by NelsonCorp Wealth Management | Feb 22, 2024 | Indicator Insights

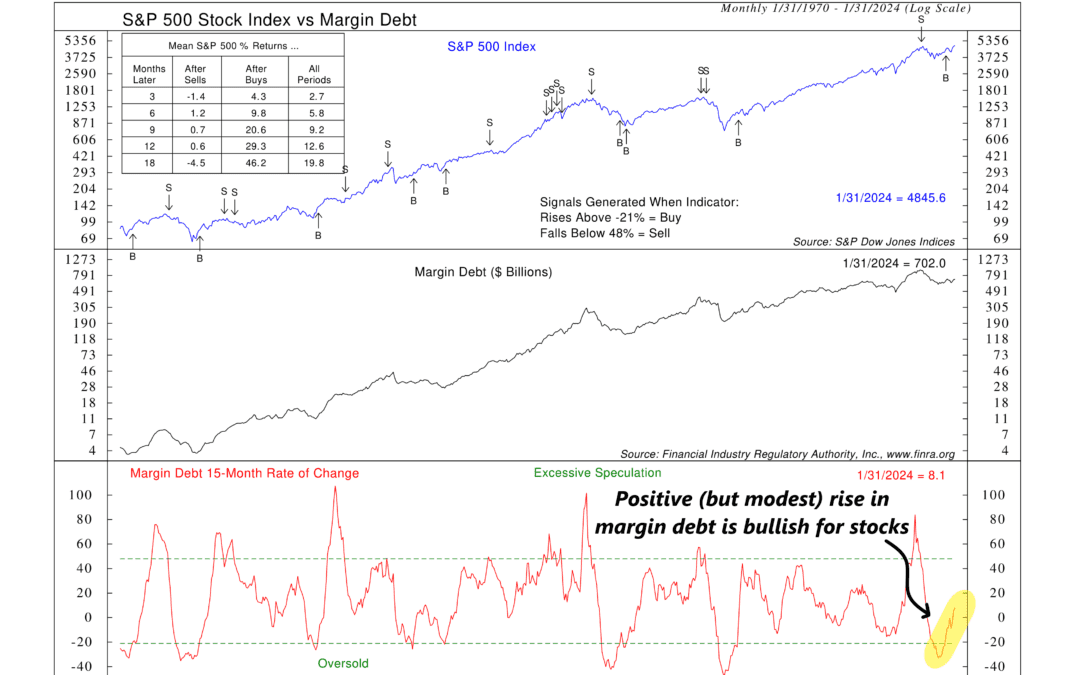

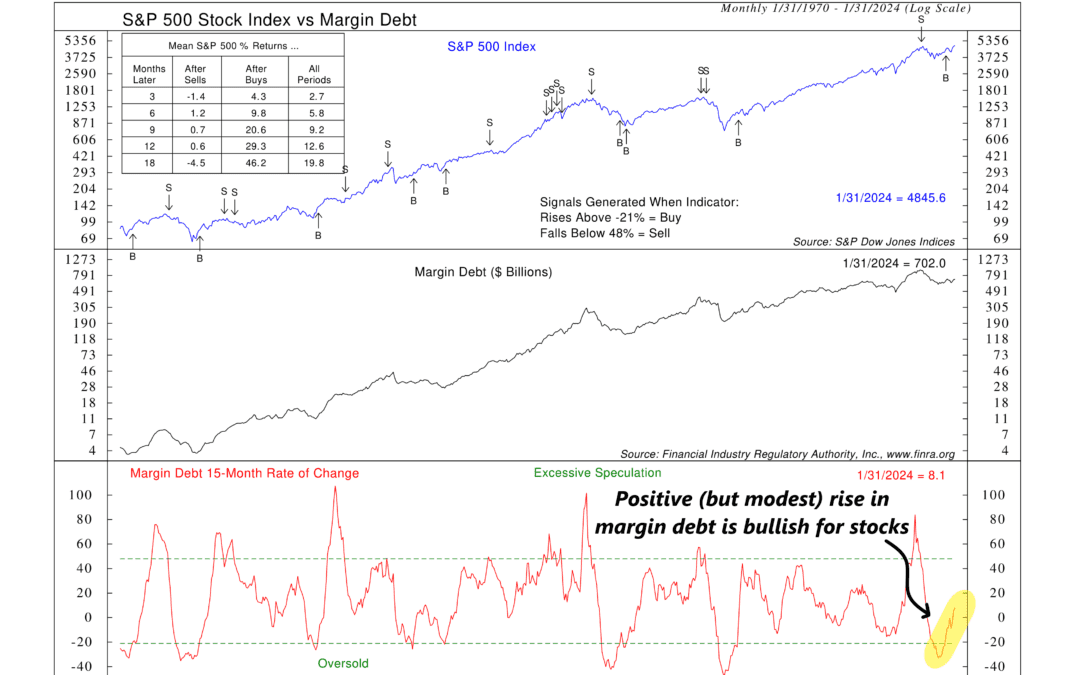

The focus of this week’s indicator is margin debt. What is margin debt? In simple terms, it’s money that an investor borrows to purchase stocks. Think of it like a credit card for the stock market. It allows investors to amplify their returns, but there’s...

