OVERVIEW

The U.S. stock market had a good week, with the S&P 500 rising 0.94%, the Dow gaining 0.78%, and the Nasdaq surging ahead by 1.11%.

Growth stocks gained about 0.96% for the week, which beat out value’s 0.88% gain by a small margin.

Internationally, we saw developed country stocks register gains of roughly 1%. Emerging markets did even better, rising about 1.15%.

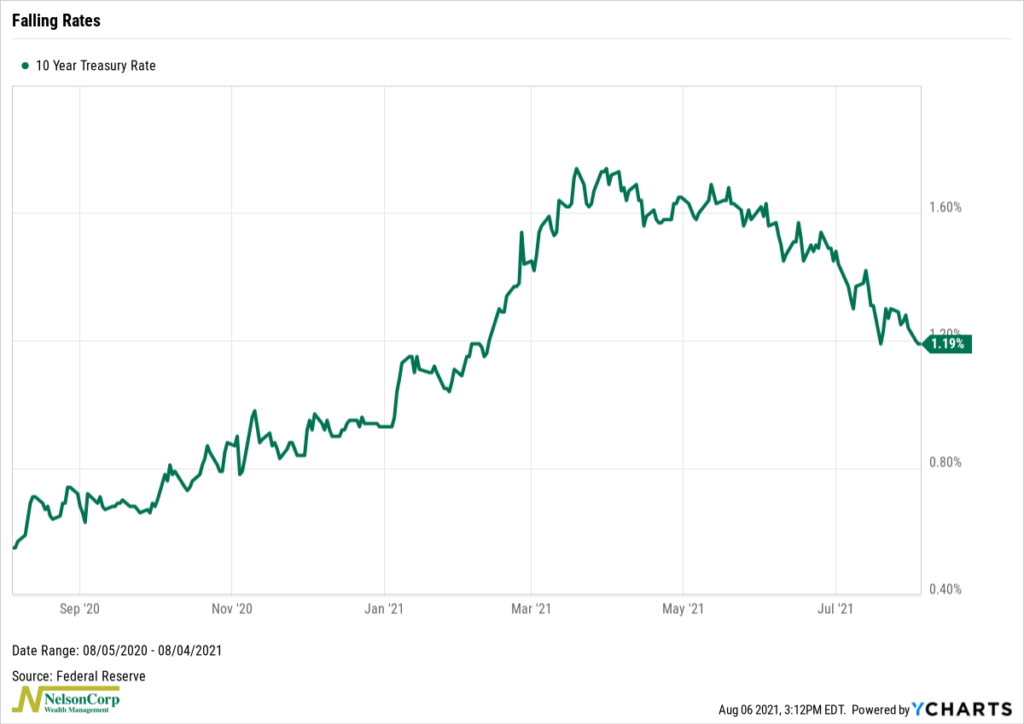

Interest rates had a bumpy ride throughout the week. After dipping below 1.2% earlier in the week, the 10-year Treasury rate climbed to 1.3% by Friday’s close. Bond prices were mostly down across the board, with long-term Treasuries falling 0.72%, investment-grade corporate bonds declining 0.68%, high-yield (junk) bonds down 0.19%, municipals down 0.14%, and TIPS down around 1.23%.

Real estate posted gains of roughly 0.58%. Commodities, however, suffered declines of roughly 1.65%. Oil fell 6.1%, gold dropped 2.98%, and corn rose 1.52%.

The U.S. dollar strengthened by 0.65%.

KEY CONSIDERATIONS

The Contrast Effect – At one point last week, the yield on the U.S. 10-year Treasury note dropped below 1.2%. This was astonishing given that it hit nearly 1.75% just a few months earlier.

With interest rates dropping, bonds have done well. But there’s another asset that benefits from falling rates: stocks. Stocks compete with bonds for capital, so if bonds are suddenly yielding less than before, stocks could look more attractive.

