OVERVIEW

U.S. stocks rose again last week, the sixth week of gains out of the past seven. The S&P 500 rose 1.32%, the Dow gained 0.29%, and the Nasdaq surged 2.38%.

Growth stocks led the way, gaining 2.52% versus a 0.9% loss in value stocks. Mid-cap and small-cap stocks fell 2.08% and 2.5%, respectively.

It was a big week of news outside the U.S., with the European Central Bank cutting interest rates. Overall, developed country stocks increased about 0.6%, and emerging markets gained 2.3%.

Falling yields helped boost bond prices. The 10-year Treasury yield fell to 4.4%, resulting in gains of about 0.4% for intermediate-term Treasury prices. The Bloomberg Aggregate Bond Index rose about 0.1%.

Commodities traded lower for the most part, down a little over 1% for the week. Oil fell 2.4%, gold dropped 0.9%, and corn rose around 0.8%. The U.S. dollar bounced 0.35%.

KEY CONSIDERATIONS

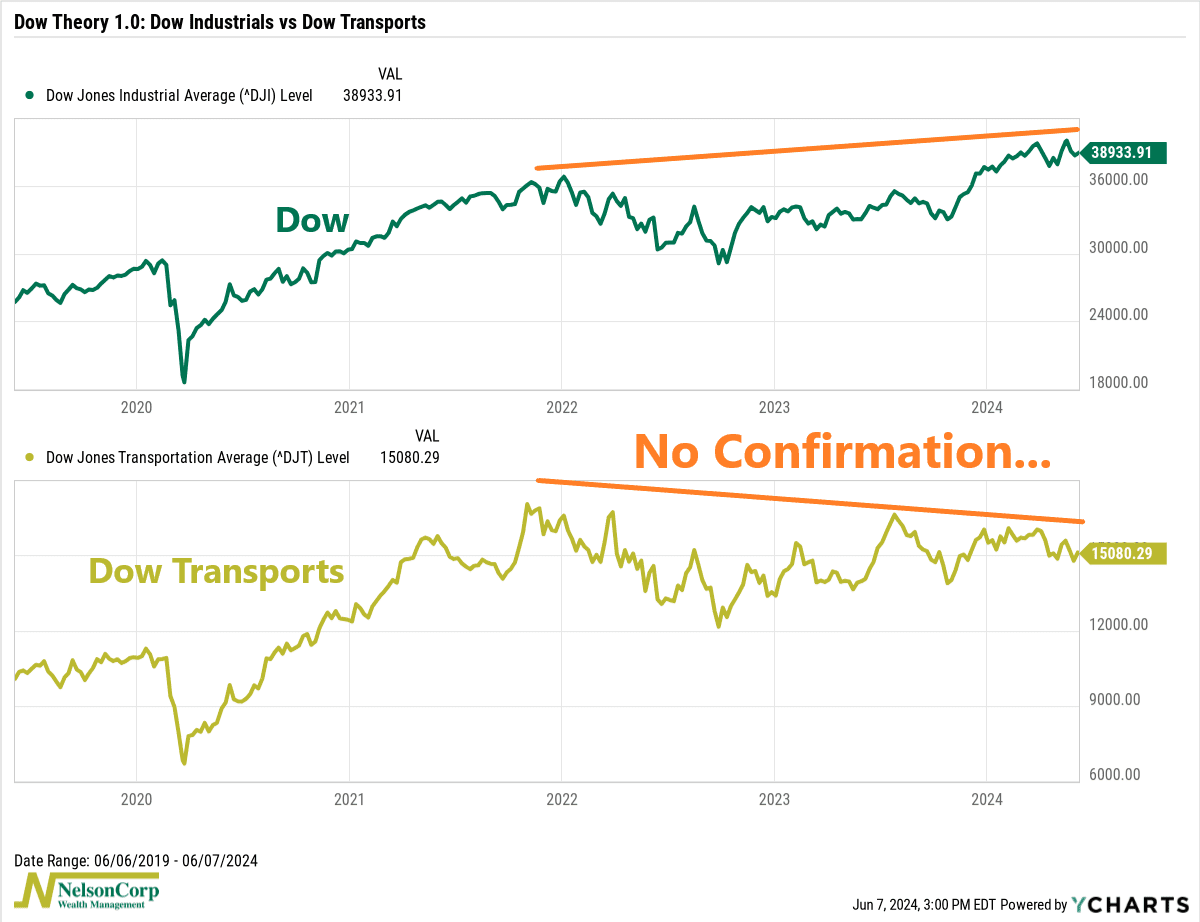

The Dow’s New Groove – In last week’s commentary, we talked about divergences in the stock market. As a refresher, a divergence is when the stock market continues to trend higher despite a lack of confirmation from another index or indicator. Typically, this is a bad sign for the overall market.

