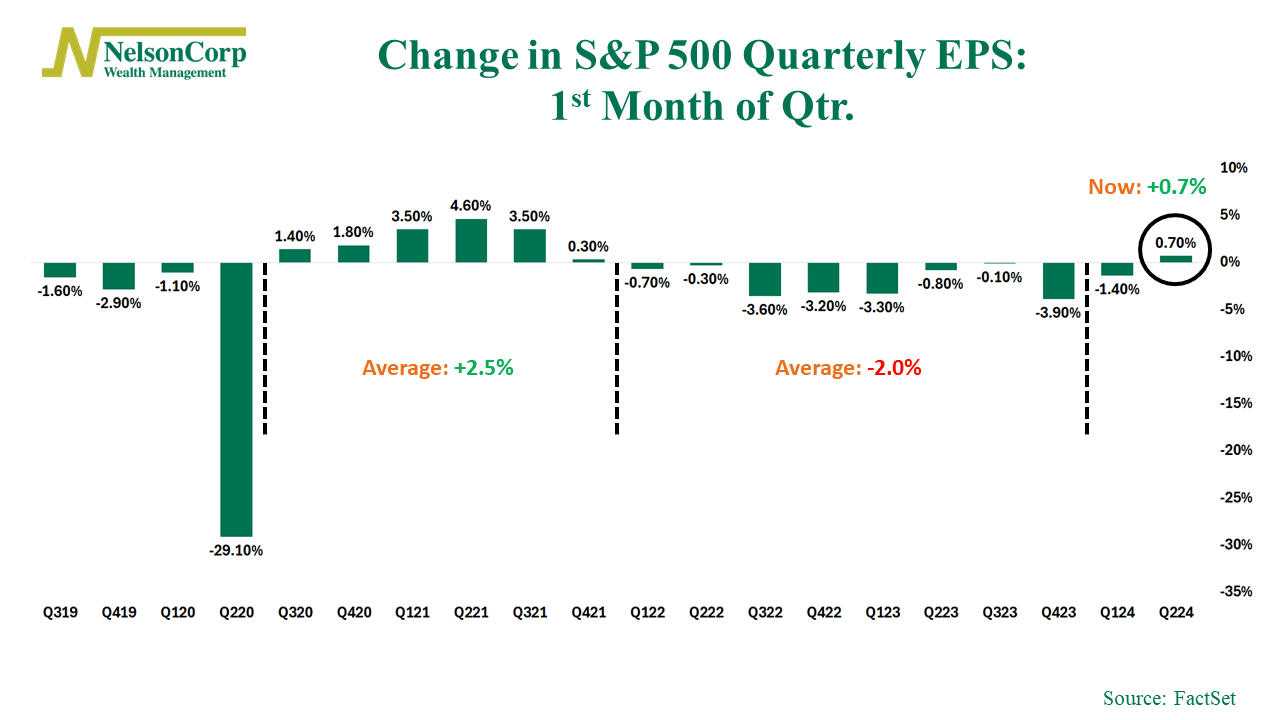

April brought a surprising turn of events in the world of stock market forecasts: for the first time since 2021, stock analysts actually boosted their earnings per share (EPS) estimates for the current quarter.

As our featured chart above shows, analysts increased their S&P 500 quarterly EPS estimates by 0.7% during the first month of the new quarter. This is highly unusual. Analysts are typically an optimistic bunch. Too optimistic. So they generally end up cutting—not raising—their current quarter estimates as the quarter progresses and the real numbers trickle in.

You can see how this was the case in 2022 and 2023. At the end of the month, analysts always cut their estimates by an average of 2%. (The period after the pandemic in 2020 was an outlier, as is the case with most financial metrics during that strange period.)

But now, Wall Street anticipates big things on the earnings front this year, so analysts are revising their forecasts. This is likely a bullish (positive) development for the stock market. Although there is some skepticism as to whether companies can actually deliver the 7% sequential EPS growth anticipated this quarter, we think the April estimate revisions are definitely a step in the right direction.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.