OVERVIEW

Markets were mixed last week, with sharp rotation beneath the surface. The S&P 500 slipped 0.10%, while the Dow rose 2.50%. The NASDAQ fell 1.84% after a tech-led selloff earlier in the week, though a rebound on Friday helped stabilize sentiment.

Leadership continued to favor value over growth. Russell 3000 Value gained 2.24%, while growth fell 1.84%. Mid- and small-cap stocks were standouts, with the S&P 400 up 4.36% and the S&P 600 higher by 3.95%. Large-cap growth remained under pressure, with the S&P 100 down 0.58%.

International markets were mixed. Developed markets edged higher, while emerging markets declined modestly on the week but remain solidly positive year to date. A slightly stronger U.S. dollar created some headwinds.

Fixed income was steady. Treasury bonds posted modest gains across the curve, and credit-sensitive areas also finished higher, suggesting financial conditions remain supportive despite equity volatility.

Commodities pulled back, led by a decline in oil, while gold surged nearly 5% and continues to outperform in 2026. Volatility ticked higher, but overall market action still points to rotation rather than broad risk-off behavior.

KEY CONSIDERATIONS

Profit Taking – The tech sector hit a brick wall this week. As we pointed out in this week’s Chart of the Week post, it was the software sector that got hit the hardest. You can read up more about that there.