The godfather of this idea was Charles Dow, who created the popular stock market index we all know and love today: the Dow Jones Industrial Average (DJIA). According to Charles Dow, in order for the Dow’s uptrend to be “confirmed,” we’d also want to see another index, the Dow Jones Transportation Average (DJTA), trend higher as well.

Here’s what that looks like today:

You can see the problem. The Dow Jones Industrial Average is trending higher, reaching new highs, whereas the Dow Jones Transportation Average is not. According to Dow Theory, this is a divergence—a sign of an unhealthy market.

But let’s take a step back. The whole premise behind the theory is rooted in the belief that the movement of goods is a leading indicator of economic activity, so changes in the transportation sector should foreshadow changes in the industrial sector.

But that was a description of a different economy from a different time. Charles Dow died in 1902, when railroads transported stuff around the country and the economy was dominated by old school industrial companies.

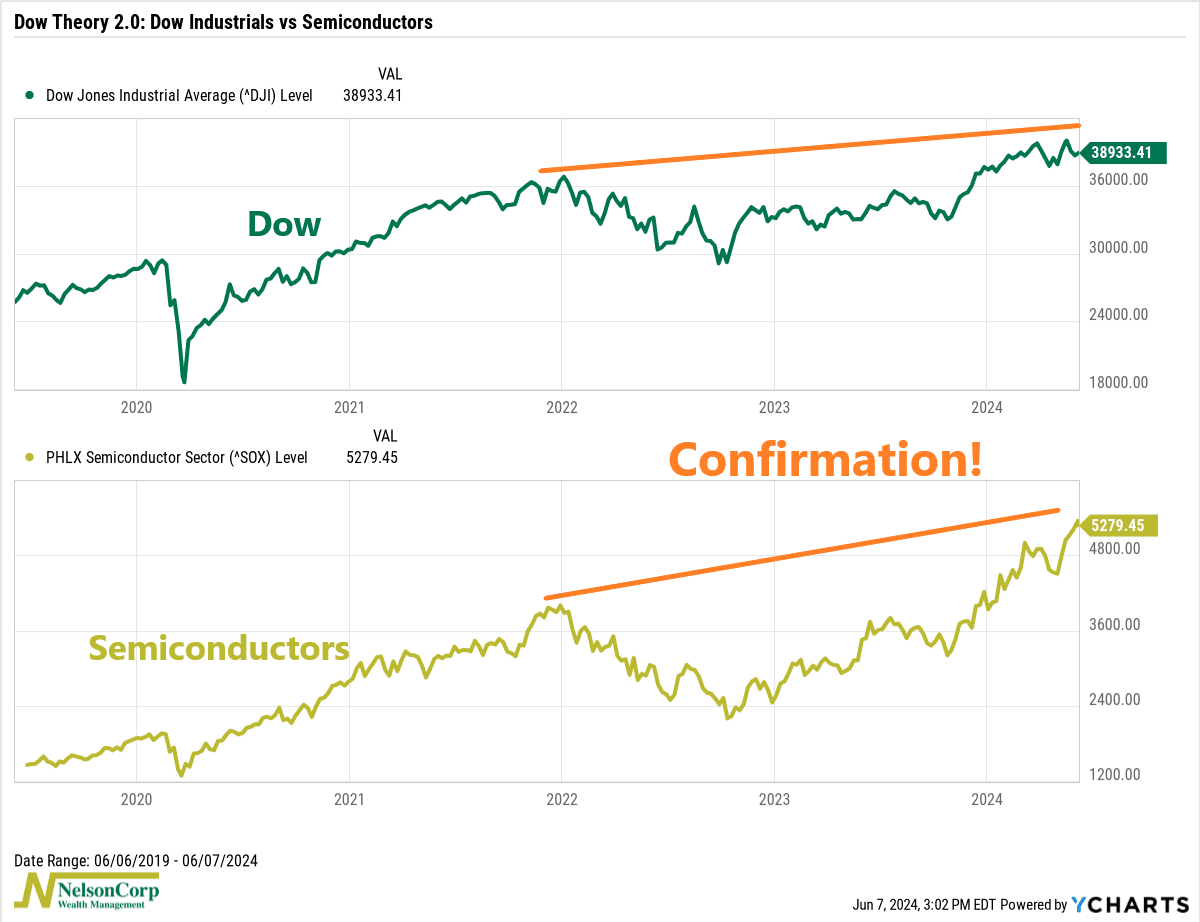

Today’s economy is different. Most of the goods and services that our modern economy depends on are driven by semiconductors and the companies that make and deliver them. Semiconductors seem to be the more relevant sector today.