It’s like Starbursts (the candy). Let’s say you don’t really love the cherry flavor Starburst, but then again, you don’t necessarily hate it either. But then they create a lemon-flavored one and introduce it to the pack. You absolutely cannot stand the lemon flavor. So now, whenever you pull a cherry Starburst out, maybe it looks a little bit better to you since, hey, at least it’s not one of those nasty lemons!

That’s kind of how it is with stocks and bonds. But instead of flavors, it’s yields—and your taste for those yields changes over time depending on what the other asset is yielding.

Earlier, I said stocks could look more attractive if interest rates (and bond yields) are falling. But that begs the question: At what point does this happen?

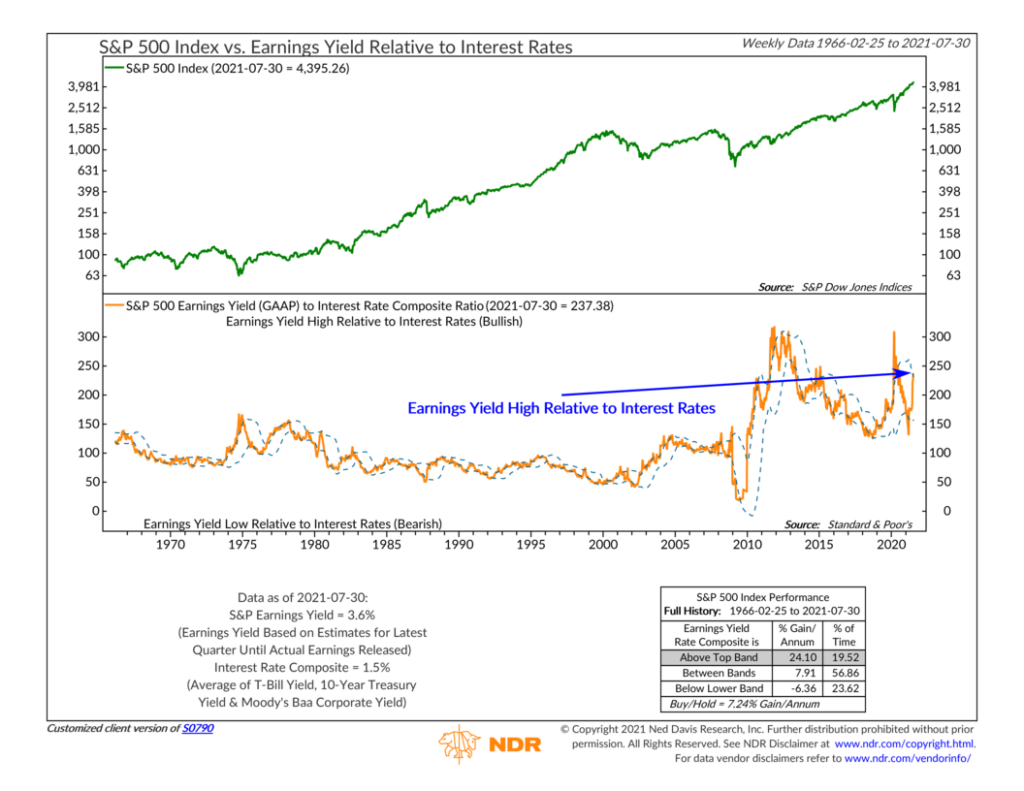

The chart below provides an answer. It shows how the S&P 500 stock index fares when the earnings yield on stocks is higher or lower than the average composite bond yield (i.e., interest rates). Not surprisingly, the indicator tells us that when stocks are yielding more than bonds by a certain amount (based on past deviations from the norm), stocks tend to perform better than bonds and vice versa.

At 3.6%, the S&P 500’s earnings yield looks respectable, but it’s still lower than its 30-year average of about 4.75%. However—and this is the key insight—the comparable yield on bonds is a mere 1.5%. So, relative to bonds, the earnings yield on stocks looks pretty darn good.

Now, falling interest rates aren’t always good for stocks. Context matters too. But with corporate earnings so strong right now, it’s hard to make a bearish case for stocks based on the current interest rate environment.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.