“Buy the rumor, sell the news.” This is an old Wall Street maxim that refers to the idea that one should buy a rumor in anticipation of an event, but by the time the rumor has become an actual fact, it’s time to sell. This is because, in today’s world, information is disseminated quickly. So, traders will typically buy on the rumor that some event is going to occur in the marketplace and then sell when the actual news or press release is made official.

This is perhaps what we are seeing play out in the universe of infrastructure stocks.

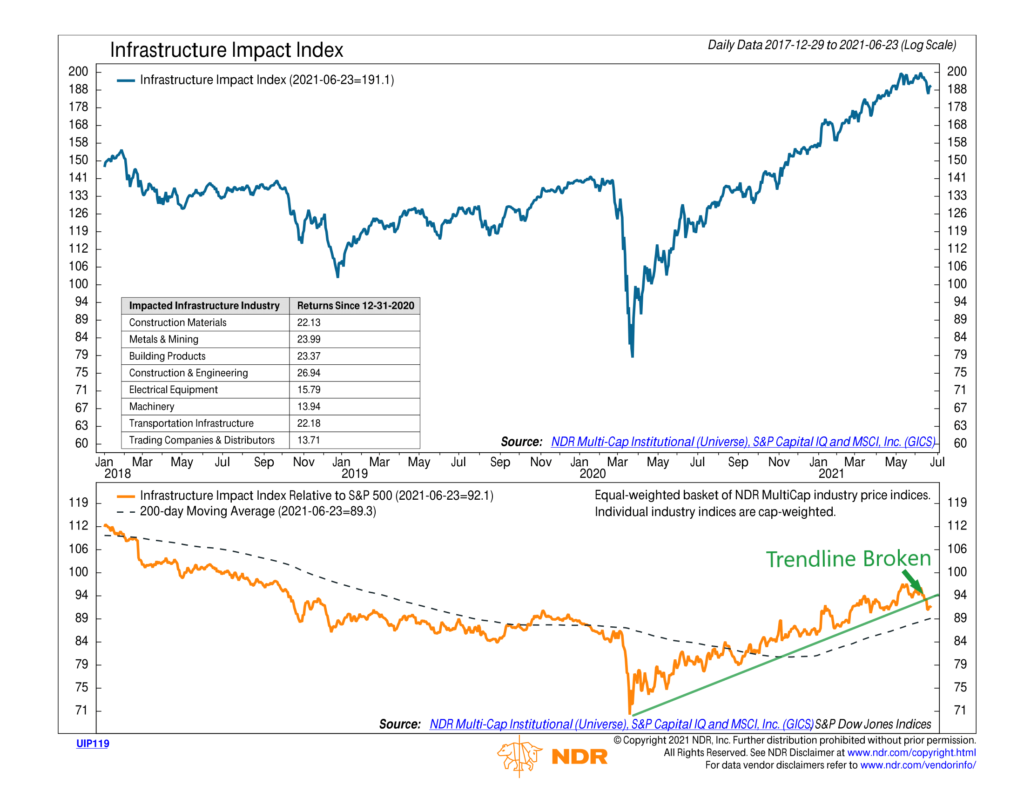

Our featured chart above shows the absolute and relative performance of something called the Infrastructure Impact Index. This index is comprised of a basket of stocks that do business in infrastructure-related industries, like Construction Materials, Metals and Mining, Building Products, Construction and Engineering, Electrical Equipment, Machinery, Transportation Infrastructure, and Trading Companies and Distributors.

The orange line in the bottom clip of the chart shows the performance of the Infrastructure Impact Index relative to the S&P 500 stock index. When the line is rising, as it has been doing quite steadily since the March 2020 low, it means that this basket of infrastructure stocks is doing better than the overall market.

Rumors have been circulating all year that the government is going to pass a large infrastructure bill. Holding to the maxim, traders have indeed been buying the rumor, as evidenced by the Infrastructure Impact Index rising steadily relative to the S&P 500 all year.

However, it appears that the trendline has been broken. Perhaps this is a sell-the-news event, as just this week, President Biden and a group of centrist senators agreed to a roughly $1 trillion infrastructure plan.

Of course, the bill will still have to make its way through Congress, and until the President signs it, anything can happen. It will be interesting to see where infrastructure stocks go from here in anticipation of the outcome. Stay tuned.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.