For this week’s indicator, we’re going to look at fund flows and how they affect stock market returns.

What is a fund flow? It’s simply the amount of cash flowing into or out of a financial asset. It doesn’t measure the performance of the asset but rather the movement of cash within the asset. However, the amount of cash moving into or out of an asset says a lot about the sentiment surrounding the asset, so investors can use this information to gauge the health of the overall market.

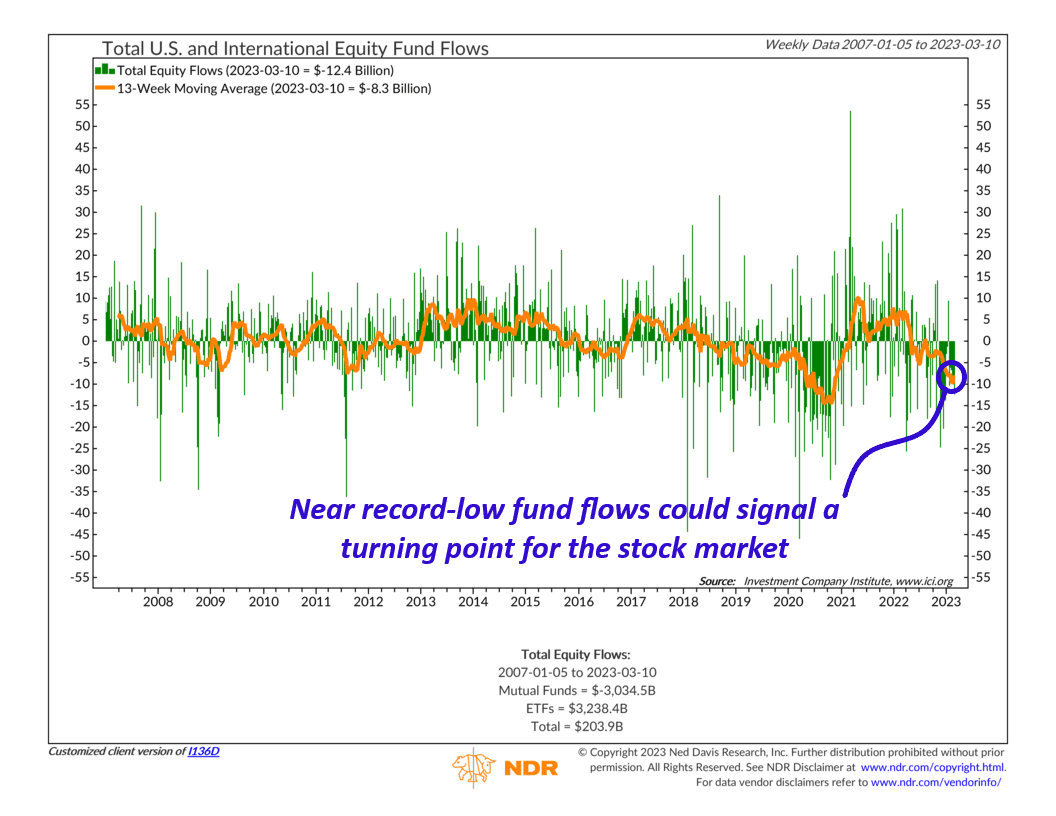

Our chart above shows weekly dollar flows into mutual funds and exchange-traded funds (ETFs) that invest solely in stocks. Each green bar represents the net weekly amount of money flowing into or out of these stock funds, and the orange line is the average over the past 13 weeks (roughly 3 months). A positive reading indicates a net inflow, and a negative reading indicates a net outflow.

Historically, strong positive inflows have been associated with high investor optimism, whereas negative outflows have occurred during times of high investor pessimism and increasing fear in the market. In general, it pays to “go with the flow,” so to speak. But when flows are at extremes, it can sometimes signal a turning point in the stock market.

For example, there have been multiple instances over the past 15 years where the 13-week moving average of fund flows (orange line) bottomed out around the same time the S&P 500 stock index stopped falling—a sign of peak pessimism. And on the flip side, periods of excessively high flows into stock funds—a sign of peak optimism—have coincided with peaks in stock prices.

Looking at recent history, we can see that fund flows peaked early last year and have been in a downtrend ever since. Stocks have suffered as a result. But, the potential good news is that equity fund flows have averaged about -$8.3 billion over the past 13 weeks—the second lowest reading on record. Maybe we are getting close to the bottom?

So, the question is: have we reached peak pessimism? If yes, it would be a bullish signal for stocks if fund flows turn a corner and start moving higher.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.