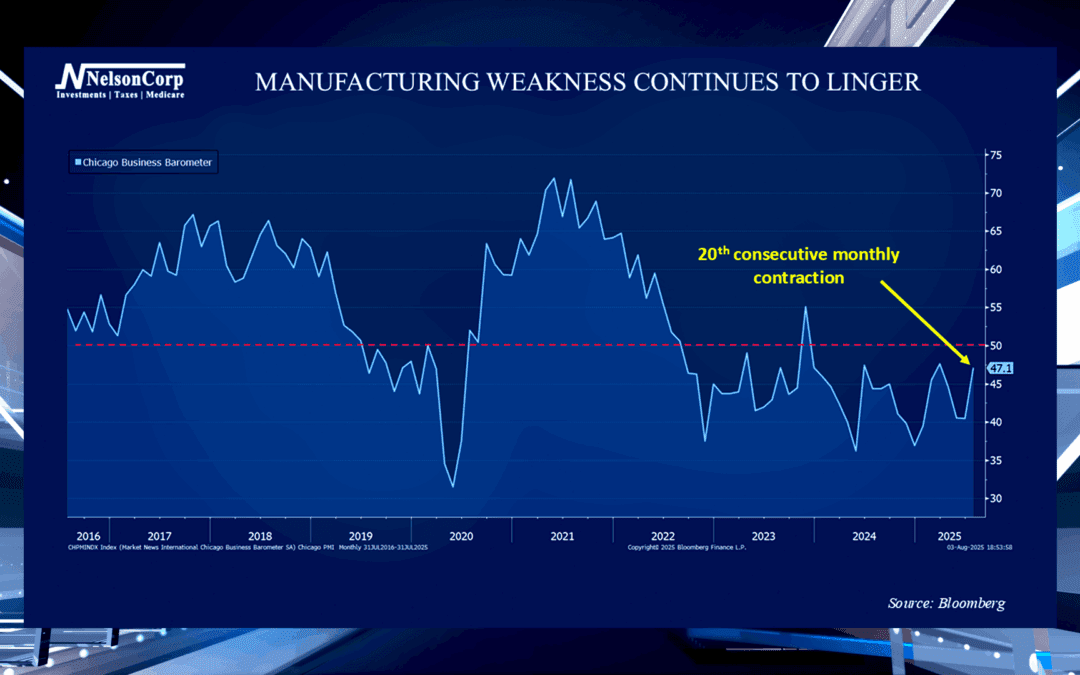

Manufacturing Malaise

When taking a bird’s-eye view, the GDP and consumer spending are currently showing positive signals for the economy. John Nelson drills down to show one pocket of weakness for investors to avoid right now.

When taking a bird’s-eye view, the GDP and consumer spending are currently showing positive signals for the economy. John Nelson drills down to show one pocket of weakness for investors to avoid right now.

