Financial Focus – November 29th, 2023

Check out this week’s episode of Financial Focus, where hosts Nate Kreinbrink and Mike Steigerwald discuss the holiday season and emphasize the significance of year-end financial planning. The program covers topics such as Roth conversions, tax planning, and the limited time available before the year-end deadline. They also highlight the ease of updating beneficiary designations on various accounts and stress the importance of having open conversations with family about financial plans during the holidays.

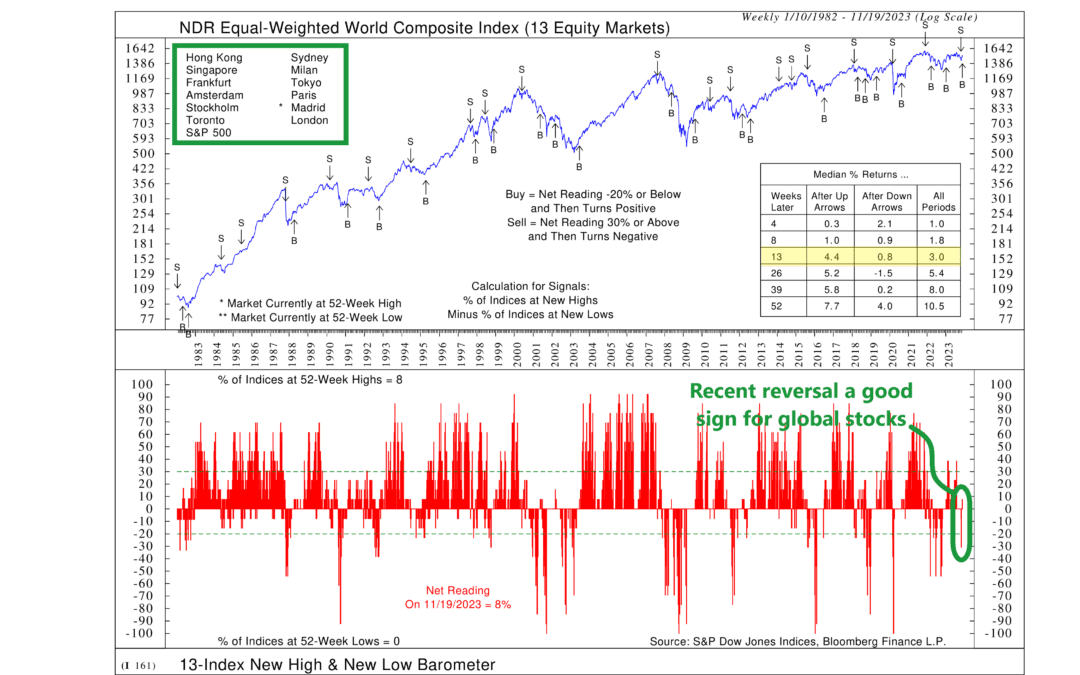

The Baker’s Dozen Barometer

This week, we’re looking at something called the 13-Index New High & New Low Barometer. It gives us a combined view of 13 different stock market indexes from around the world, telling us how strong global stocks are. Basically, it’s a health check for...