by NelsonCorp Wealth Management | Feb 15, 2024 | Indicator Insights

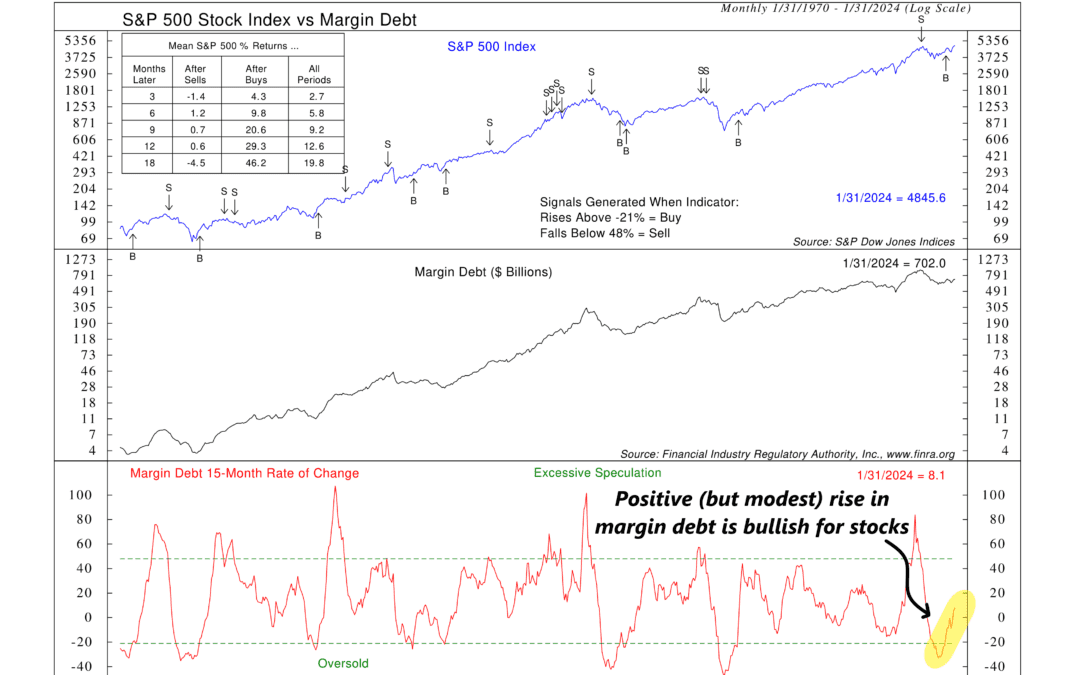

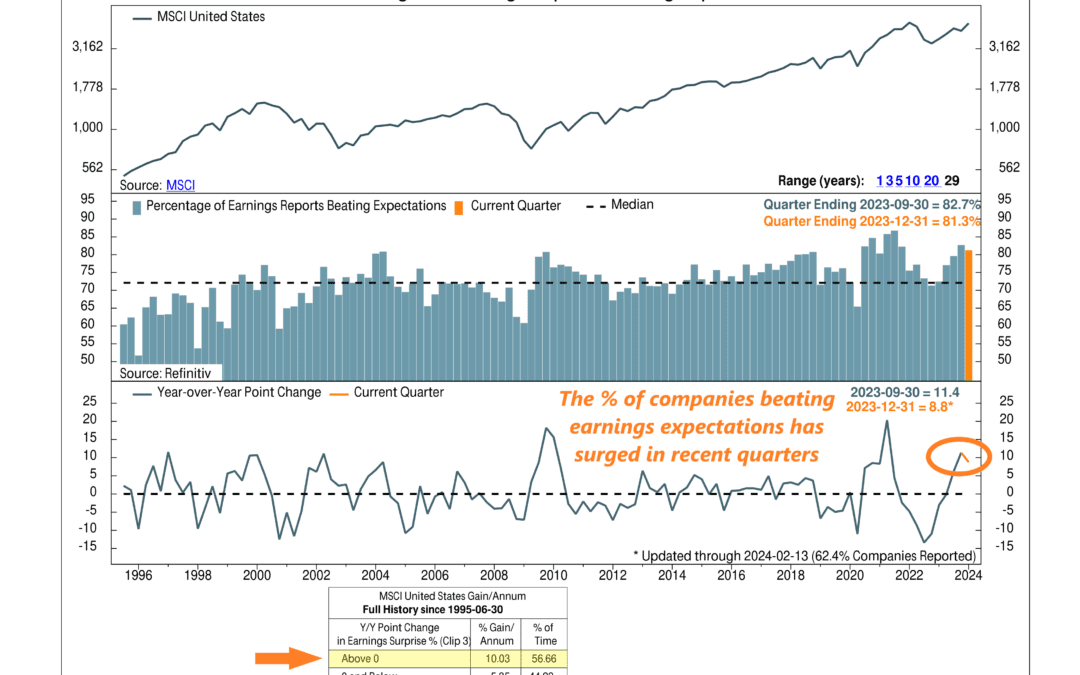

This week’s indicator looks at the percentage of U.S. companies beating earnings expectations—or what is commonly called the “beat rate” on Wall Street. The key insight of the indicator is that when more companies beat earnings expectations in a quarter, it...