So, what if we swap out the transportation average with an index of semiconductor stocks?

That’s better. The PHLX Semiconductor Sector Index is very much moving in concert with the Dow Jones Industrial Average. Call it Dow Theory 2.0.

So, from this perspective, the technical health of the market appears to be in much better shape. But, with that said, we don’t want to get carried away. Enthusiasm around AI, semiconductors and everything else associated with the “new economy” can go too far. We don’t want investors to get too complacent.

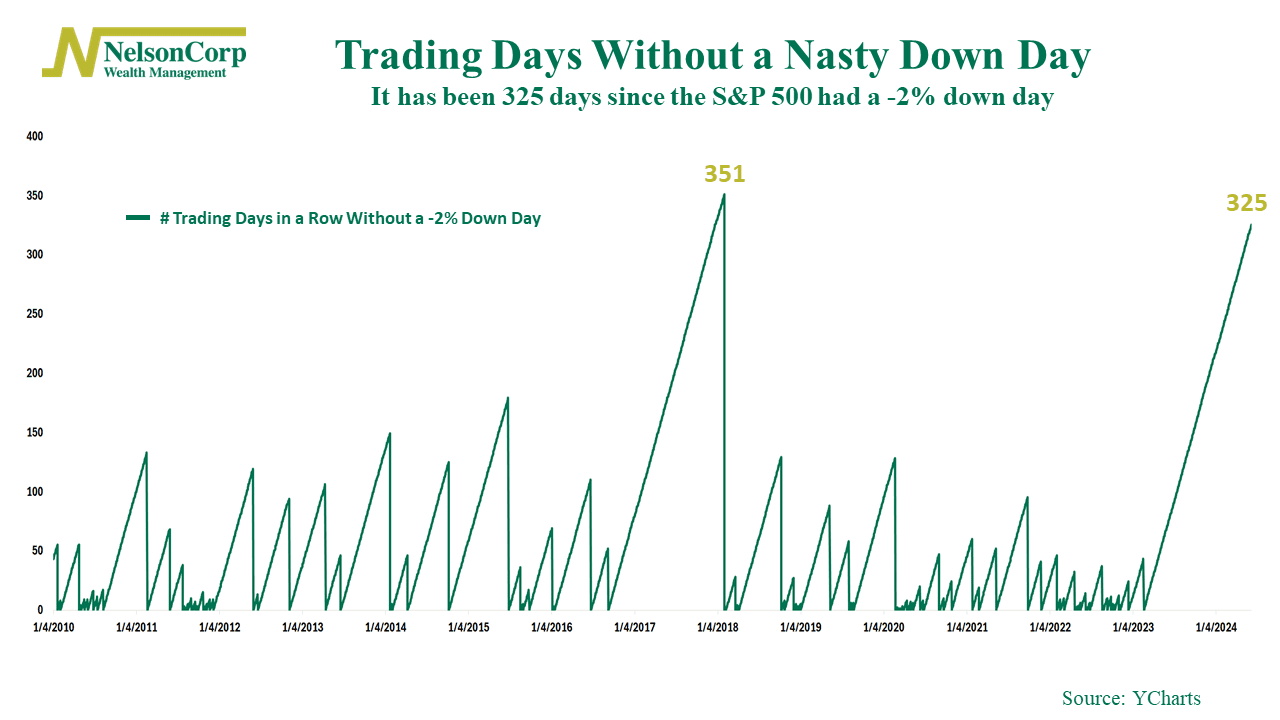

Here’s one concern. The chart below shows that the stock market, as represented by the S&P 500 Index, has now gone 325 days straight without a -2% or more down day.

This is the type of complacency that can lull investors into a feeling of comfort and safety—which, if we’ve learned anything from history, the stock market is anything but.

So, the bottom line is that while we see reasons to believe the technical health of the market remains on solid footing, we don’t want to get complacent. Keep your head on a swivel, because the market always finds a way to surprise you.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.

The Dow Jones Transportation Average (DJTA) is a 20-stock, price-weighted index that represents the stock performance of large, well-known U.S. companies within the transportation industry.

The PHLX Semiconductor Sector Index (SOX) is a Philadelphia Stock Exchange capitalization-weighted index composed of the 30 largest U.S. companies primarily involved in the design, distribution, manufacture, and sale of semiconductors.