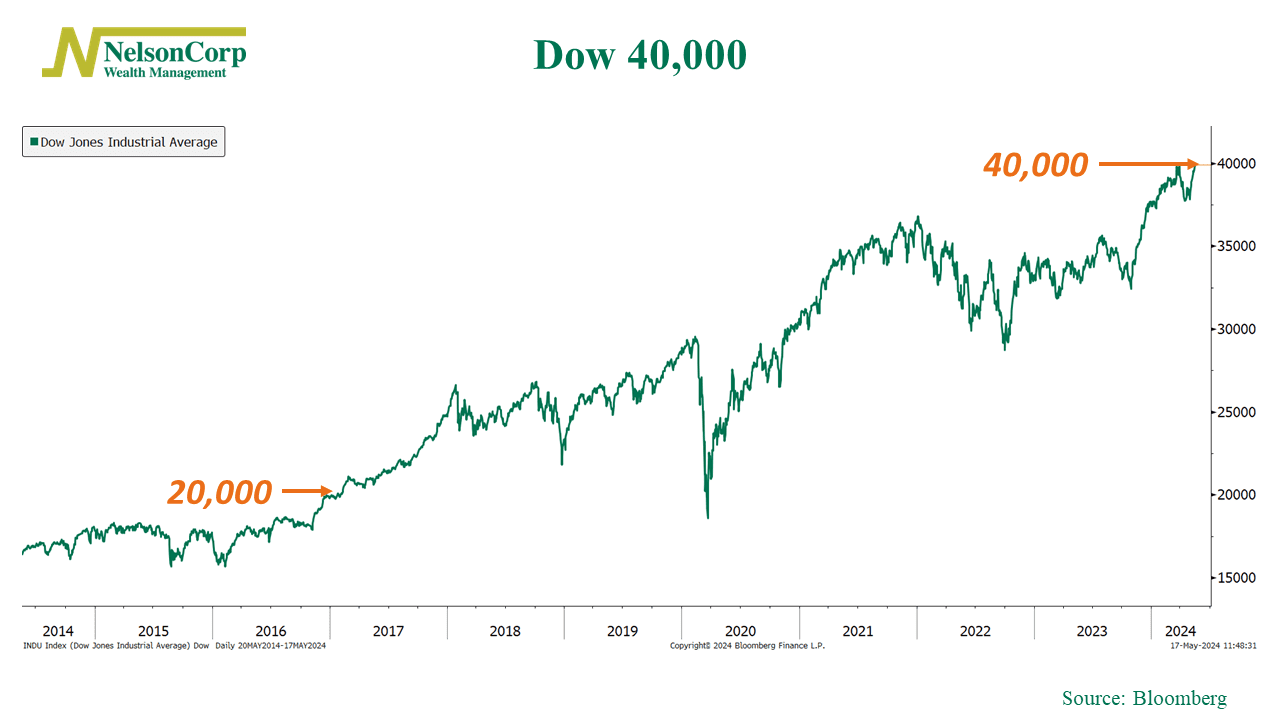

The U.S. stock market reached a major milestone last week as the Dow Jones Industrial Average crossed the 40,000 mark for the first time ever.

Looking at the chart, you can see that the Dow first crossed 20,000 in January 2017. So, it took a little over 7 years to double in price.

Not bad. The Dow has compounded at an annualized rate of roughly 9.5% per year (excluding dividends) for the past 10 years. Quick math says an investment should take about 7 – 8 years to double at that rate. So, we’re right on track.

Now, the Dow only represents 30 stocks. And it’s also oddly weighted according to stock price instead of market capitalization, so maybe it’s not the greatest benchmark for the overall stock market.

Nevertheless, it is noteworthy because the stocks driving the gains in the Dow happen to be different from the so-called “Magnificent 7” stocks that are highly represented in market-cap-weighted indexes like the S&P 500. Seeing the Dow hit 40,000 is a sign that the bull market is still here—and it’s happening in stocks outside of the usual big winners.

The bottom line is that the Dow hitting 40,000 is a sign that stocks are doing the most bullish thing they can do in a bull market—and that is go up.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.