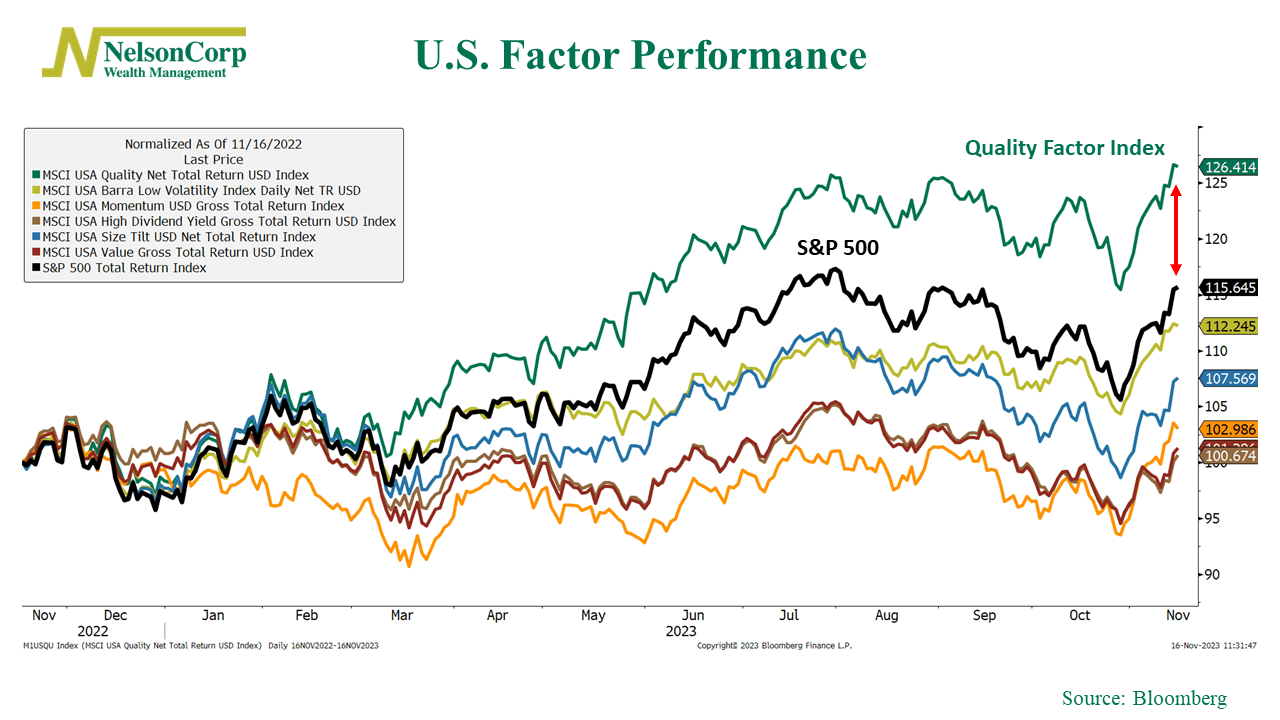

In the past year, the U.S. stock market has generally been trending upward. However, what’s interesting is that most of the gains have come from a particular kind of factor: quality.

The Quality Factor Index, shown as the green line on the chart above, represents the performance of companies with strong balance sheets and stable earnings. The index is up roughly 26% in the past year, surpassing the 15% gain of the broader S&P 500 Index (shown as the black line on the chart). As you might also notice, all the other factors on the chart have underperformed the market over the past year—some by quite a lot.

So why is quality standing out? Well, companies that embody quality factor characteristics tend to shine when interest rates drive up the cost of capital and economic growth looks uncertain. In this situation, investors lean towards companies that provide safety and resilience in generating earnings.

Of course, it’s important to note that factor leadership can change over time; they come and go based on economic conditions, market sentiment, and other factors. For the past year or so, quality has been the star of the show. This could (and likely will) change in the future, but quality is the champ for now.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.