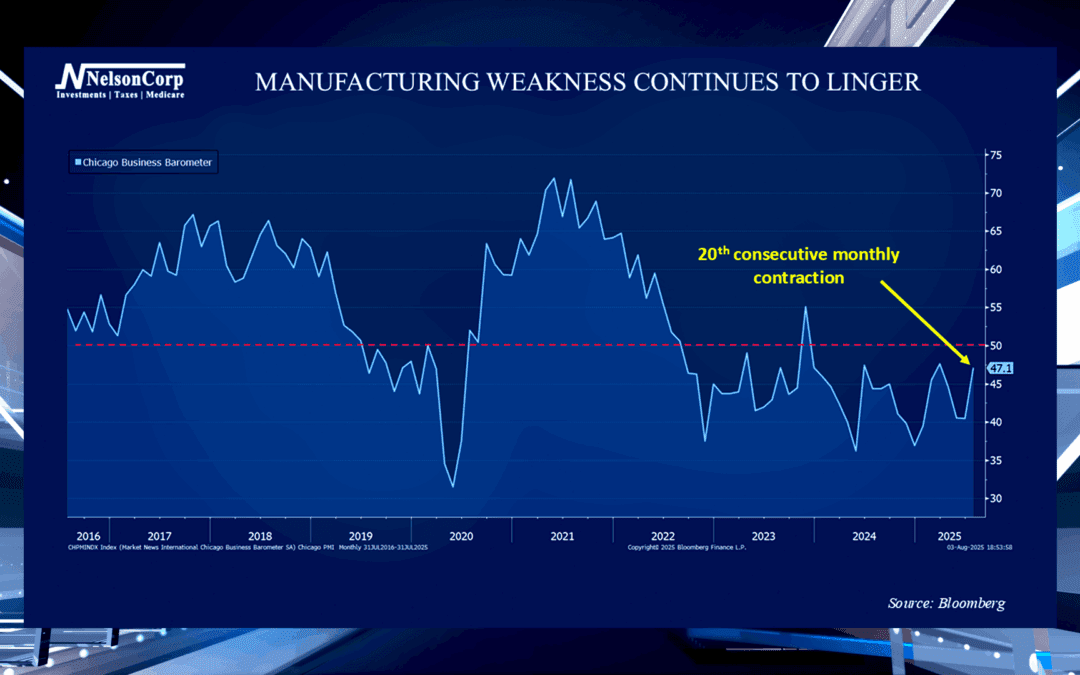

There has been a big jump in speculative trading that involves a higher degree of risk compared to traditional long-term investing. David Nelson joins us to share if these potential short-term gains usually provide a long-term advantage.

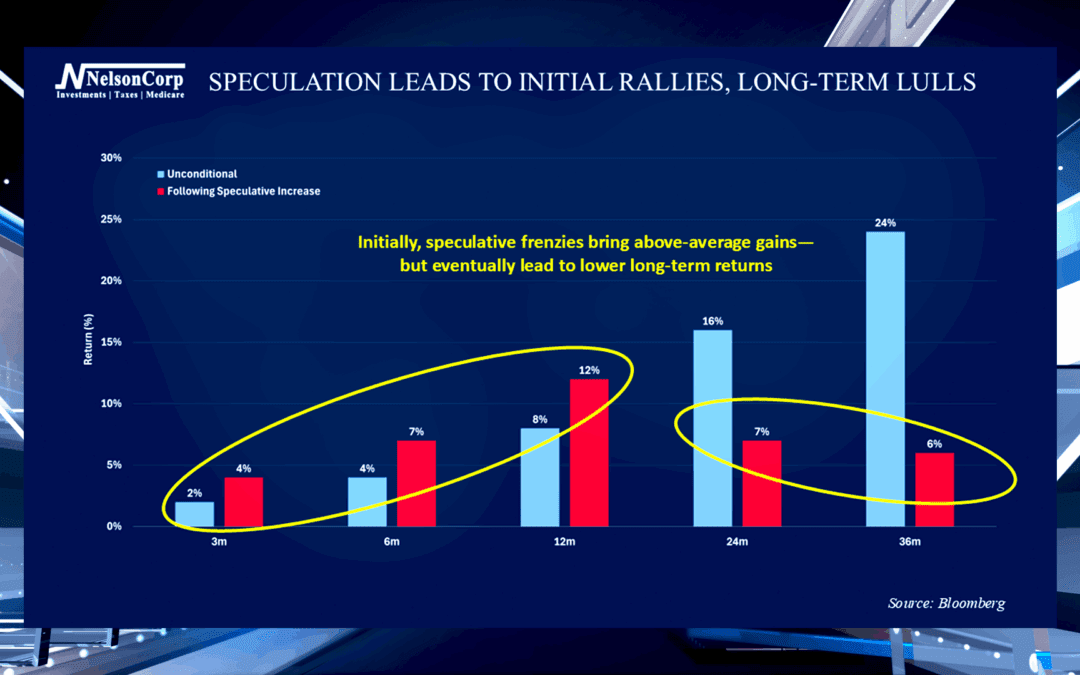

David Nelson is here to discuss drawdowns and how they are a factor investors often overlook when it comes to stock market risk.

