OVERVIEW

It was a down week for large-cap U.S. stocks as the VIX index, a measure of market volatility, increased to 16.14. The S&P 500 pulled back 2.08%, the Dow lost 1.24%, and the Nasdaq fell 3.15%. Small-cap stocks didn’t fare much better, down 3.01%.

The U.S. dollar strengthened about 1.9%, and equity markets fell globally. Developed markets dropped 2.63%, and emerging markets plummeted 4.46%.

Bonds struggled as the benchmark 10-year Treasury rate rose to 4.44%. This resulted in a 0.85% loss for the aggregate bond market, with long-term Treasuries faring the worst, down roughly 2.6%.

Real estate suffered declines of about 2.17%, and commodities were down broadly by over 2%. Oil dropped 4.62%, gold fell 4.11%, and corn dipped 0.24%.

KEY CONSIDERATIONS

Shaken, Not Stirred – Markets had a tough time shaking off the negativity this past week.

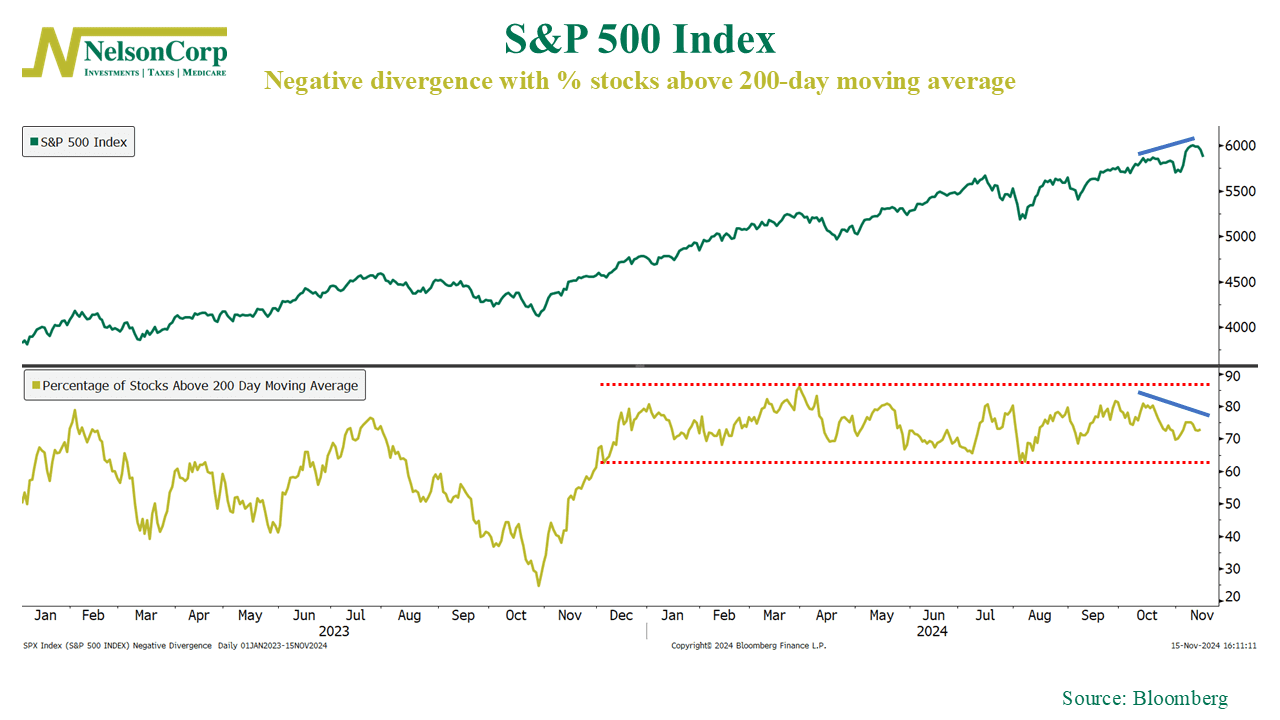

For example, investors are increasingly concerned about a widening divergence between the S&P 500 Index and the number of underlying stocks trading above their longer-term trend (200-day moving averages).

We call this a negative breadth divergence. Think of it like a car engine running on fewer and fewer cylinders. Momentum is fading under the surface, even if the headline index hasn’t fully stalled yet.

