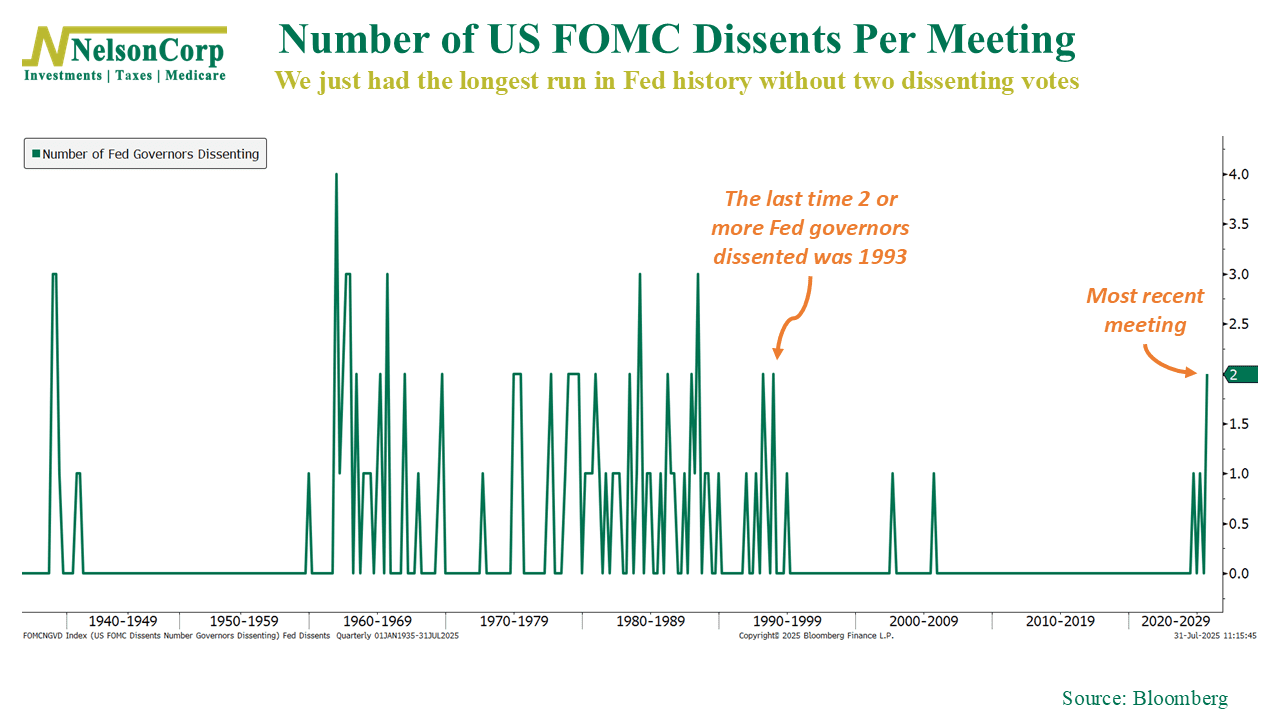

Something unusual just happened in the “exciting” world of monetary policy. At the latest FOMC meeting, two Fed governors broke ranks and voted against the consensus to hold rates steady—the first time we’ve seen that kind of dissent since 1993.

As this week’s featured chart shows, this breaks a historic run of consensus. We just experienced more than 30 years without two or more dissenting votes. Sure, there have been pockets of dissent around key turning points in policy, but for the most part, unanimity has defined the post-90s Fed.

To be clear, dissent doesn’t guarantee a rate change. But it does suggest growing disagreement over the Fed’s current stance. Two governors now favor cutting rates—which could open the door for more to follow.

Our take? A healthy debate inside the Fed is a good sign. It shows that complacency isn’t creeping in. But it also means the Fed’s next move will be under even closer scrutiny, especially with labor markets softening and inflation near target. A misstep here could spark renewed market volatility—which is exactly the kind of risk we plan for.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.