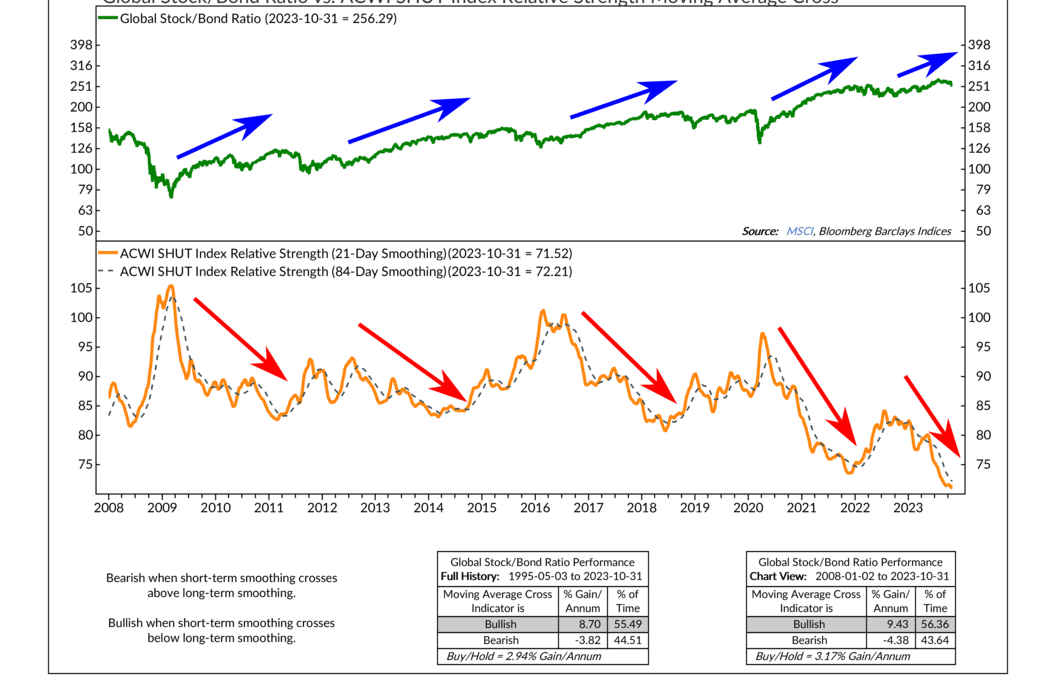

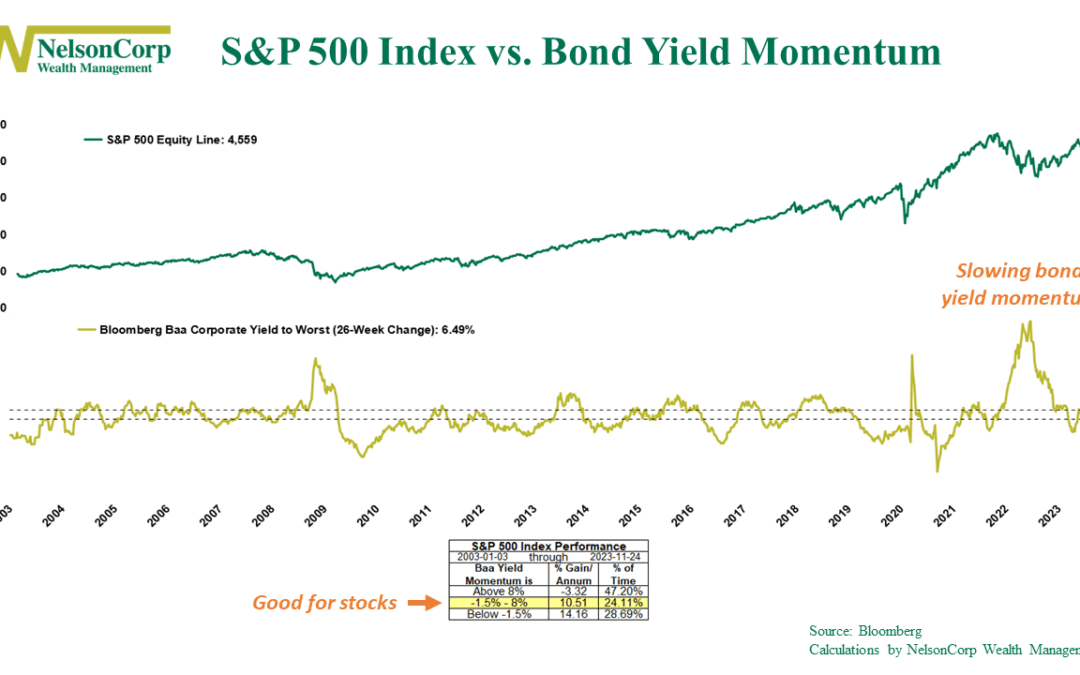

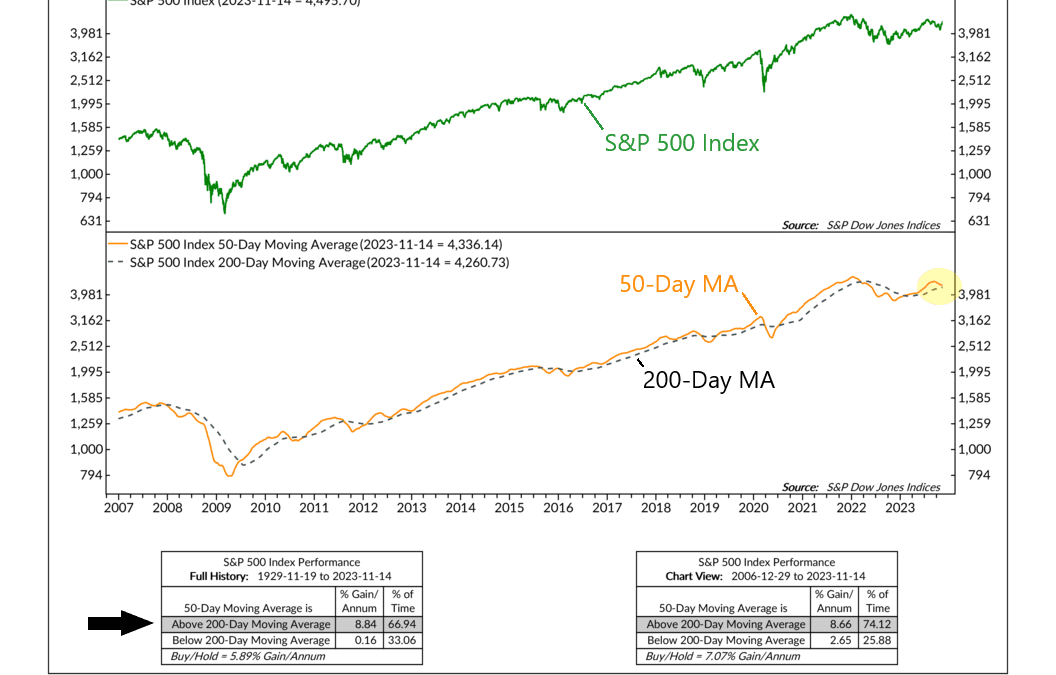

Dodging the Death Cross

The stock market has been in a slump for the past few months. However, a rally over the past couple of weeks has been so strong that it looks like the market might have just dodged the dreaded “death cross.” What is a death cross? It’s a term used in technical...

