by NelsonCorp Wealth Management | Oct 25, 2023 | Indicator Insights

The VIX Index is one of those esoteric things that financial professionals think about frequently but likely goes unnoticed by the average person. Therefore, in this week’s discussion, we’ll shed some light on the VIX Index and highlight why it’s...

by NelsonCorp Wealth Management | Oct 18, 2023 | Indicator Insights

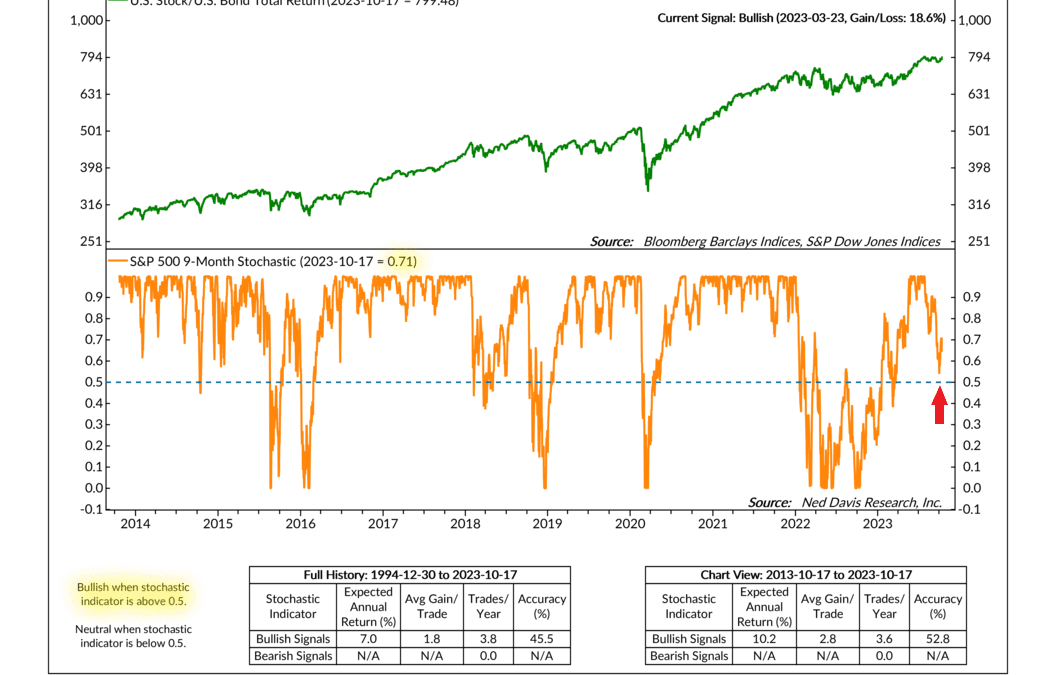

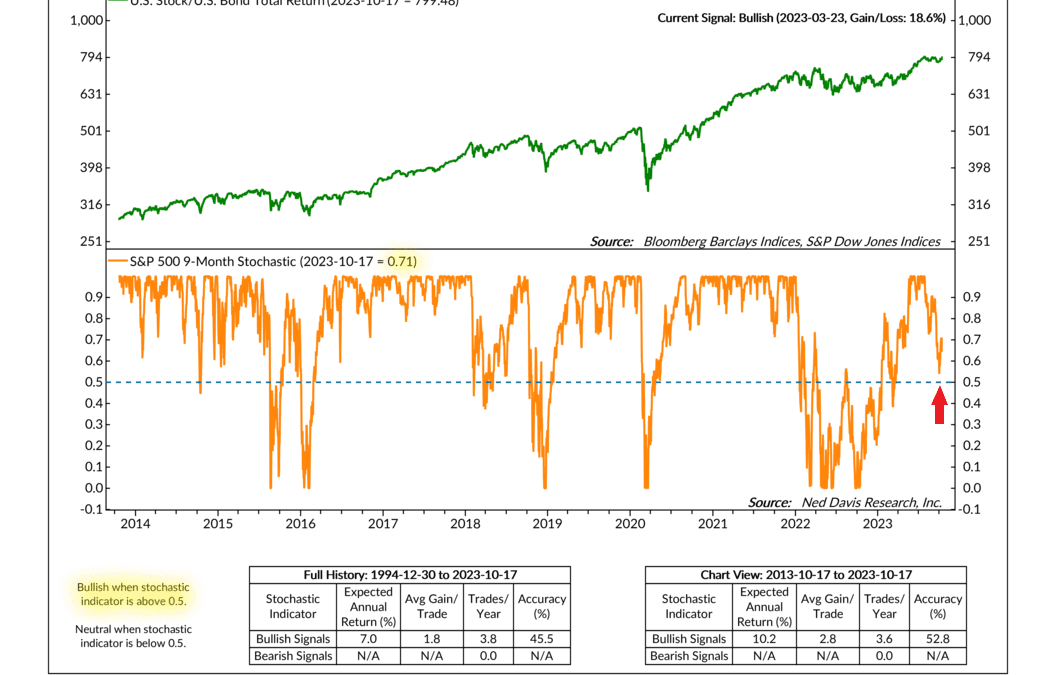

At times, the stock market can seem like a mystery—a hard-to-solve puzzle. But like any good detective, we have tools to help peel away the layers and unearth some underlying truths about the stock market. One such tool is an indicator called a stochastic. A...

