OVERVIEW

The U.S. stock market enjoyed another solid week, with all three major indices posting gains. The S&P 500 rose 0.85%, the Dow climbed 0.96%, and the Nasdaq added 0.8%. Small-cap stocks led the way, jumping 1.64%.

Meanwhile, foreign markets struggled. Stocks in developed countries slipped 0.39%, while emerging markets fell 0.38%.

Bonds saw modest gains across the board, with short-term Treasuries edging up 0.07%, intermediate-term Treasuries rising 0.1%, and long-term Treasuries gaining 0.18%.

Real estate had a standout week, surging 2.88%. However, commodities took a hit, dropping 2.55% overall. Oil plunged 7.88%, corn declined 2.65%, though gold managed to climb 2.01%.

KEY CONSIDERATIONS

Not-So-Terrible Twos – The stock market is acting like a two-year-old—but not in a bad kind of way.

That’s because the bull market in stocks that began in October 2022 turned two years old this month.

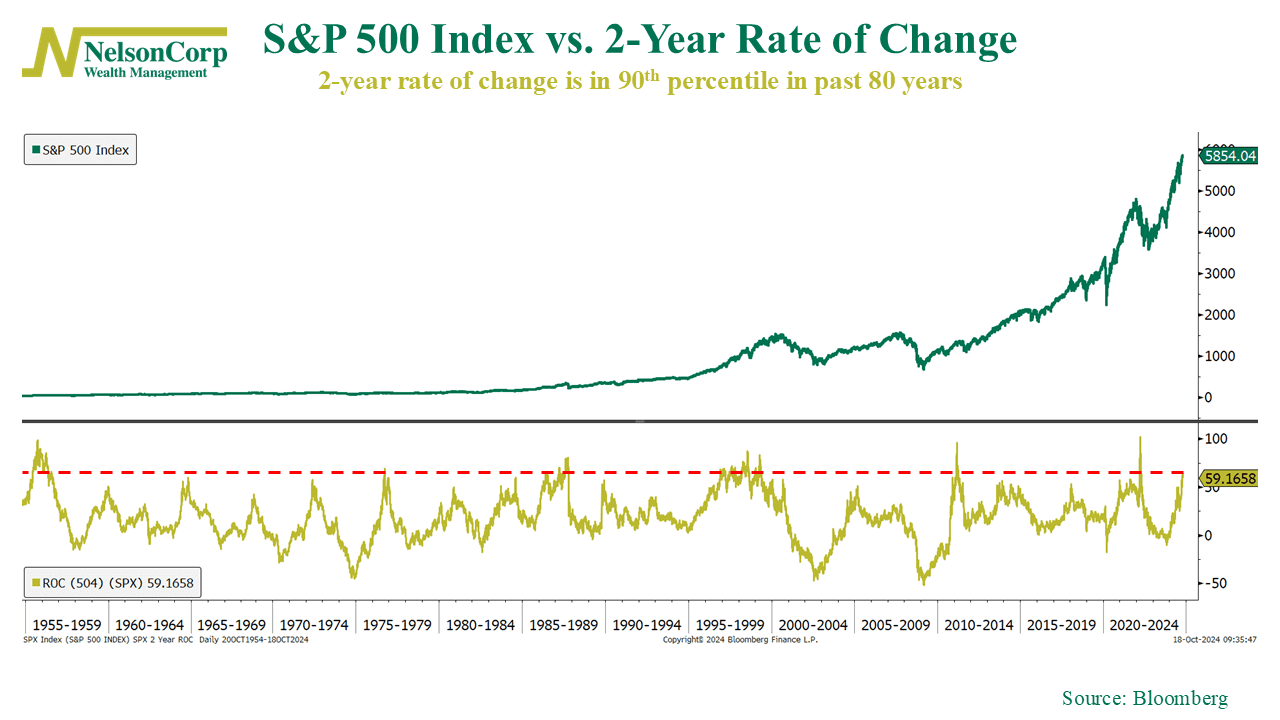

How does this two-year run in stocks measure up to history? Well, as our chart below shows, quite well.

