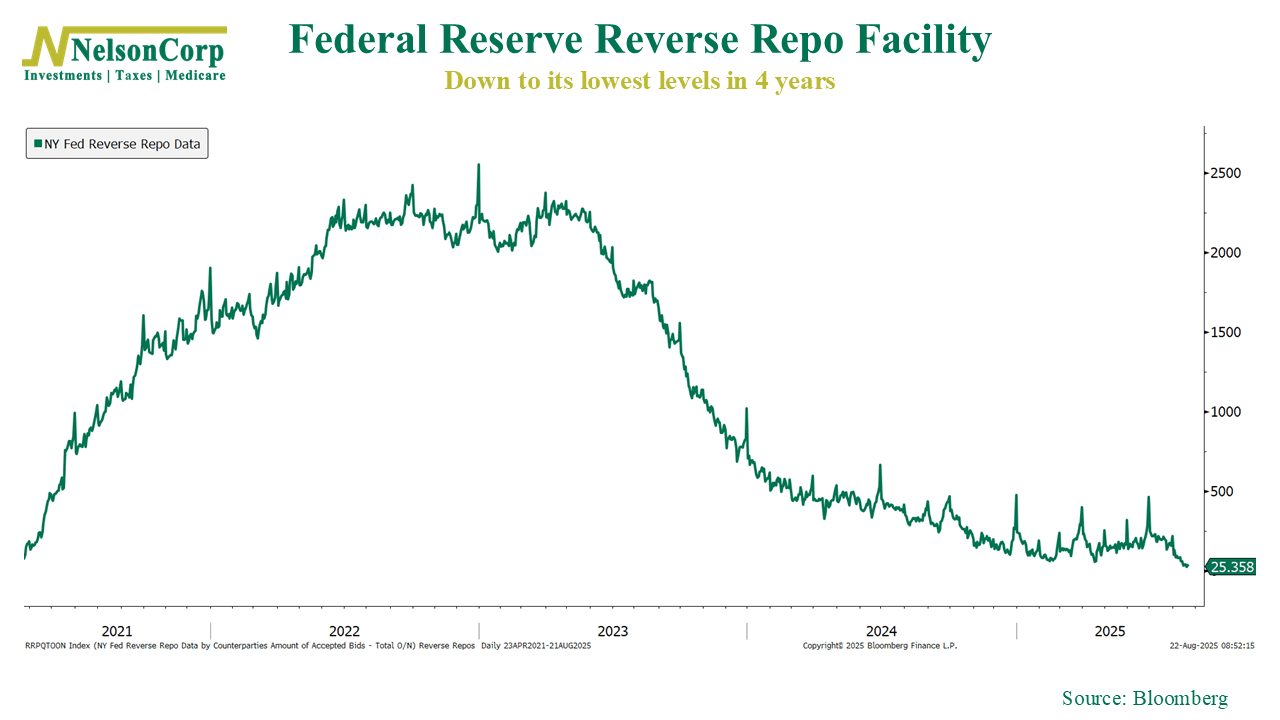

There’s an interesting development happening in financial markets right now. Sure, it’s a little boring and technical, but it centers on something called the Reverse Repo Facility. I like to think of it as financial markets’ version of coins in the couch cushion. It’s where big money-market funds and banks have been storing extra cash they don’t need overnight in exchange for a small return.

But as this week’s chart shows, that cushion has been nearly emptied. Balances have dropped from more than $200 billion in late July to under $30 billion today—the lowest level since 2021. Why? Because the Treasury has been selling a mountain of short-term government debt, and money managers would rather scoop up those higher-yielding Treasury bills than leave money with the Fed.

So why does this matter? Well, for the last couple of years, this facility has acted like a shock absorber in the financial system—a backstop of liquidity, so to speak. But with the couch cushion now nearly cleaned out, the pressure shifts to the banking system. Reserves are still plentiful, but they’re beginning to shrink. If they fall too low, markets can get jittery and interest rates can jump sharply.

The bottom line, though, is that this isn’t a crisis. It’s kind of like a normalization of the plumbing of the financial system at work. But it’s also a reminder that liquidity—the grease that keeps markets running smoothly—isn’t unlimited. And once the spare change is gone, markets might not have as much of a cushion to fall back on.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.