by NelsonCorp Wealth Management | Feb 8, 2024 | Indicator Insights

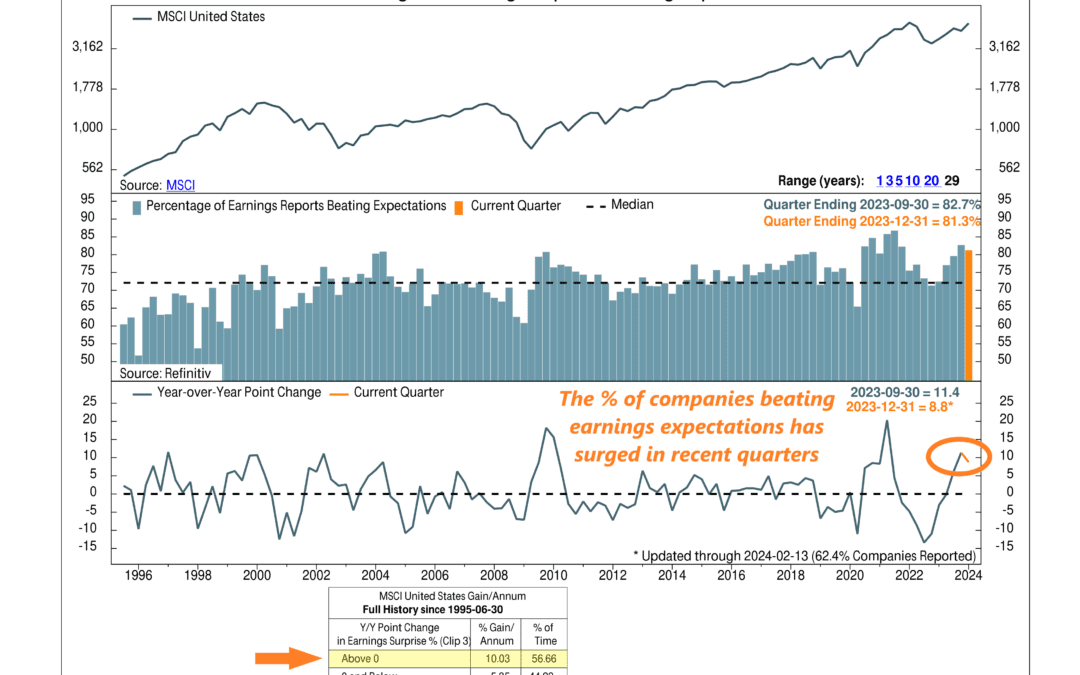

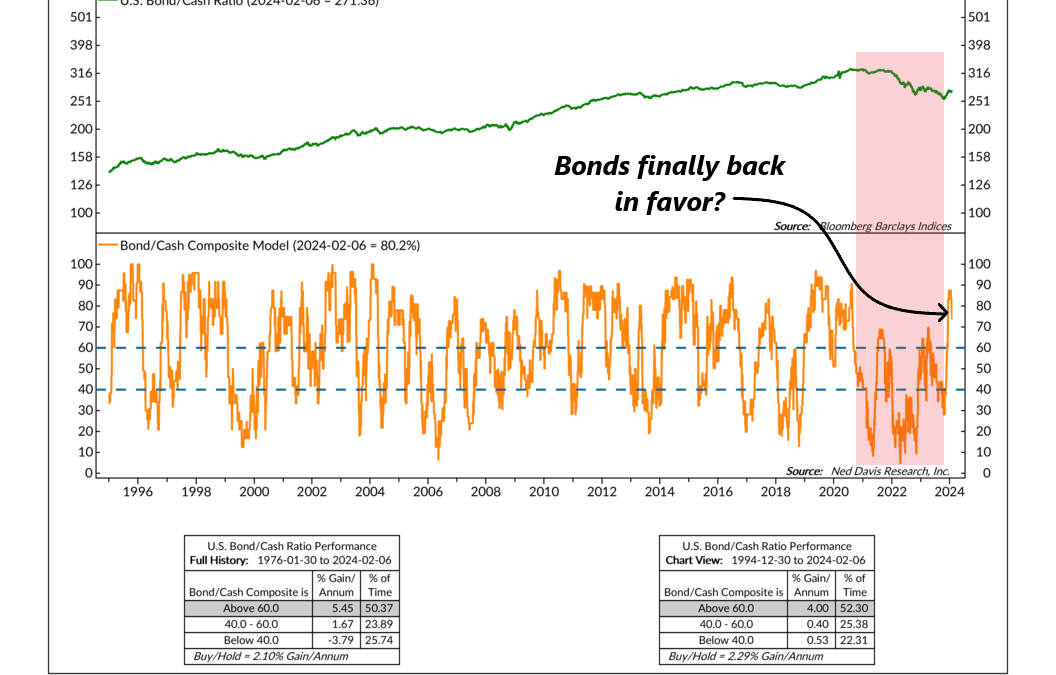

Bonds have had a rough time the past few years. The Fed started raising cash rates in 2021 to tackle inflation, and bond returns suffered severely. But, according to this week’s featured indicator, things are starting to look up for bonds. The indicator is...