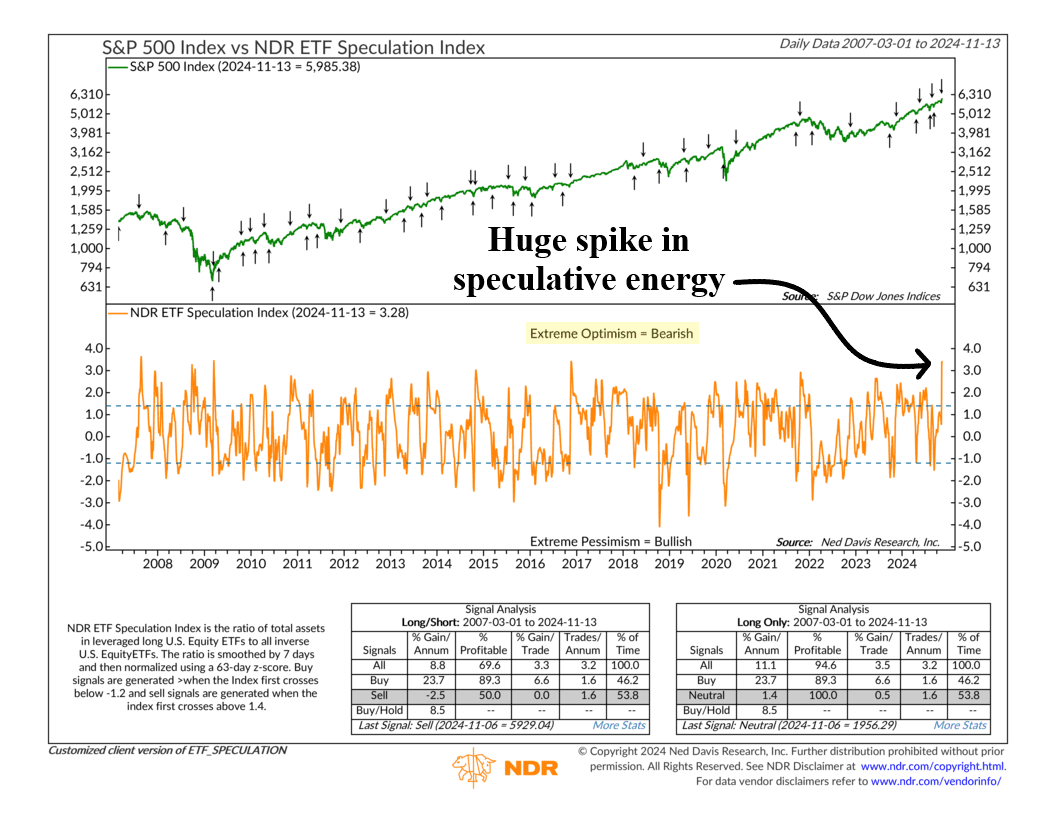

Meanwhile, our Indicator Insights post revealed an unsettling level of optimism in the leveraged ETF space. When investors start piling into long ETFs at a much higher rate than inverse ETFs, it’s often a warning sign that the crowd is too eager for gains.

Historically, this has been followed by sub-average gains in the broader stock market.

