My daughter loves strawberry milk, but when she makes it, she uses way too much strawberry syrup. You can barely taste the milk because it’s so concentrated. It kind of reminds me of today’s stock market. But instead of syrup, a few giant companies dominate the market.

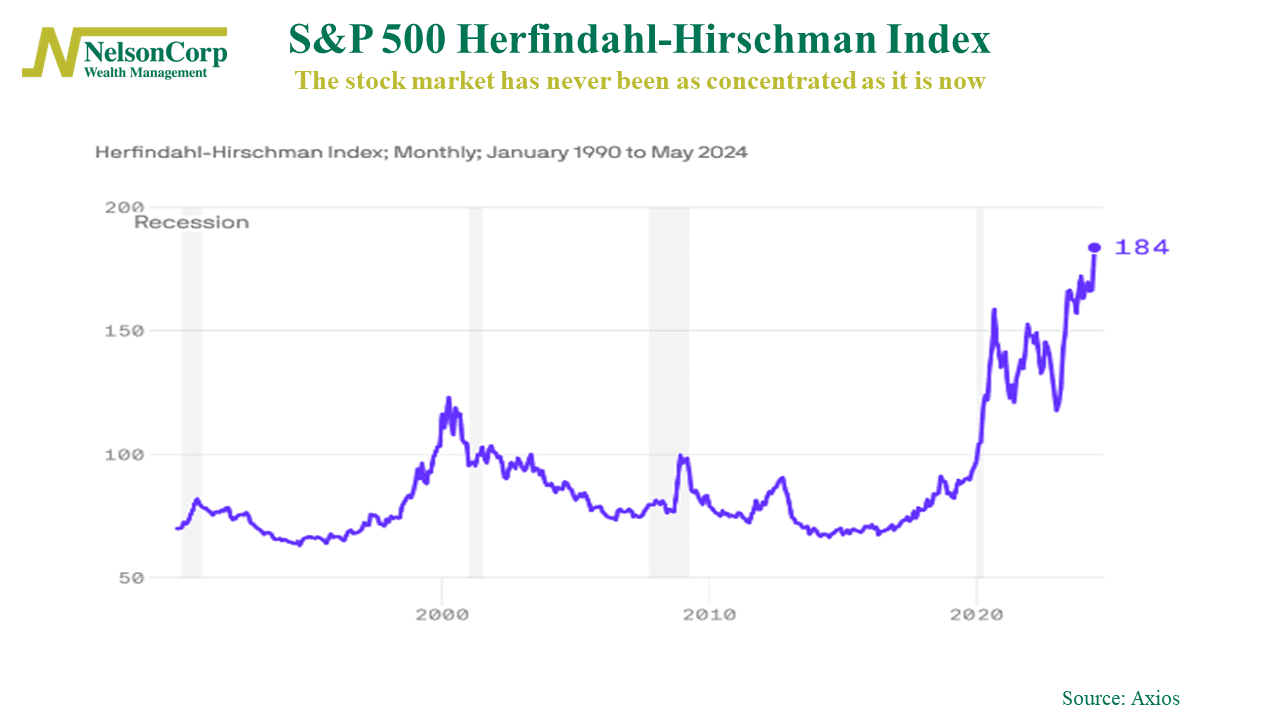

To measure this concentration, we use the Herfindahl-Hirschman Index (HHI), a fancy mathematical calculation often used in antitrust enforcement but also applicable to the stock market. The HHI sums the squares of each S&P 500 company’s market share. The result is that a higher HHI means more concentration, while a lower HHI indicates a more balanced market.

As you can see on the chart, the AI boom has catapulted the HHI to record levels, surpassing even the peaks of the dot-com era and the post-pandemic surge.

Is this a bad thing? It’s hard to say. Market concentration will likely retreat from its current highs at some point. If the smaller companies can grow and take the reins from the giants, the transition could be smooth. If not, the overall market might face challenges.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.