by NelsonCorp Wealth Management | Feb 1, 2024 | Indicator Insights

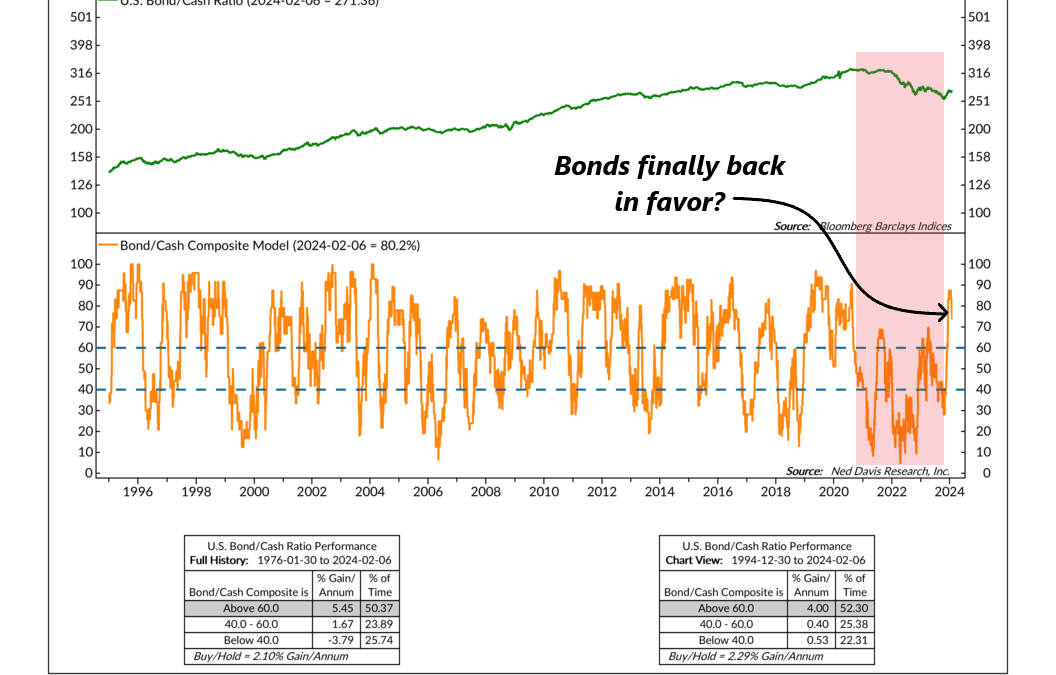

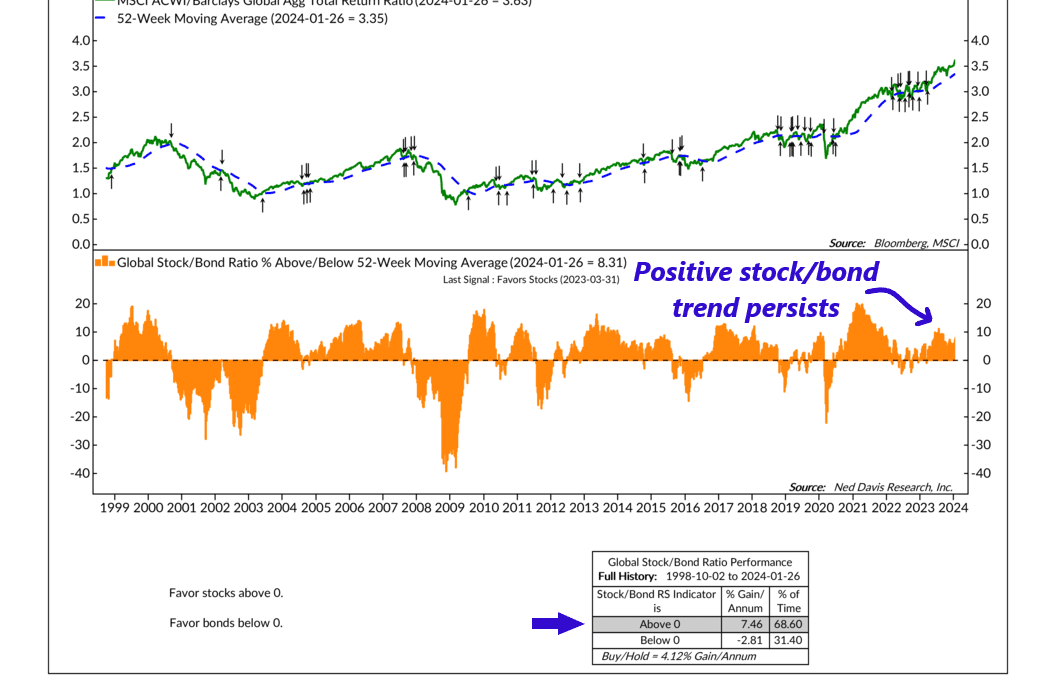

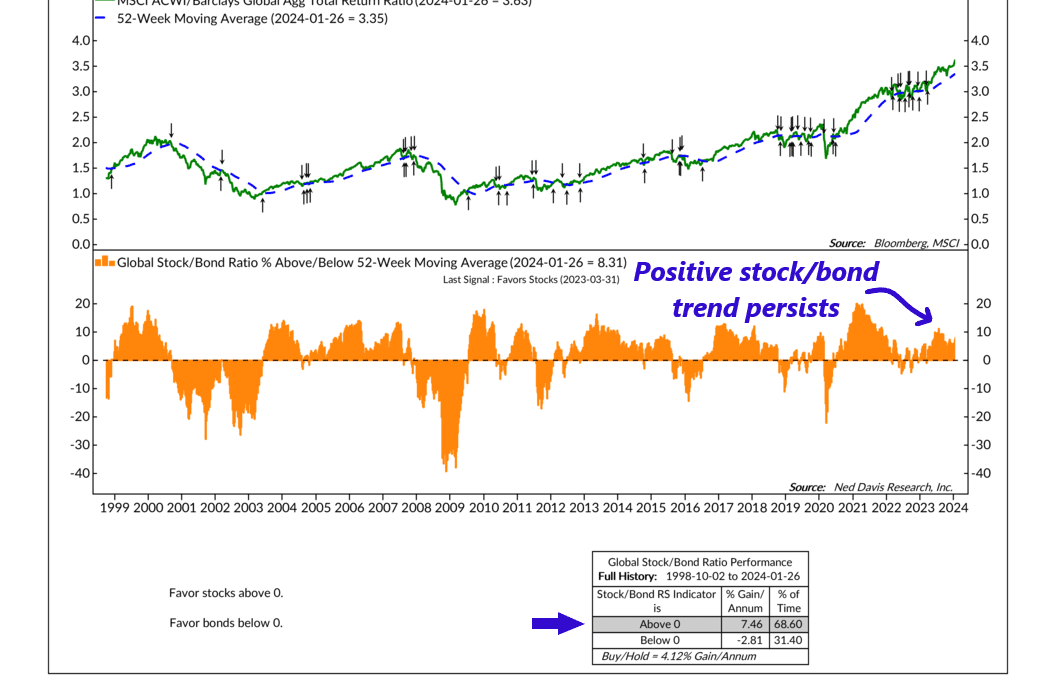

For this week’s indicator, we’re going to look at a technical concept called relative strength. What is relative strength? In simple terms, it measures how well one investment or asset is doing compared to another. It’s typically calculated by dividing...