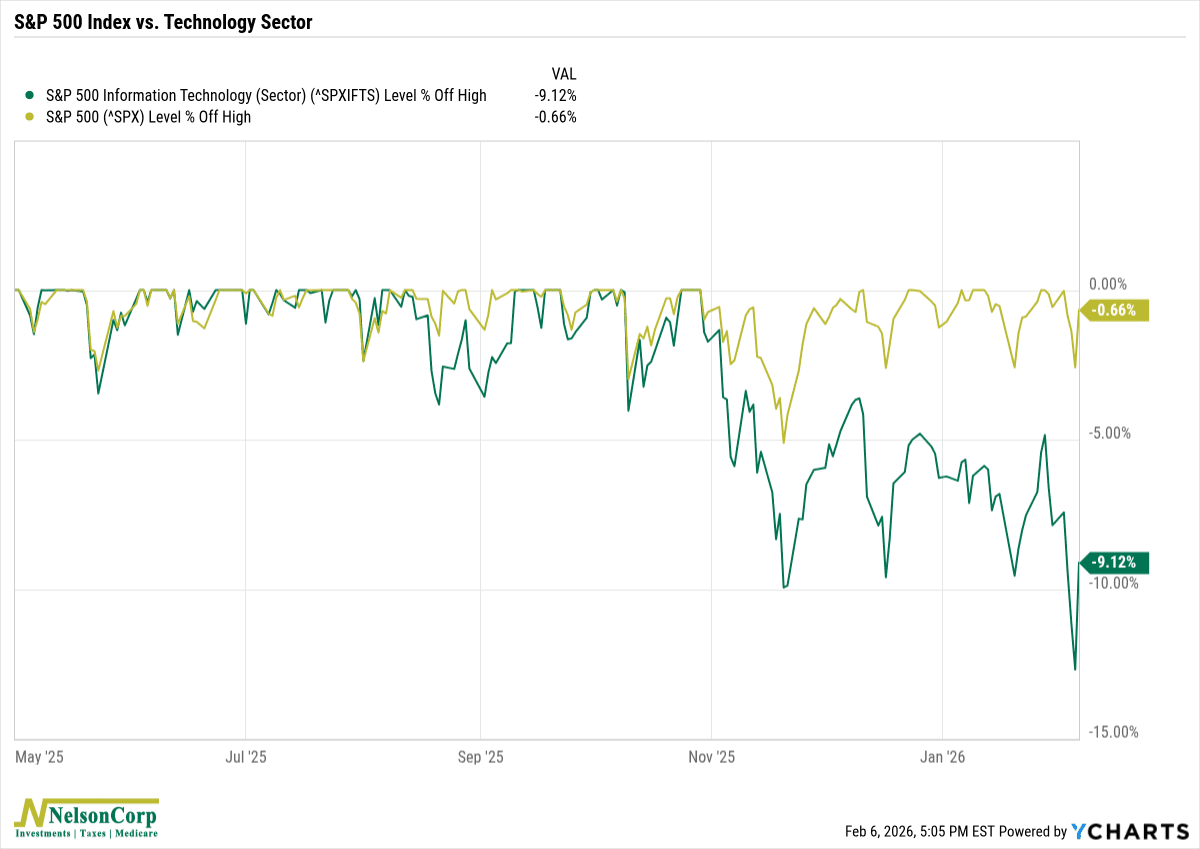

But what I find interesting is that the S&P 500 Technology sector has been in a drawdown since last Halloween, as the following chart shows.

Meanwhile, you might notice that the S&P 500, the broader stock market, has hit multiple new highs along the way—and is currently just a tad below its all-time high.

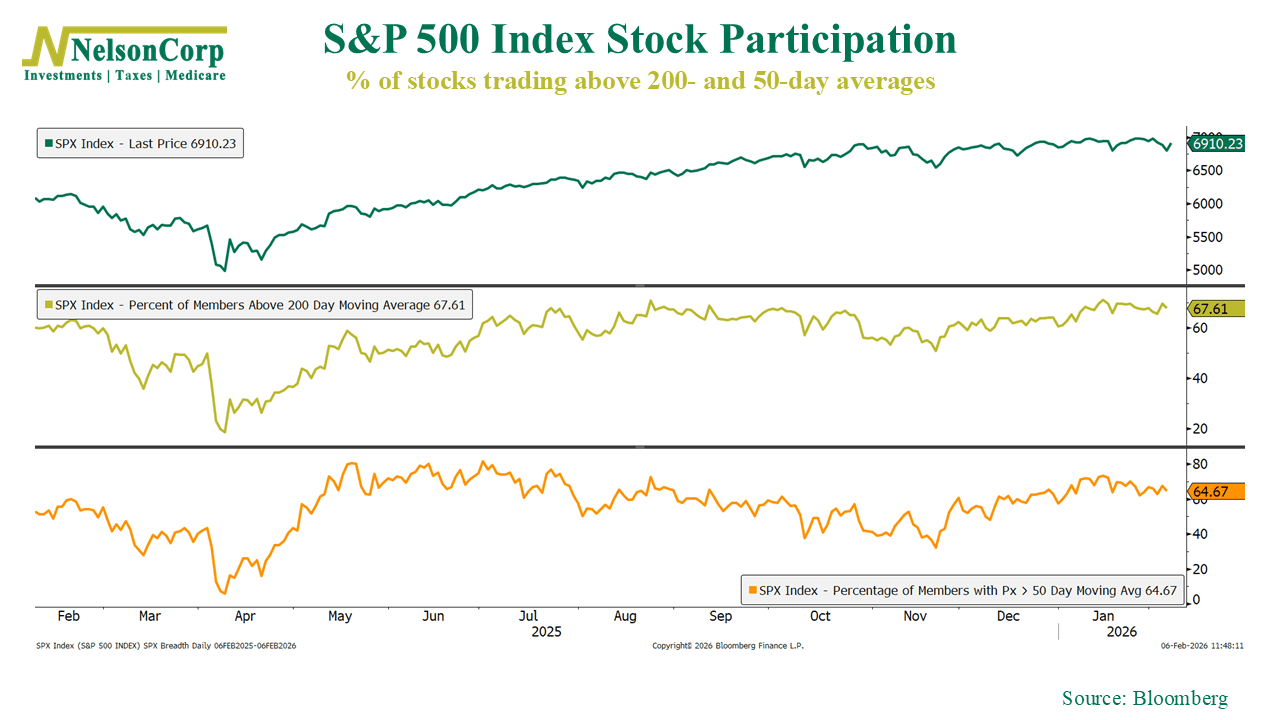

That’s likely because other areas of the stock market are broadening out. As this next chart shows, nearly 68% of S&P 500 stocks are trading above their average 200-day price. And even more striking, nearly 65% of them are still trading above their average 50-day price!

