The Fed went ahead and cut rates again this week. It was mostly expected. The bigger question is what comes next. Looking into next year, it is not clear how many additional cuts are actually on the table. Inflation remains above the Fed’s comfort zone, and policymakers have been careful to signal they are not in a hurry to roll out a full easing cycle. As a result, the next major driver for stocks may have less to do with rate cuts and more to do with who eventually replaces Fed Chair Jerome Powell.

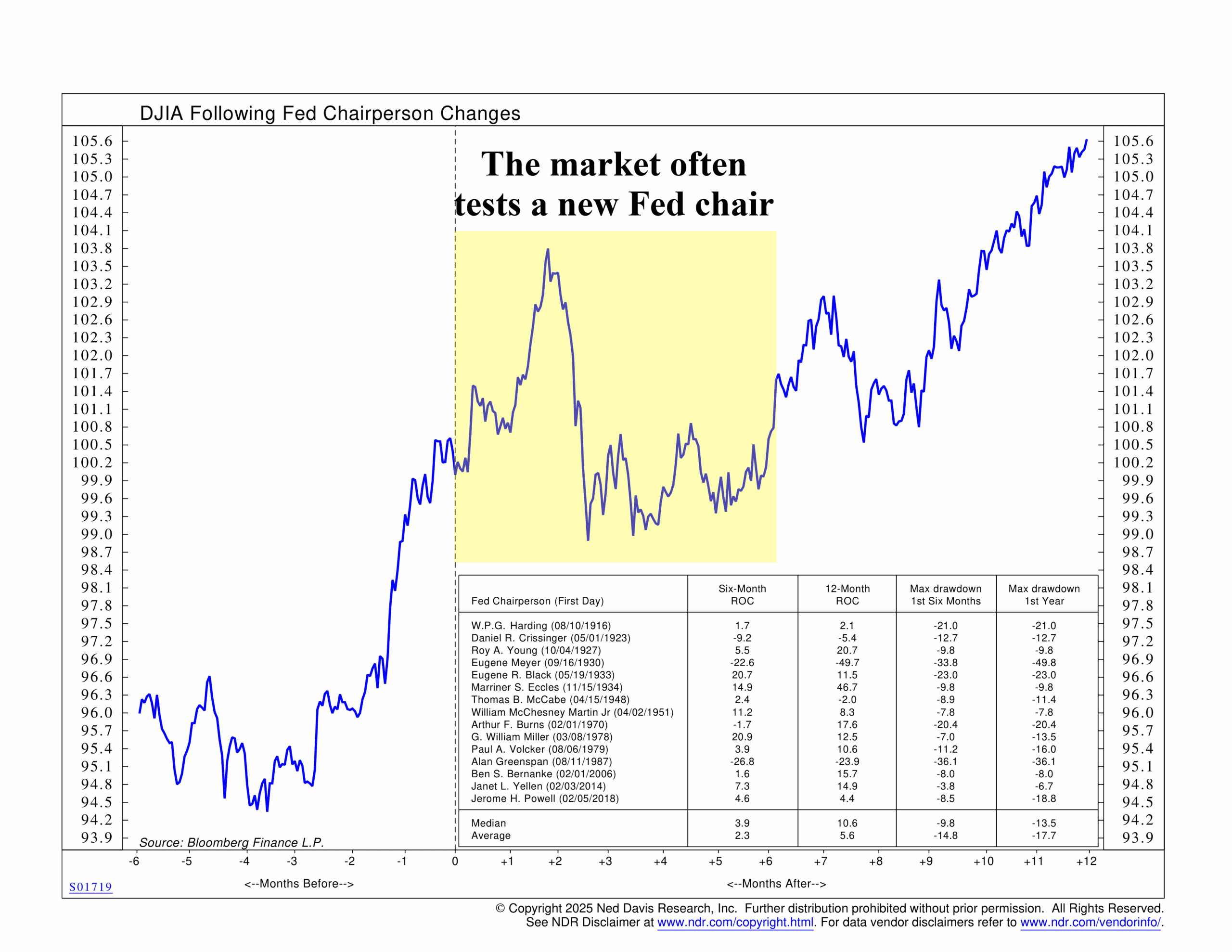

Why? Because the market often tests a new Fed chair. This week’s chart looks at how the Dow Jones Industrial Average has typically behaved around past Fed chair transitions—and at first glance, it’s not especially comforting. Historically, the market tends to tread water during the first six months after a new chair takes over. Drawdowns are also common during this period, and the maximum pullback during the first year has generally been in double digits.

In other words, the early phase of a new Fed regime has often been marked by uncertainty rather than immediate confidence.

That uncertainty speaks to a bigger issue looking ahead to 2026, and that is Fed credibility. Whoever steps into the role may face a difficult choice between proving their inflation-fighting credentials or responding to pressure to deliver rate cuts. History shows that this tension can create volatility, and the market’s reaction will likely hinge less on promises and more on whether the Fed can maintain trust while navigating that tradeoff.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.