OVERVIEW

It was rough for stocks last week. In the United States, the S&P 500 fell 5.68%, the Dow dropped 5.68%, and the Nasdaq tumbled 7.55%.

Everything was down pretty bad last week, but value stocks—down 4.74%—did relatively better than growth stocks, which fell 7.1%. Small-cap stocks got hammered, falling about 7.6%, versus a 5.8% decline for large-cap stocks.

Internationally, stocks held up better but were still in the red. Developed country stocks fell 2.09%, and emerging markets dropped 1.05%.

Treasuries offered some relief as the yield on the U.S. 10-year Treasury note fell to 1.76%. Long-term Treasuries rose 1%, and intermediate-term Treasuries gained about 0.2%. Investment-grade bonds, however, were down 0.13%, and high-yield bonds dropped 0.68%.

Real estate had another poor week, falling 3.87%. But commodities were a bright spot, gaining about 1.75% overall. And the U.S. dollar gained about 0.43% for the week.

KEY CONSIDERATIONS

Defense Wins Championships – If you’re a football fan, you may have heard this phrase before: Offensive may win games, but defense wins championships. Football fans will debate whether that statement is true or not. But when it comes to investing, I think there’s a lot of truth to it.

In the context of investing, playing defense is akin to preserving your capital. In other words, it’s all about keeping the money you already have.

In many ways, it’s an under-appreciated part of the investment process—probably because it comes off as boring. Sure, putting your cash into a stock that might double in a day is more exciting. But, as a wealthy investor once said, “You don’t want to have to make the money twice. Once is hard enough.”

So, how does one go about preserving capital?

Well, one way is to simply move a portion of one’s assets away from riskier stocks and into safer investments—like short duration bonds—whenever the environment shifts to a more risk-off regime. That’s the essence of Risk Aware Investing. You adapt to current conditions in order to take advantage of changing market dynamics. In doing this, you give yourself a better chance of preserving your hard-earned money.

We look at various factors to determine if the environment is changing for the worse—like investor sentiment and the economic backdrop—but at the end of the day, the element that matters the most is the price movement of the stock market itself. We call this the price action, and if it tells us something is wrong, it usually pays to listen.

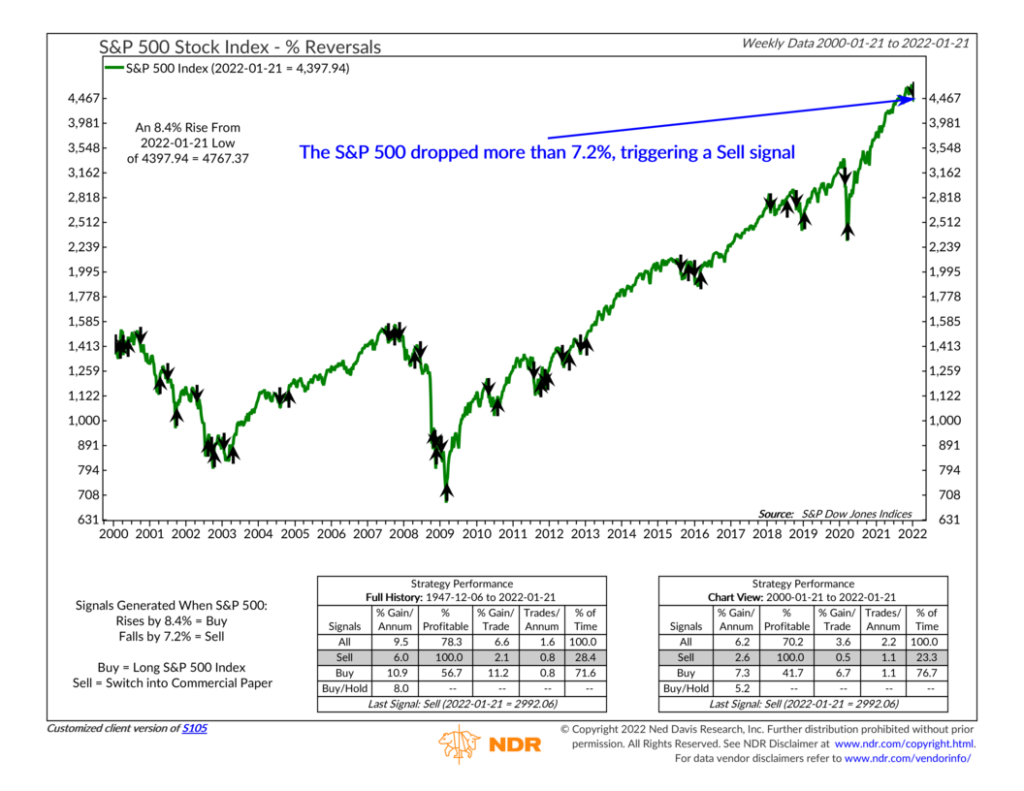

The chart below is a great, simple example of an indicator that we use to measure the price action. It generates buy and sell signals for the S&P 500 stock index based on the index’s percentage reversals from a high or a low. For example, when the index rises by 8.4% from a low, it produces a buy signal; when it falls 7.2% from a high, it triggers a sell signal.

Historically, the market returns after a buy signal have been nearly double the returns after a sell signal. This is compelling evidence that the market moves with momentum, meaning if stocks are up one day, they are more likely to be up the next day—and vice versa.

Looking at the current environment, we see that the indicator triggered a sell signal last week after the S&P 500 fell more than 7.2% from its high. This is the most the market has been down on a weekly closing basis since the March 2020 selloff.

It’s this type of environment where playing defense has paid off historically. That doesn’t mean it works every time. But, by blocking your capital from being sacked, it does help you win the championship in the end.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.