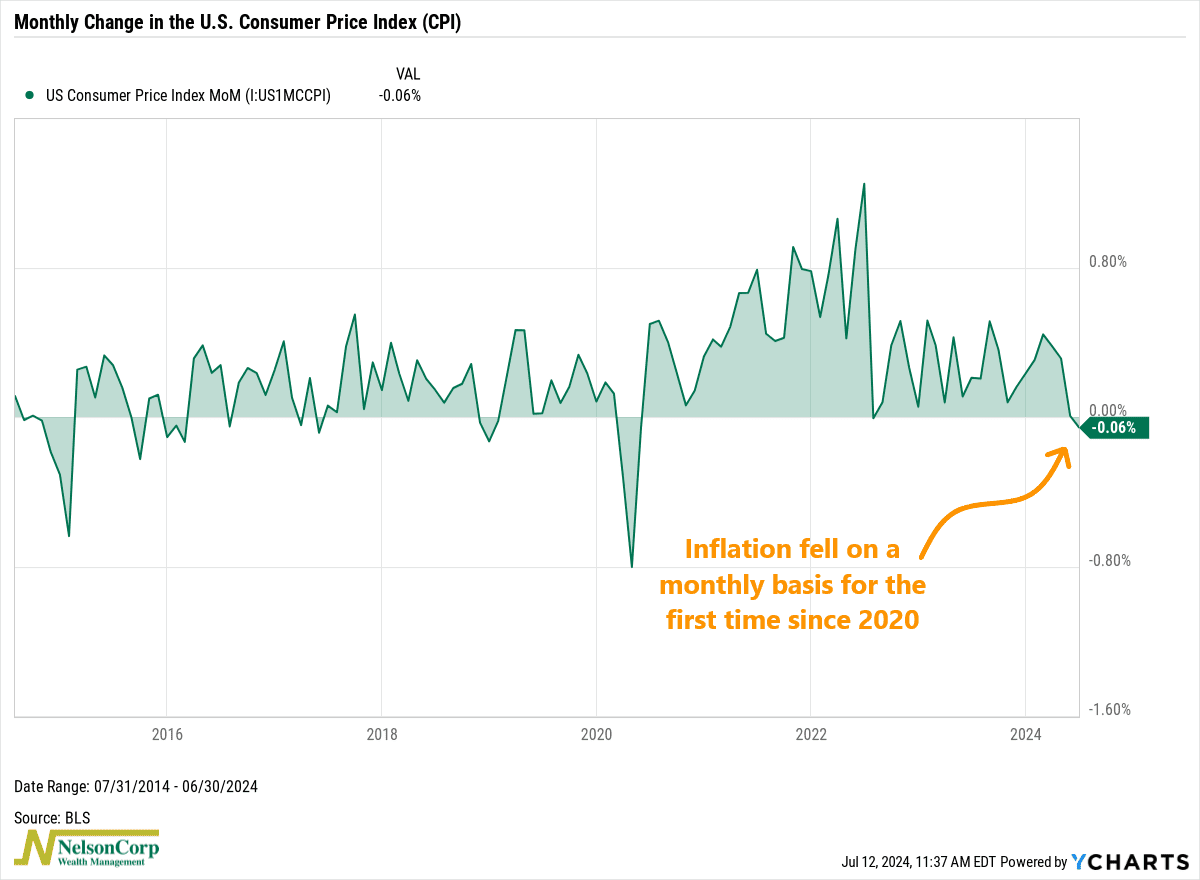

We got some big news regarding the economy this week. The latest inflation reading showed that June’s Consumer Price Index (CPI) fell 0.6% over the previous month. This was the first monthly decline since 2020.

What caused the price drop?

Used cars, mostly. Over the past year, used and rental car prices have decreased by 10% and 6%, respectively. Prices for appliances and furniture have also fallen by around 4% to 5%, while gasoline prices are down 2.5%.

However, not all prices are falling. Auto insurance has surged by 19.5% over the past year, and rent remains stubbornly high, up about 5%.

Overall, this brings the annual inflation rate to exactly 3%. While this is not quite the Fed’s target of 2%, it’s getting close. So close, in fact, that the market is now predicting an 88% chance of a rate cut at the Fed’s September meeting.

What does this mean for asset markets?

It’s likely good news for bonds, as it suggests rates are likely moving lower from here. You might feel comfortable extending duration and locking in these higher rates for longer. For stocks, uncertainty may persist, so it’s best to stay vigilant.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.