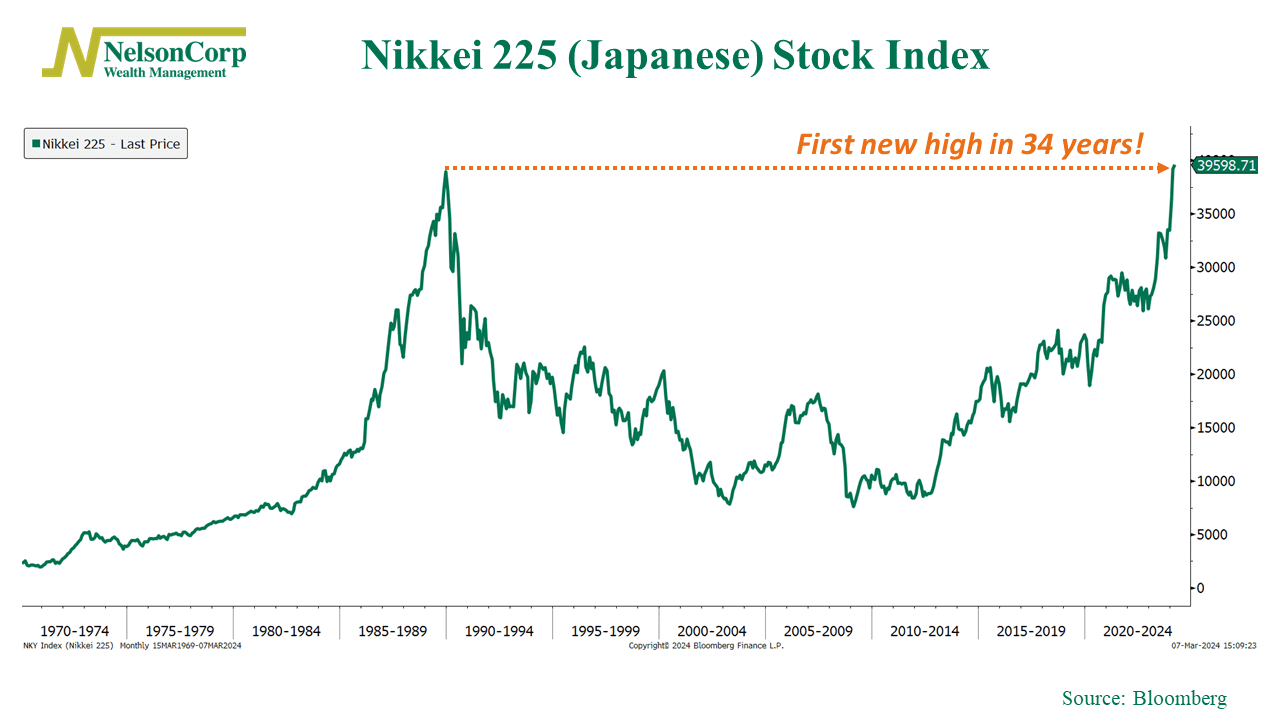

It’s been a while, but the Japanese stock market finally hit a new all-time high this month.

It reminds me of that scene in the movie Titanic where the old woman who survived the tragic incident starts her story by saying, “It’s been 84 years…”

Okay, maybe it hasn’t been quite that long, but for Japanese investors, it probably felt like that.

As our chart above shows, the Nikkei 225 stock index, which is like the yardstick for Japanese stocks, had been underwater for a whopping 34 years! But now, thanks to some seriously impressive profit growth, it’s back on top. According to the Wall Street Journal, the 225 Japanese companies in the Nikkei 225 Index are expected to rake in about $226 billion in profit this year, three times what they earned just ten years ago.

So, why should American investors care about this? Well, as the legendary investor Peter Lynch once said, “Sooner or later earnings make or break an investment in equities.” In other words, corporate profits are a big deal, and they ultimately drive stock prices up or down.

This ties in neatly with another important lesson: stocks are risky. We’ve gotten used to seeing stocks bounce back relatively quickly here in the U.S. whenever there’s a dip in the market. But that’s because there’s been solid profit growth backing them up. What if that growth wasn’t there?

That’s why we believe it’s crucial for investors to have a plan in place ahead of time to protect their money. Having to wait 34 years to recover the value of your stock holdings is no joke!

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Nikkei 225 Index is a stock market index for the Tokyo Stock Exchange (TSE), measuring the performance of 225 large publicly traded companies listed in Japan.