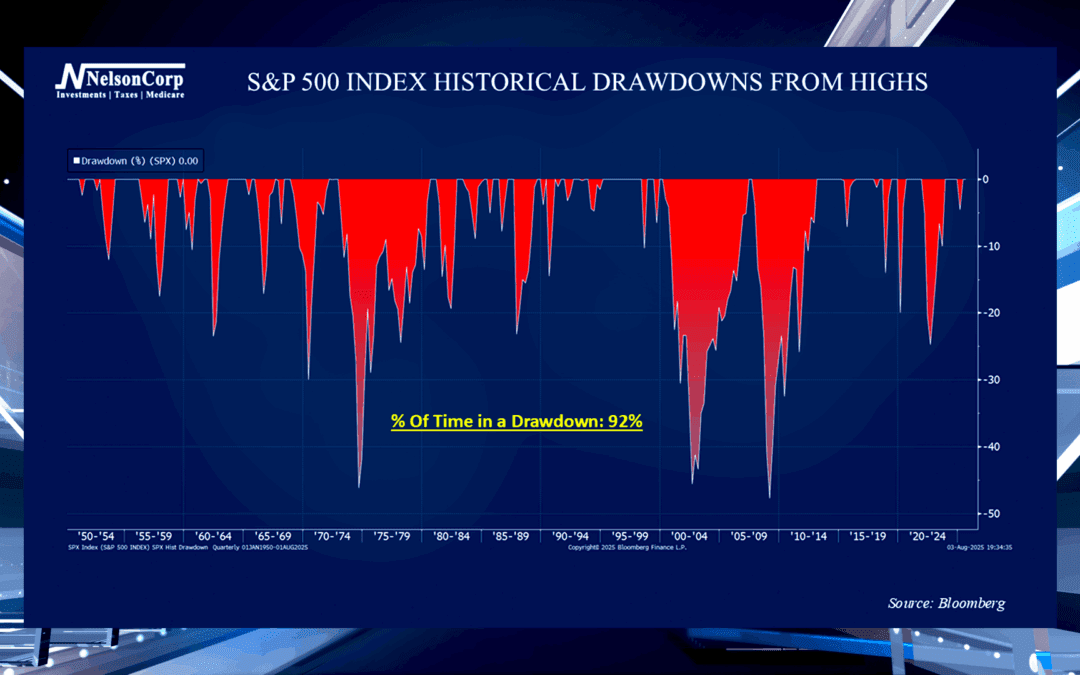

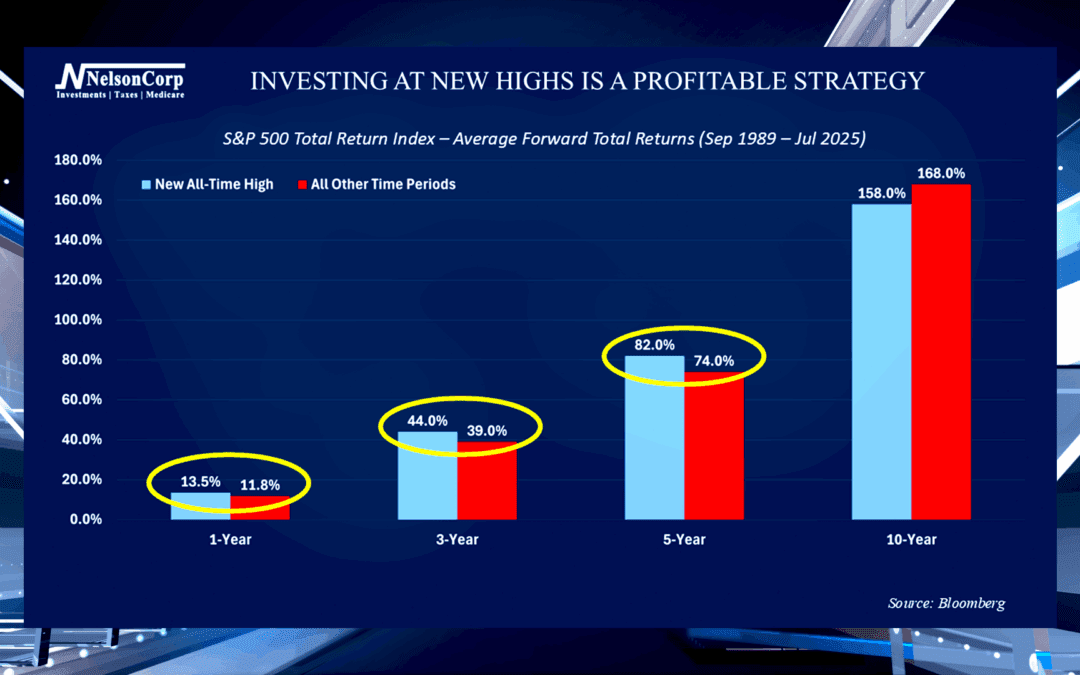

The stock market has been trending toward new record highs in recent weeks. Nate Kreinbrink explains the historical patterns that suggest investors should be encouraged by the all-time highs.