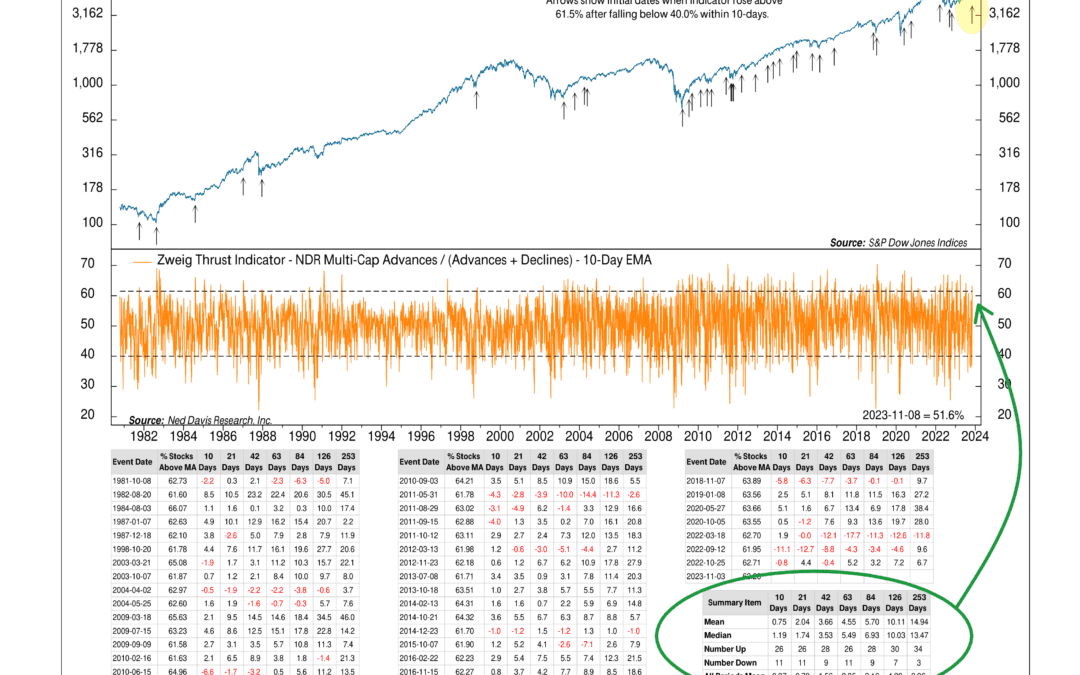

Market Gusts and Zweig Thrusts

This week’s featured indicator is the Zweig Thrust Indicator, named after the savvy financial analyst and investor Martin Zweig. This so-called market breadth indicator is all about figuring out how strong a market rally is. The indicator (shown as the orange...