This suggests that what we are currently seeing is probably more of a rotation, meaning investors are taking profits on their massive tech-sector gains and repurposing those funds into the other more “forgotten” areas of the market.

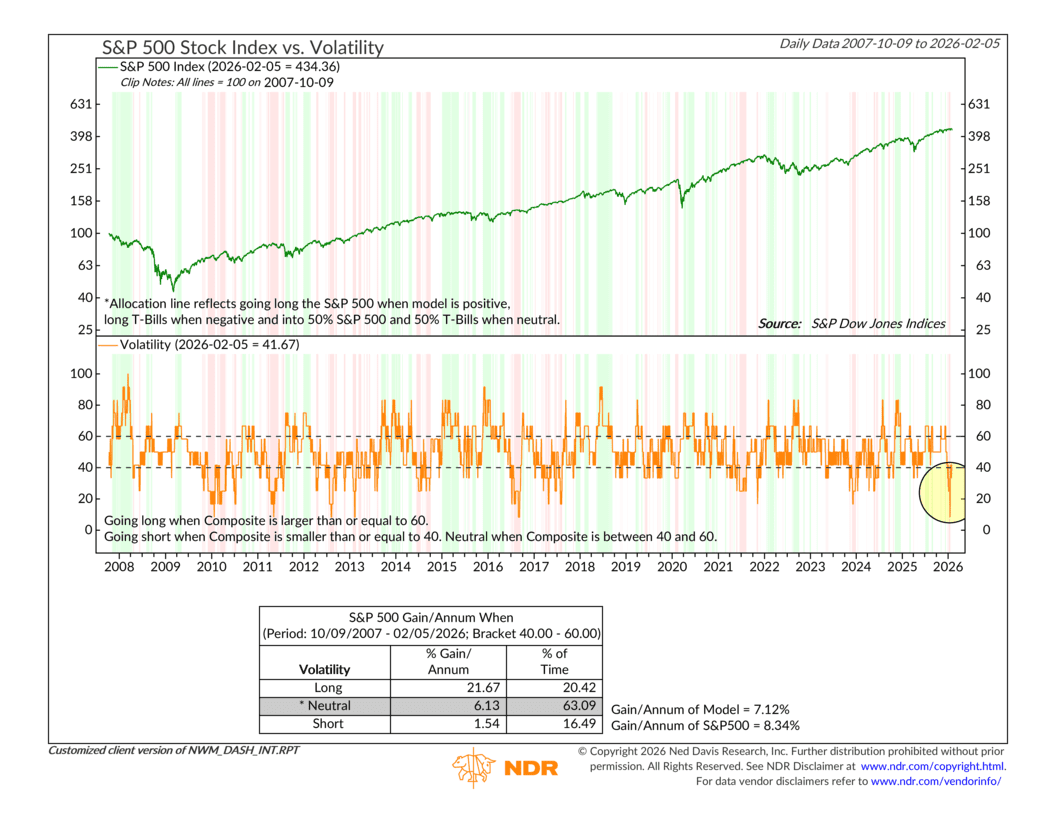

But, with that said, I don’t want to downplay the risks. Our primary stock market risk model has been trending negatively for the past few weeks. To be clear, it’s still positive, but there has been some deterioration beneath the surface.

For example, our composite of volatility indicators got really weak over the course of January, which likely set us up for this most recent bout of market weakness.