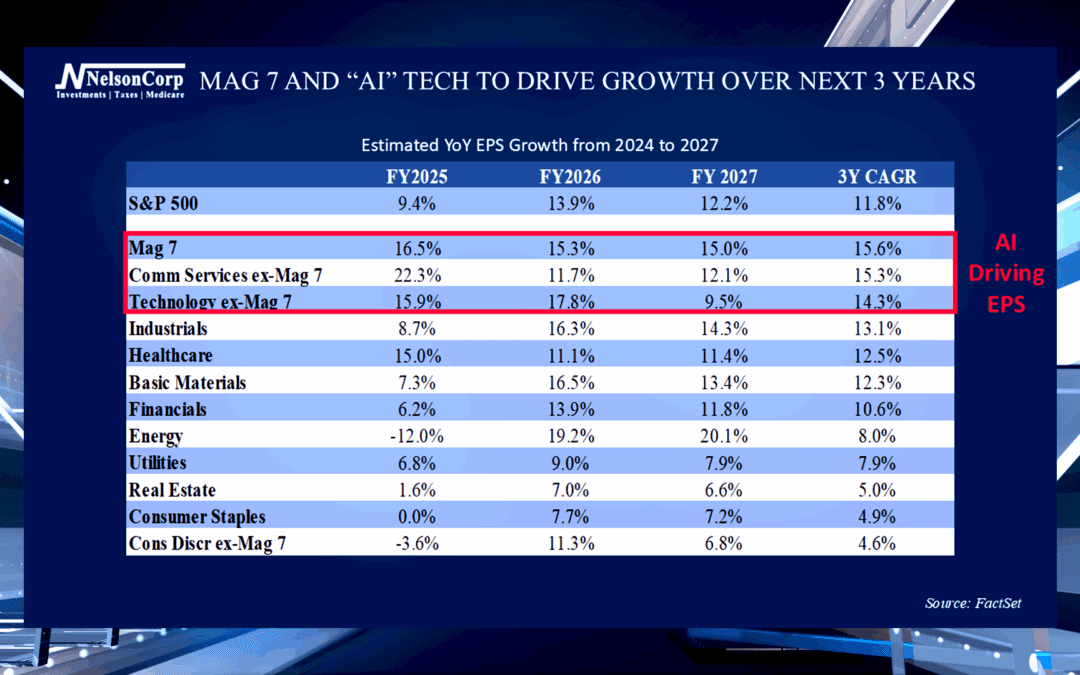

AI has been a big buzzword in the financial world. John Nelson is here to share the stock market numbers that indicate AI’s growing importance is the real deal.

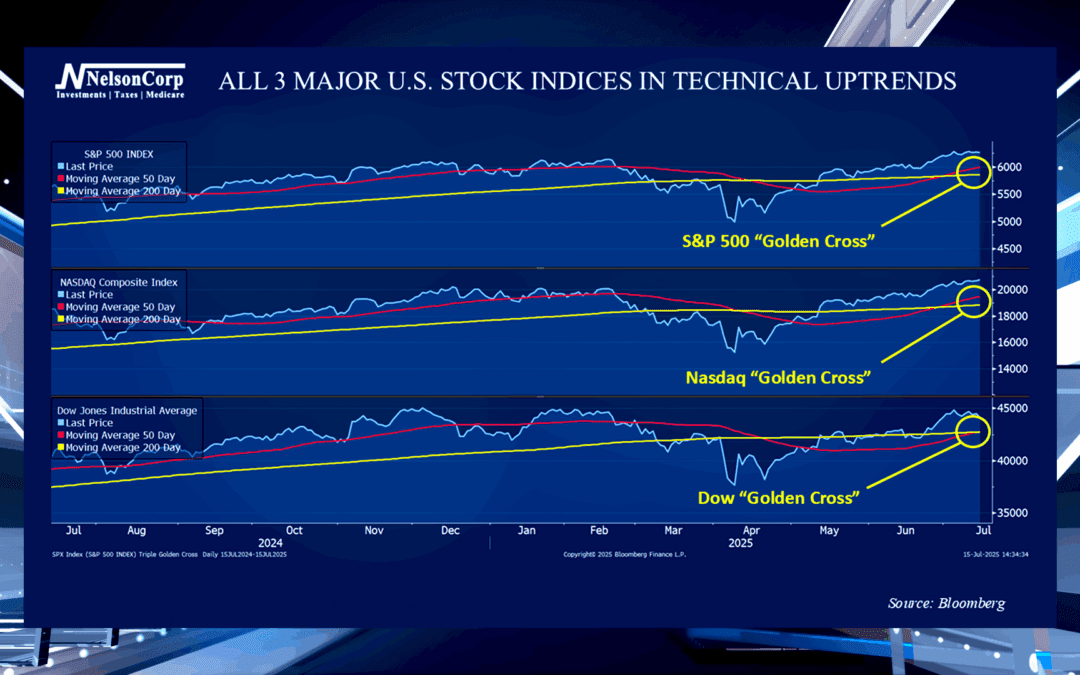

The stock market’s momentum has continued to gain strength this month. James Nelson explains how the triple golden cross indicates a winning time for stocks right now.