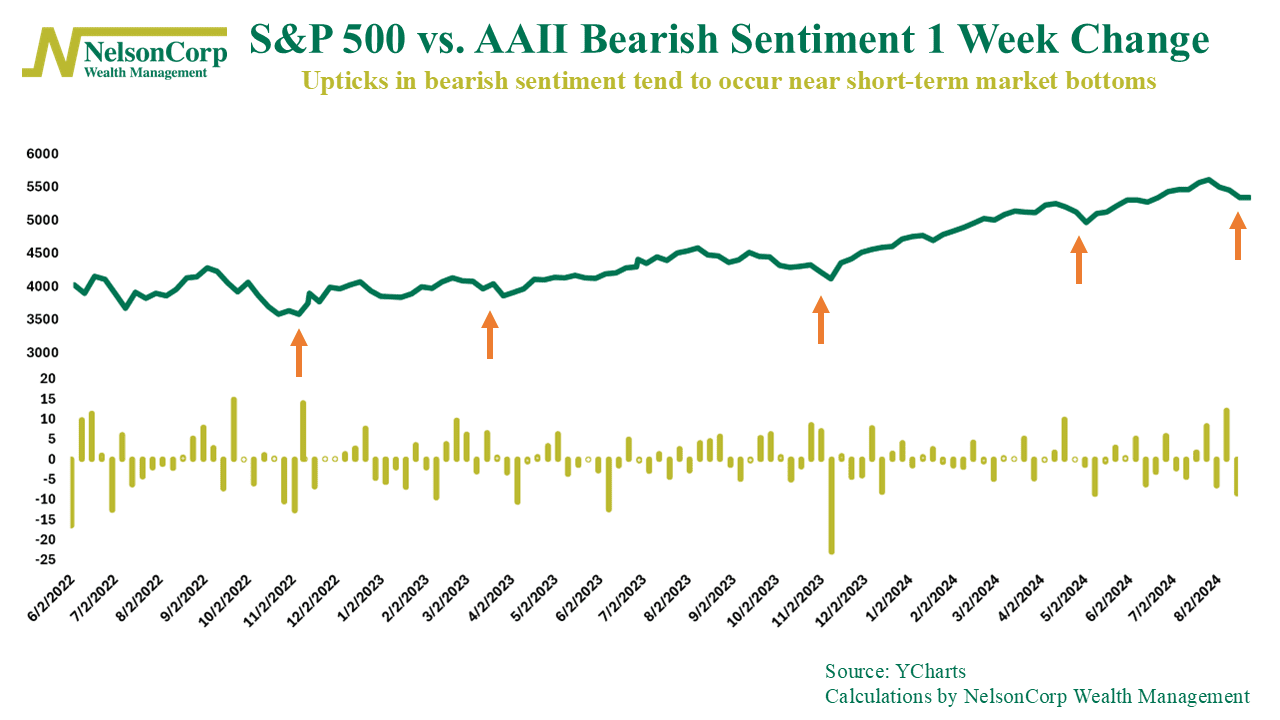

Well, check out this next chart. It shows the weekly change in the AAII Bearish Sentiment survey.

As you can see, pessimism recently surged at the fastest pace since November 2022. That’s good! In the past, strong surges in bearish sentiment have typically coincided with short-term bottoms in the stock market.

In other words, when short-term sentiment gets washed out, stocks usually rip.

All this leaves us cautiously optimistic about the current state of the stock market. However, the overall weight of the indicator evidence remains largely neutral. Following the recent bout of volatility, we’ll be closely monitoring to see if the evidence begins to tilt decisively in either direction.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.