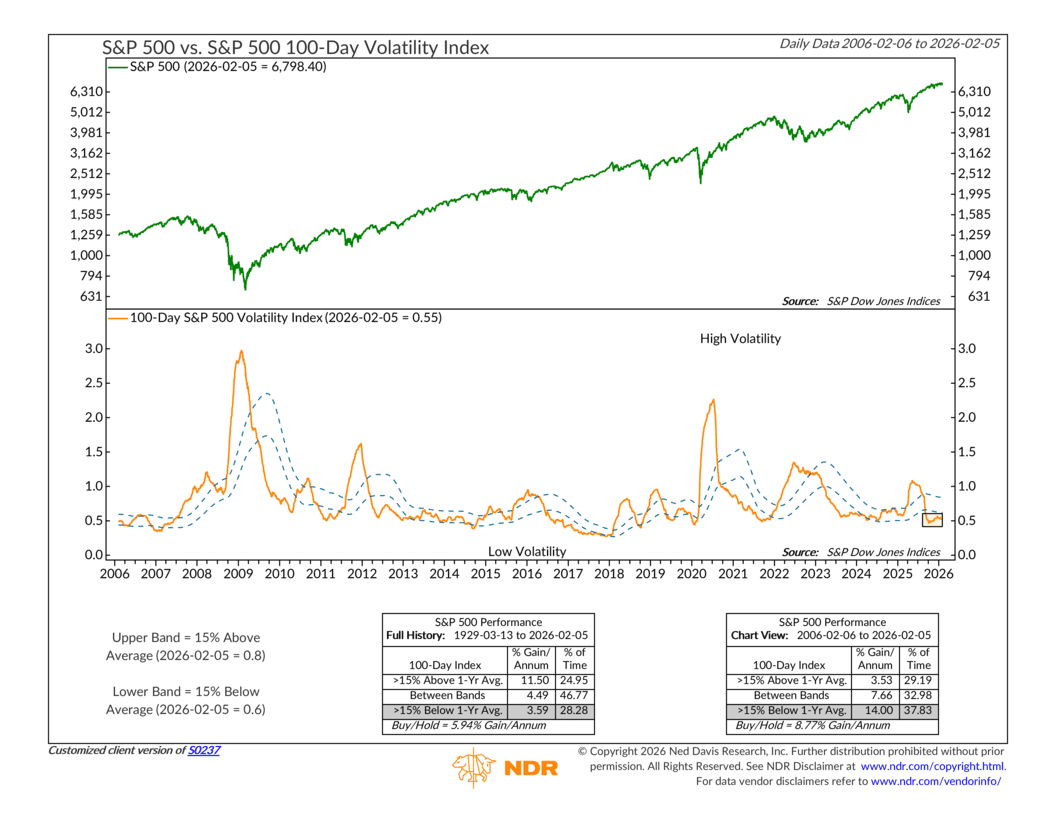

One reason has to do with complacency, in the form of low volatility. The following chart shows that over a rolling 100-day period, the actual (realized) volatility of the S&P 500 has been extremely low by historical standards.

This tends to equate to lower returns over the very long run, and only after a big surge in volatility does the expected future return of the index go up.

However, I will note that over the past 20 years, the performance breakdown has actually been opposite for this indicator. Low 100-day volatility has actually corresponded with better markets returns, which does line up with what we’ve experienced for the broader market. Sure, some sectors have gotten hammered recently, but like I said previously, overall, the S&P 500 is doing relatively well.

This means that if we do see a sustained rise in realized volatility over the next few months, the risk of a market downturn might just become more likely.

The bottom line? So far, this looks more like a healthy rotation than the start of something more sinister. Leadership is changing but not necessarily collapsing, and the broader market is still standing on solid footing even as tech cools off. That said, the internal warning signs are worth respecting. If volatility stays contained, markets can likely grind higher. But if volatility starts to wake up and stick around, that’s when we’d expect the risk picture to shift, and we’ll be watching closely for that signal.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks. The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market. The S&P MidCap 400 is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. S&P 600 Index measures the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. The S&P 100 index is a capitalization-weighted index based on 100 highly capitalized stocks for which options are listed on the CBOE (Chicago Board of Exchange). The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada.

The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. The Bloomberg U.S. Corporate High Yield Index is comprised of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million. The Bloomberg U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.