by NelsonCorp Wealth Management | Jan 25, 2024 | Indicator Insights

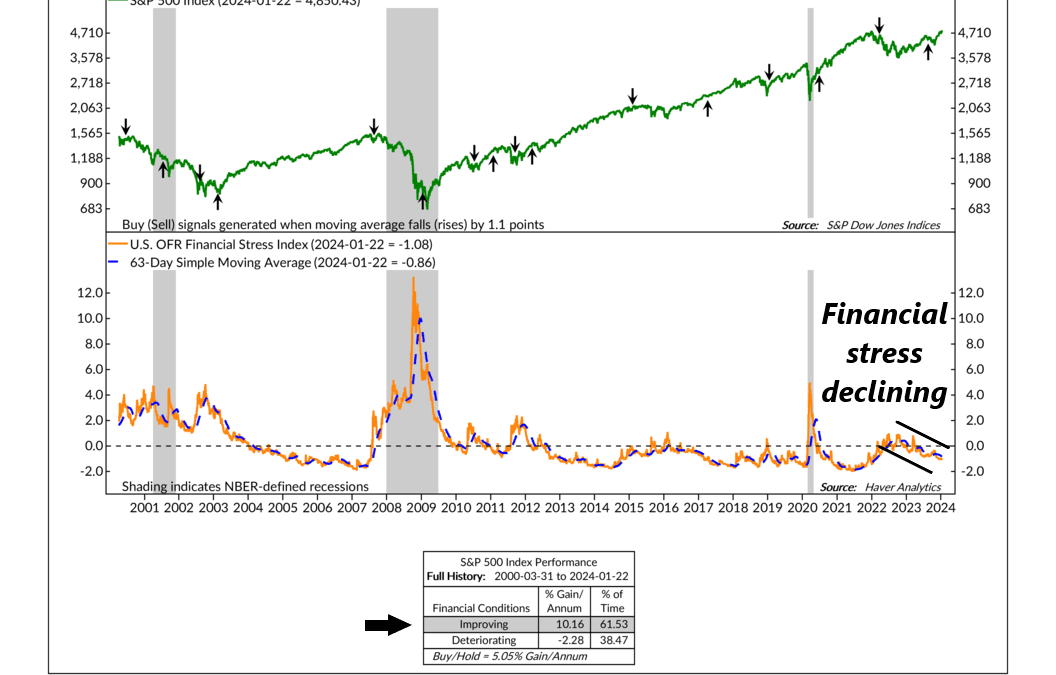

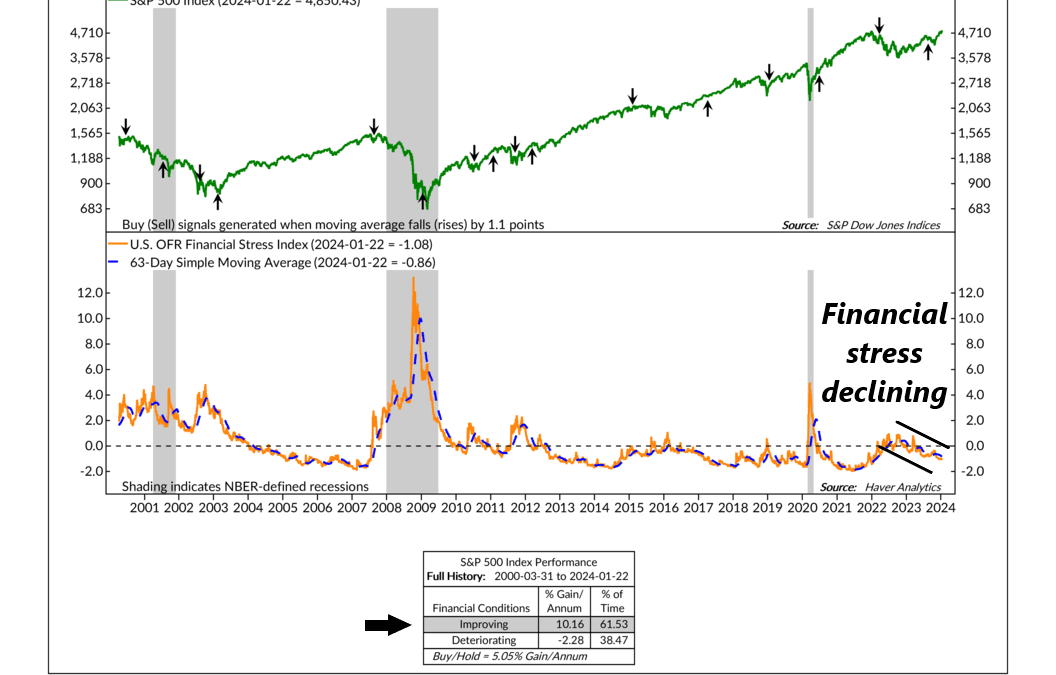

The OFR Financial Stress Index (OFR FSI) is a neat little metric produced by the Office of Financial Research that measures the amount of stress in global financial markets. It combines roughly 33 market variables—from yield spreads to valuation measures—into...

