Higher interest rates have been a thorn in the side of the stock market for many months now. But fortunately, relief appears to be on the way—and it’s coming in the form of improved stock market earnings.

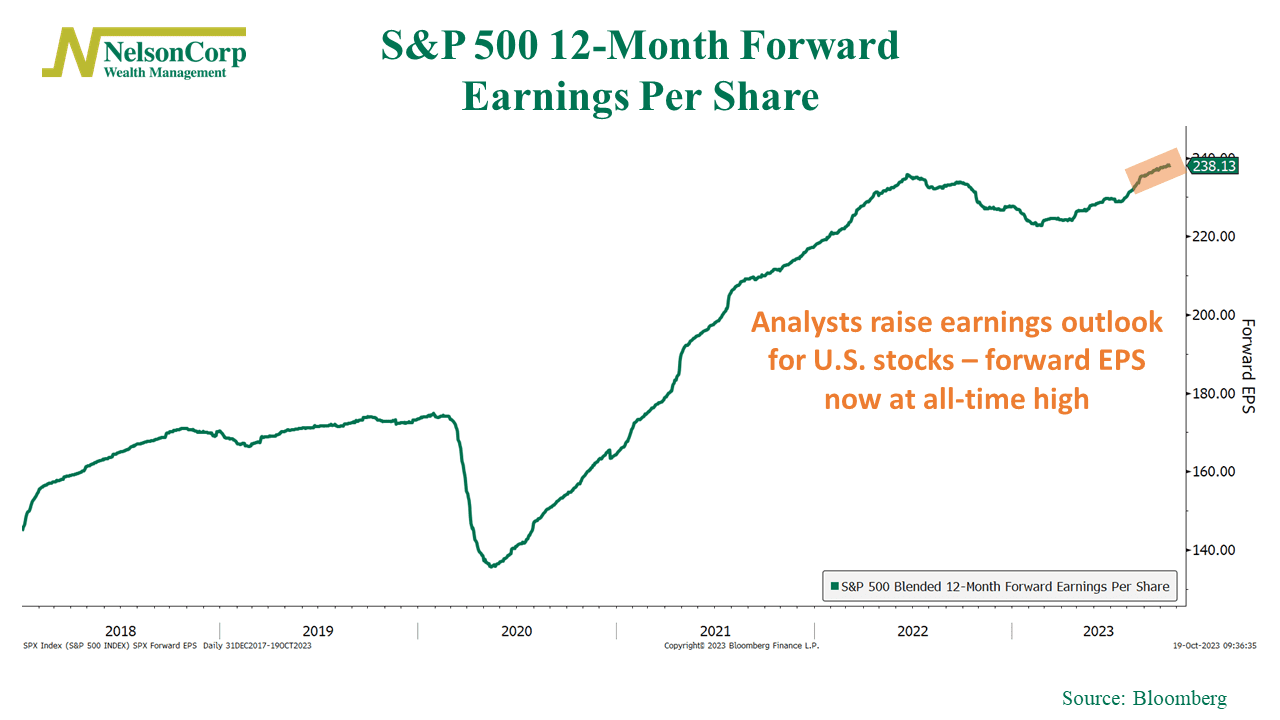

Our featured chart above shows the 12-month forward (or expected) earnings per share of the S&P 500. Essentially, this tells us what market analysts believe S&P 500 stocks will earn in profits over the ensuing 12 months. As highlighted, you can see that analysts have raised their expectations for corporate profit growth in recent months. In fact, they’ve raised it so high that the expected earnings per share figure is now in record-high territory.

This could be a lifeline for a stock market rally that has stumbled in recent months. While a more robust economy and strong consumer spending have contributed to higher interest rates (resulting in lower stock valuations), a resurgence in corporate profit growth could be the fundamental ballast needed to keep the stock market afloat. Interest rates, and their impact on valuations, will remain significant factors, but a robust corporate profit foundation will also play a crucial role in maintaining market stability.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.