In 2023, the stock market has been largely influenced by the Technology sector, which has emerged as the best-performing sector within the S&P 500. Indeed, approximately 90% of the S&P 500’s gains this year can be attributed solely to the Technology sector.

The dominance of this sector has raised concerns about the sustainability of the stock market rally. However, historical precedents suggest that the breadth of the Technology sector can serve as a leading indicator for the overall market.

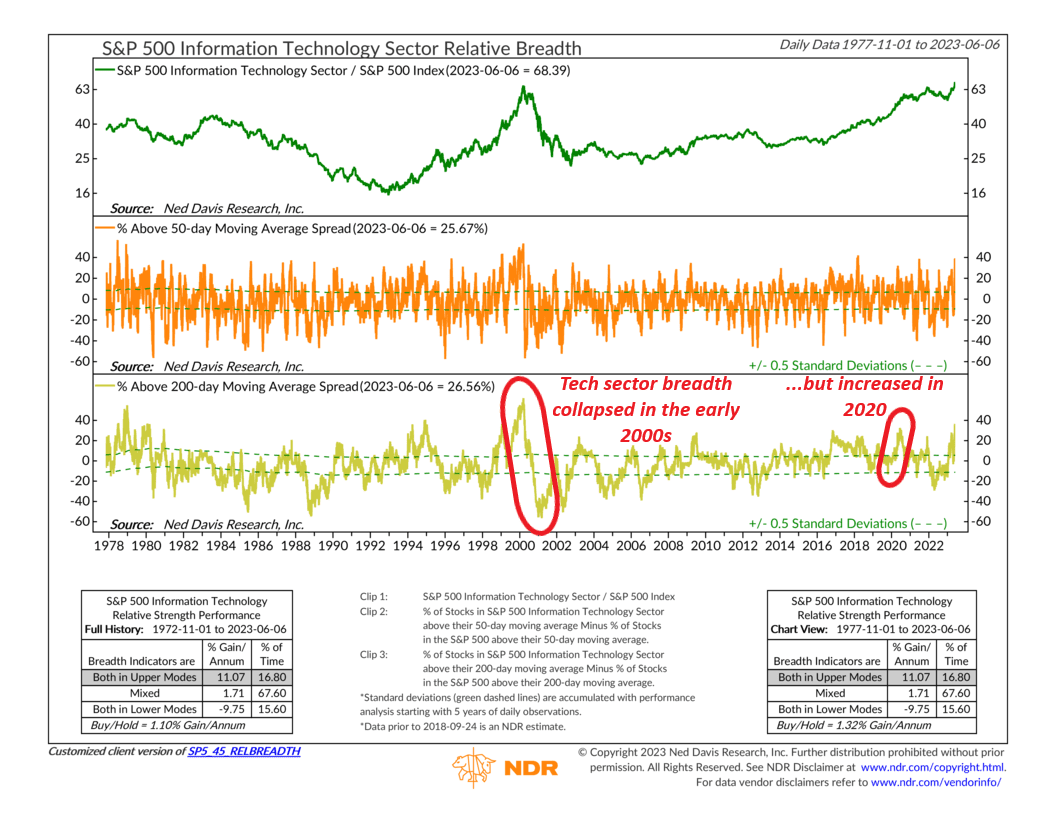

The chart above features what is called relative breadth for the Technology sector. It takes the percentage of stocks within the S&P 500 Information Technology sector trading above their 50-day and 200-day moving averages and subtracts out the percentage of stocks in the S&P 500 trading above their 50-day and 200-day moving averages. (This is the orange and gold line on the chart, respectively).

When these lines are trending upward, it indicates that the breadth of the Technology sector is increasing in comparison to the broader market. Currently, the 50-day relative breadth for Technology is at its highest level since June 2021, and the 200-day reading is the strongest since April 2020. As the performance box and the green relative strength line at the top of the chart show, this has historically been a bullish signal for the Technology sector relative to the S&P 500.

But what does this mean for the broader market? If we look at the early 2000s, for example, we see a massive deterioration in the Technology sector’s relative breadth, which coincided with a bear market in the S&P 500. In contrast, Technology’s relative breadth was broadening in 2020, which likely contributed to the stock market’s resilience that year.

In other words, as goes Technology, so goes the market. Broad participation in Technology sector stocks can help determine where the overall market is headed, as long as that breadth holds up. If breadth starts to deteriorate, however, it would be a warning sign that weakness might seep into the broader stock market. For now, though, widespread breadth in the Technology sector is likely an optimistic indicator for the market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.