Let’s say you like a particular stock, and you want to buy a lot of it because you think it’s going to go up in price. But there’s a problem: you don’t have or don’t want to put up all the cash required to buy the shares needed.

One solution is you could buy a call option on the stock. A call option is a contract that gives you the right but not the obligation to buy, let’s say, 100 shares of a stock at a specific price up until the expiration of the contract. In exchange, you pay a fee, called the premium, which is typically much lower than the cost of buying the shares outright.

This does a few interesting things. It provides a source of leverage for the investor because the option is much cheaper than buying the stock, which allows a trader to control a larger stock position using a smaller amount of capital.

But it also provides—to use the technical jargon—an asymmetric payoff for the investor. This means you get all the potential upside of buying the stock (minus the premium), but you get to avoid any downside if the stock drops below the exercise price specified in the contract. In other words, you pay a fee, and it gives you the right to buy a stock at a specific price—but only if the payoff is worth it to you.

If, however, you are bearish on a stock and think it’s going to go down in price, you can instead buy a put option. Everything works the same as in a call option, but instead of giving you the right to buy the stock, a put option gives you the right to sell the stock at a predetermined price.

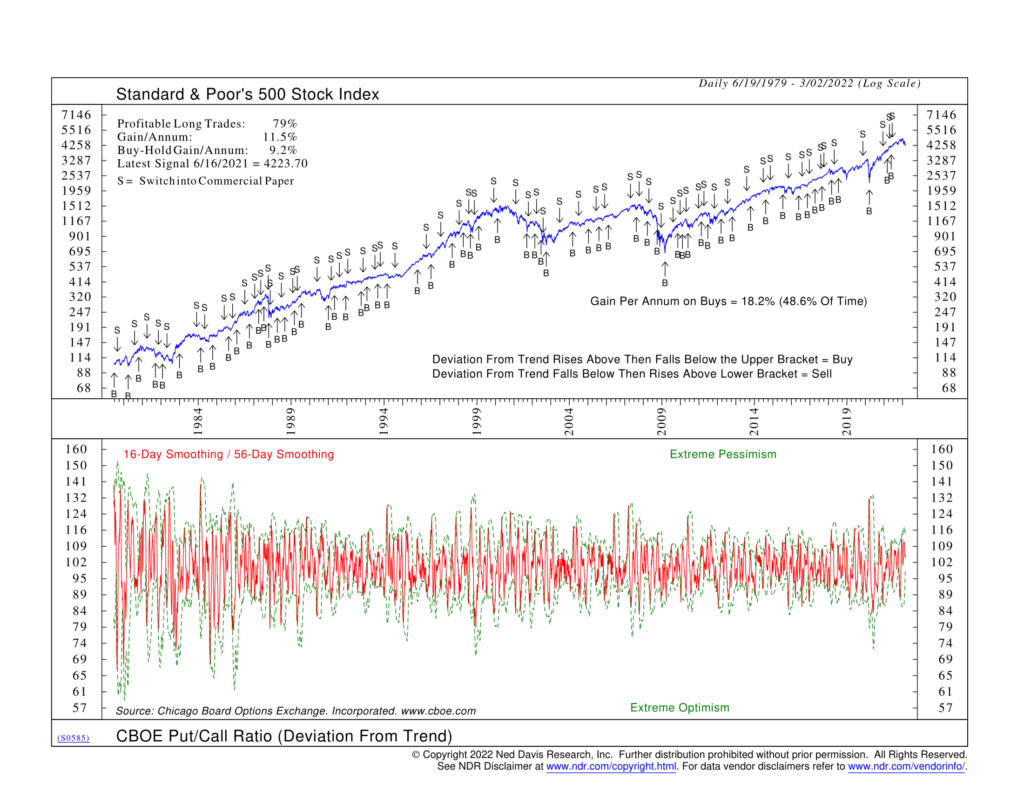

So, naturally, given these characteristics, you can see why call and put options would be attractive to investors who wish to make big, speculative bets on the stock market. And that’s what our featured indicator above looks to exploit.

It looks at the ratio of puts to calls traded for the S&P 500 Index on the Chicago Board of Options Exchange (CBOE). When the put/call ratio is rising, it means investors are buying more puts, betting aggressively that the market is going to fall. But when the put/call ratio is falling, it means investors are optimistic about the stock market and thus buying more call options.

More specifically, the indicator employs a deviation-from-trend technique that divides the shorter 16-day moving average of the put/call ratio by the longer 56-day moving average. This is the red line. The green dotted lines are volatility bands that mark extremes in the ratio. These bands move with the data and adjust for changes in longer-term trends.

We’ve found that when the smoothed CBOE put/call ratio rises above the upper volatility band, it suggests excessive pessimism among investors, a sign that a market bottom may be nearby. Conversely, a drop in the indicator below the lower volatility band indicates excessive optimism, a warning sign of a market top. A buy signal is generated when the ratio rises above the upper band and then falls back below it. A sell signal is generated when the ratio dips below the lower band and then rises back above it.

Historically, following the buy/sell signals generated by this indicator would have produced a gain per annum of 11.5% for an investor versus a buy and hold gain of 9.2% for the S&P 500 Index. More so, about 80% of the signals would have resulted in a profitable trade.

We use the CBOE put/call ratio as a market sentiment indicator. It tells us when to act against the market when sentiment has reached extremes, based on speculative options traders. Historically, this indicator has done a good job of identifying the excessive levels of sentiment that tend to precede reversals in the stock market. Since it’s based on what options traders are actually doing, as opposed to what investors are saying in surveys and polls, we bucket this indicator into our Investor Positioning component of our models.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.