We have found that interest rates tend to call the tune of the stock market. In particular, the stock market tends to get stressed out when interest rates rise rapidly.

Why? One reason is that bond yields (i.e., interest rates) compete with stock dividend yields, which matters a lot for investors seeking income. Also, higher interest rates raise the cost of financing business growth, affecting corporate profitability and, therefore, stock prices.

That’s why we look at indicators based on interest rate movements when we model stock market risk.

One indicator in particular that we focus on has to do with the corporate bond yields of companies rated Baa by Moody’s. Bonds with this rating are generally considered the lowest level of investment-grade debt, or what you might call medium-quality corporate bonds. (Bonds rated below Baa are considered high yield or “junk” bonds). So, this series is representative of a typical large corporation’s borrowing costs.

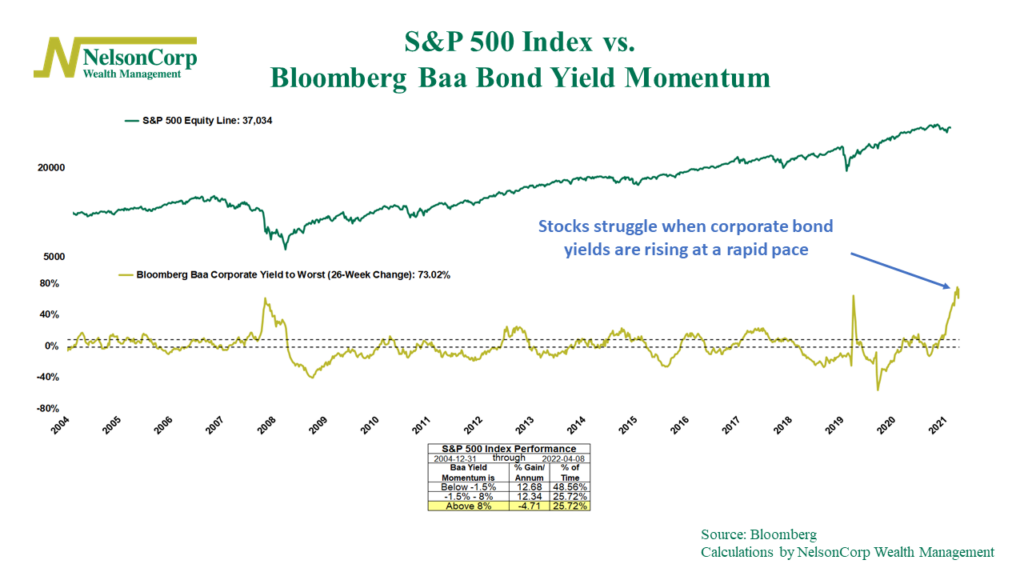

The next step, then, is to figure out whether corporate bond yields are putting pressure on the stock market. To do this, we take the 26-week change of the Bloomberg Baa Corporate Bond Yield series, shown as the gold line on the chart above. We call this corporate bond yield momentum.

When this line is rising, it means corporate bond yields are higher than they were 26 weeks earlier. Historically, when they’ve been higher by at least 8%, the S&P 500 index (green line) tends to struggle, with a -4.7% annualized gain per annum. Typically, we see this happen during periods of market stress when investors sell out of riskier assets like corporate debt and equities in favor of safer investments like U.S. Treasuries.

We’ve seen this play out recently in the market. Near the end of November last year, corporate bond yield momentum rose above the 8% mark. As of last week’s close, it was as high as 73%, the highest on record! And sure enough, the S&P 500 is down roughly 4% over this period.

Going forward, we’ll be looking for this measure to fall back below 8%, where market returns tend to be more normal (and positive!). About 3/4ths of the time, corporate bond yield momentum is lower than the bearish 8% mark. But it’s the other 1/4th of the time—like now—when the risk to stock returns from rising corporate bonds yields is the greatest.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.