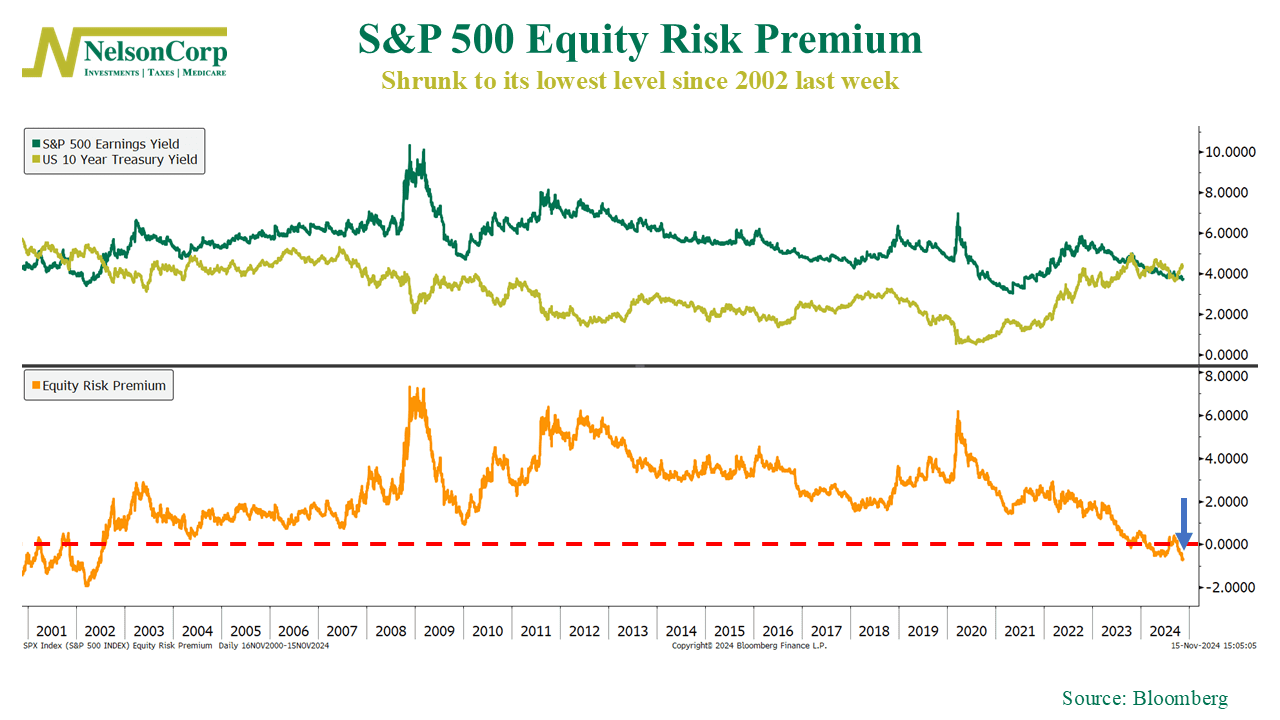

Couple that with our latest Chart of the Week, showing a shrinking equity risk premium, and it’s easy to see why some are hitting the brakes.

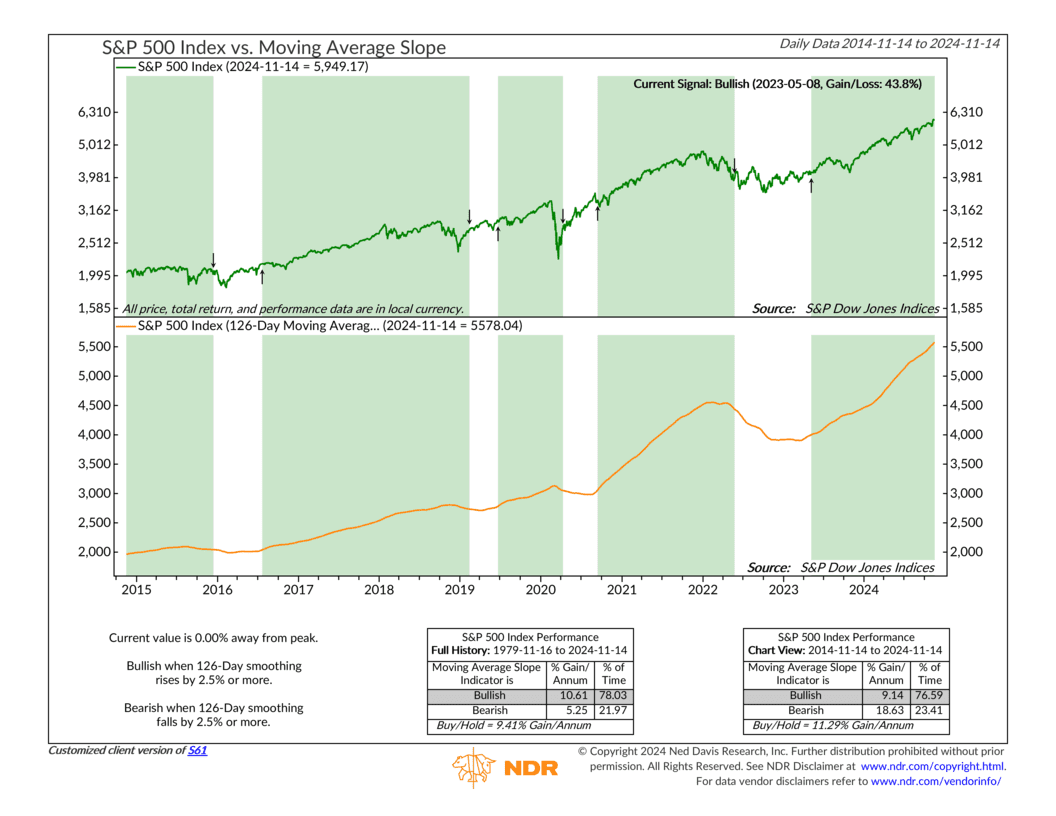

But it’s not all doom and gloom. The S&P 500’s longer-term trend, defined by its 126-day moving average, remains a bright spot.

As you can see, the orange line points confidently upward, a reminder that even though the market is wobbling now, the broader trajectory is still intact.

So, the bottom line is that this week’s market action shook investors, but as long as the market’s longer-term uptrend stays intact, it hasn’t yet stirred into something more dangerous.

For now, prepare for bumps—but keep your eyes on the road ahead.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.