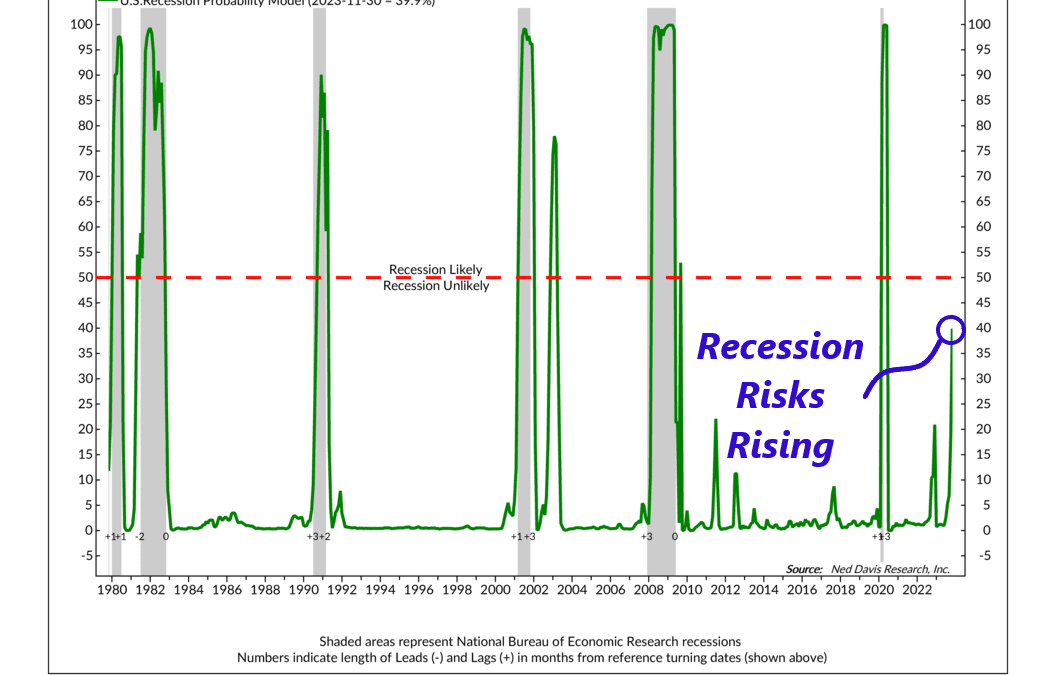

by NelsonCorp Wealth Management | Jan 18, 2024 | Indicator Insights

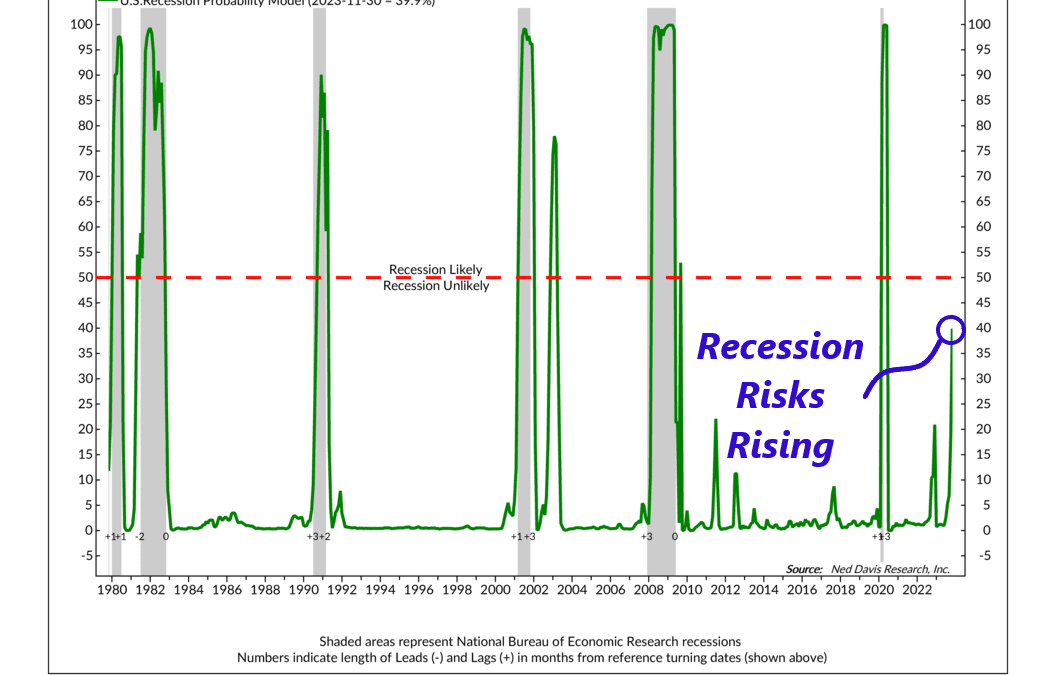

Is a recession coming? While a definitive yes-or-no answer to a question like that is virtually impossible, we can get somewhat close by using a model that assigns a probability to the outcome—called a Recession Probability Model. The main ingredients for the...