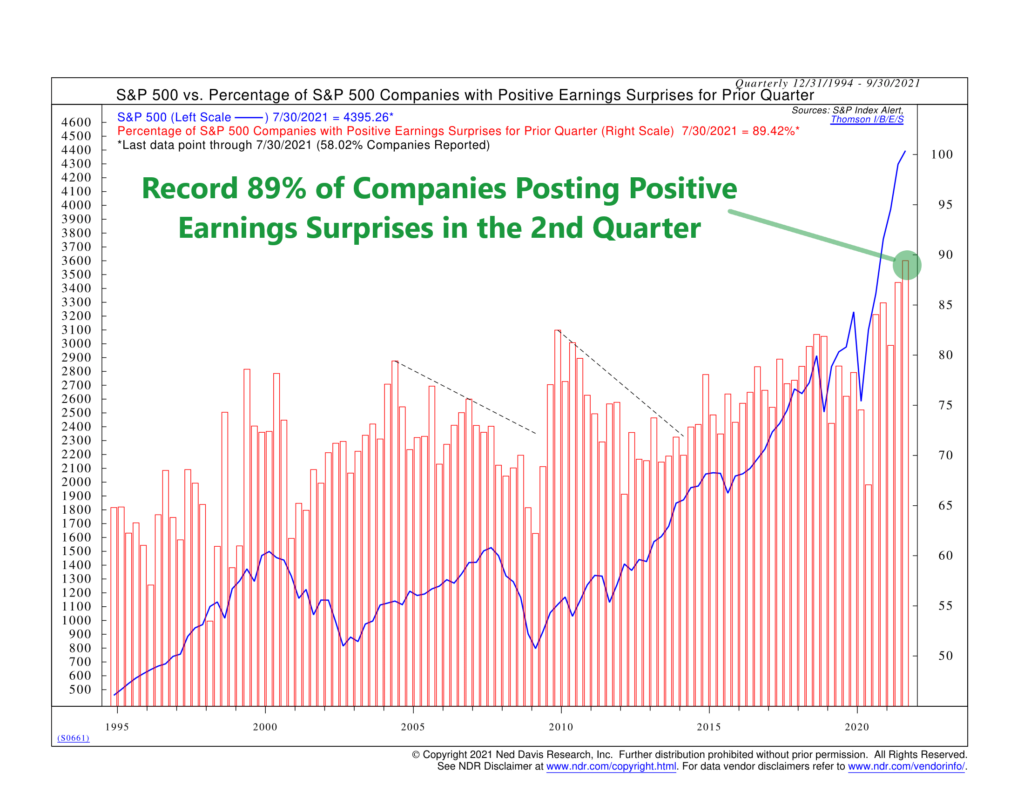

Ok, Wall Street has come around to the fact that corporate earnings will be good for the companies in the S&P 500 this year. So surely, after a record-setting number of earnings surprises in the first quarter, expectations would be better adjusted for the second quarter, right?

Nope. Of the 58% of companies that have already reported their profit numbers for the second quarter, roughly 89% of them have beaten their earnings estimates—resulting in what is called an “earnings surprise.” As our chart of the week above reveals, that is the highest percentage of earnings surprises on record, surpassing even last quarter’s record percentage.

Analysts now expect S&P 500 aggregate earnings per share to be $207 this year, up from the previous forecast of $193. That is a 45% year-over-year growth in profits, set to surpass profit levels in 2019.

Historically, earnings surprises have acted as a tailwind for stock prices in the early stages of a cyclical bull market. So, things look good right now. However, I should note that the earnings surprise rate tends to drop dramatically as the bull market ages. Sure enough, earnings growth is expected to moderate next year, rising around 2% on a year-over-year basis.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.