Inflation isn’t just a big deal for your wallet. It matters for financial assets, too. Whether it’s rising or falling relative to its recent trend plays a big role in determining which asset class leads. That’s what this week’s indicator is all about.

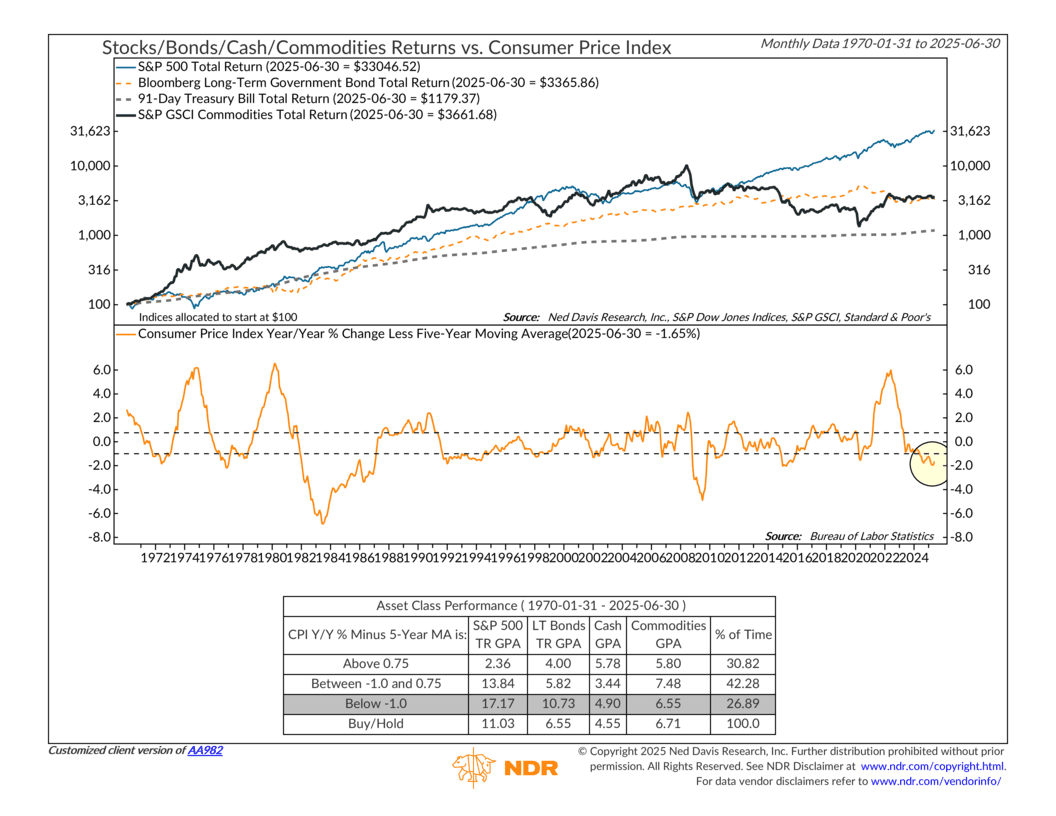

It looks at how stocks, bonds, cash, and commodities perform depending on how hot—or cool—inflation is running. But instead of just using the headline inflation number, it compares the Consumer Price Index (CPI) to its five-year moving average. That gives a clearer sense of whether inflation is unusually high or low for the current environment.

But first, why does inflation have such an impact? It comes down to how each asset class responds to changing costs and interest rates. Stocks tend to do well when inflation is cooling because it often signals stable pricing, healthy margins, and less pressure on the Fed to tighten policy. Bonds, on the other hand, are more sensitive to rising inflation, which erodes their fixed payments. Cash can be useful in high-inflation periods simply because it avoids short-term losses, while commodities—especially things like oil and metals—tend to thrive when inflation is running hot, since rising prices often reflect rising demand.

So what’s the takeaway? When inflation is more than one percentage point below its five-year average, stocks tend to come out on top. Since 1970, the S&P 500 has returned over 17% annually in that setup—far better than its long-term average, and well ahead of the returns for bonds, cash, or commodities.

Stocks also perform well when inflation is slightly above its five-year average (no more than 0.75 percentage points). But if inflation climbs higher than that, leadership tends to shift. Commodities and cash start to outperform, bonds hold up okay, and stocks lag behind.

Where are we now? That’s the good news. Inflation is currently running about 1.65 percentage points below its five-year average. That puts us firmly in the “cool zone”—a historical sweet spot for equities.

The bottom line? Inflation affects asset classes differently, depending on how extreme it is. Historically, stocks have done the best when inflation runs well below trend—and that’s where we are now. While this is just one indicator and not a guarantee of gains, it does suggest the current environment is working in the stock market’s favor.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S