The S&P 500 Index has soared roughly 60% in the past two years. That 2-year rate of change (gold line) is on track to be in the 90th percentile of returns going back the past 80 years.

That’s impressive, but will it continue? Historically, the third year of a bull market tends to slow, with average returns dropping to 5.2% per year. While it’s hard to predict with certainty, our tools suggest that the upward trend still looks solid for now.

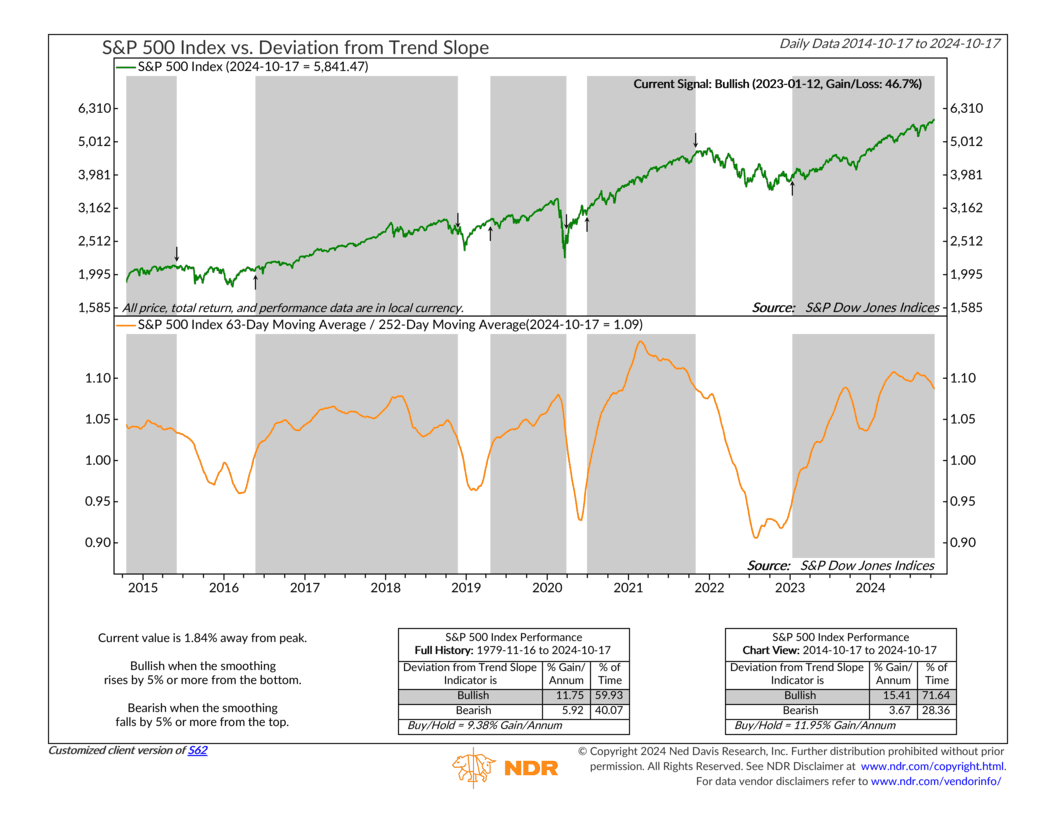

Take our Deviation from Trend Slope indicator, for example, shown below. This indicator takes the S&P 500’s shorter-term 63-day average price and divides it by its longer-term 252-day average price, resulting in the orange line on the bottom clip.

As you can see, it triggered a bullish trend reversal at the beginning of 2023, shortly after the current bull market officially began. It’s remained on a bullish signal ever since. It’s currently about 1.84% off its peak, but as long as it remains more than 5% off its peak, the evidence suggests the bull market should live on.

In short, while the market’s momentum may slow in its third year, the indicators we track suggest there’s still fuel left in the tank for this bull run.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.