by NelsonCorp Wealth Management | Oct 11, 2023 | Indicator Insights

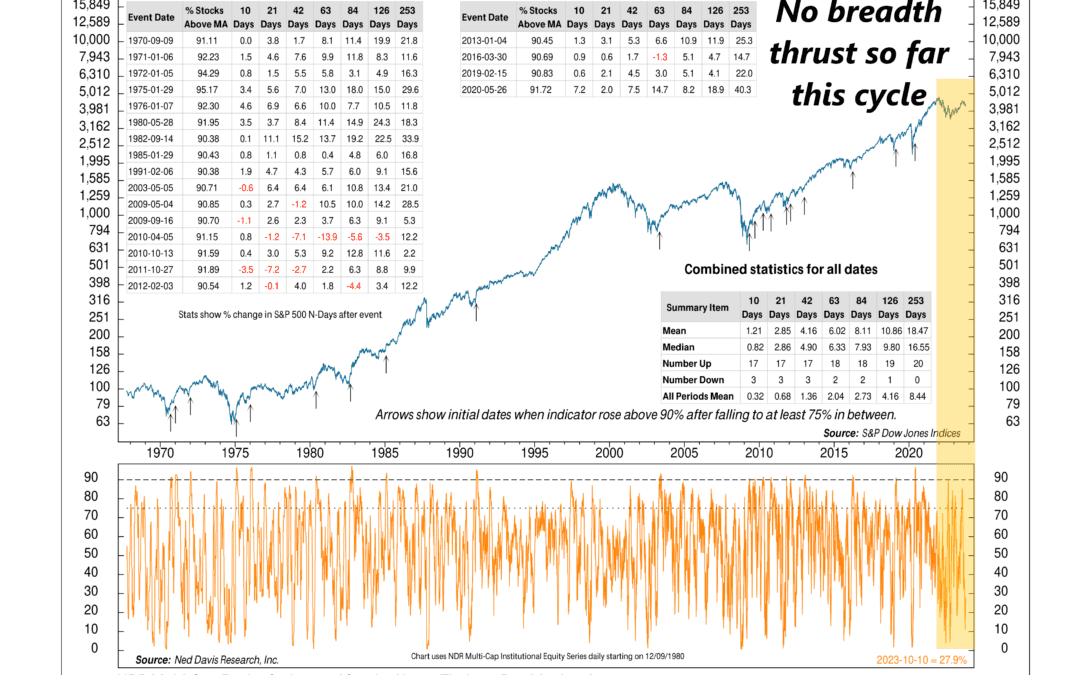

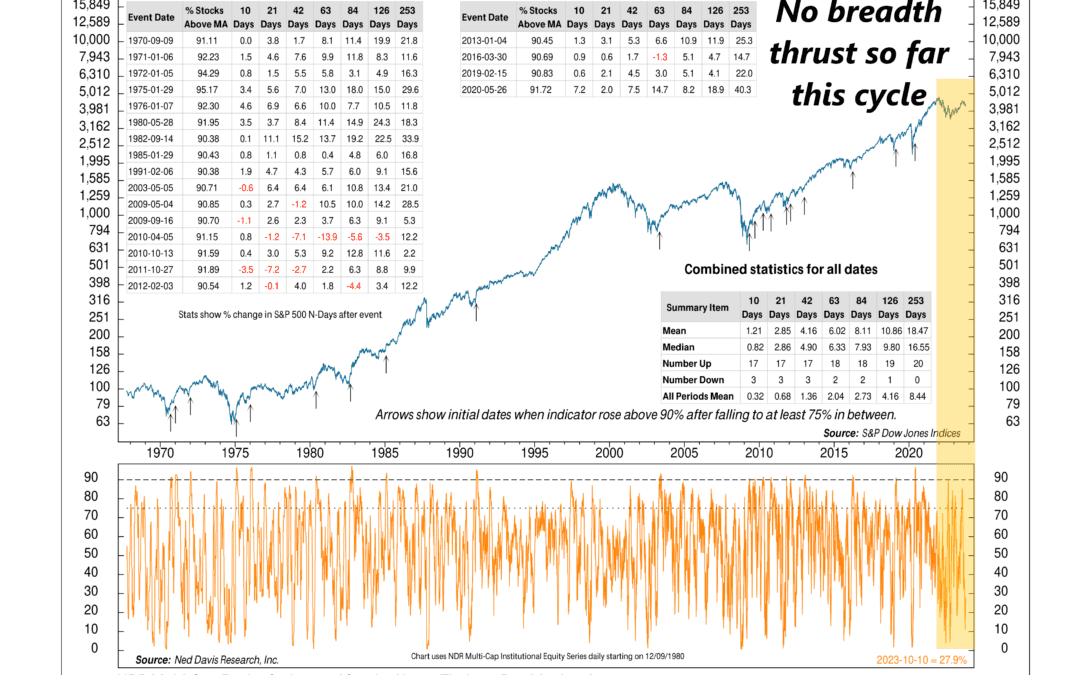

This week’s indicator is all about thrust. In the physical world, thrust is the force that moves an object, such as a rocket, through the air. It takes a lot of force, generated in a short amount of time, to get something like a rocket into space. If the rocket...

by NelsonCorp Wealth Management | Oct 4, 2023 | Indicator Insights

Valuing the stock market can be tricky; creating an actionable signal from that exercise can be even trickier. That’s because, as the famous saying attributed to the economist John Maynard Keynes goes, the stock market can remain irrational longer than you can...

by NelsonCorp Wealth Management | Sep 28, 2023 | Indicator Insights

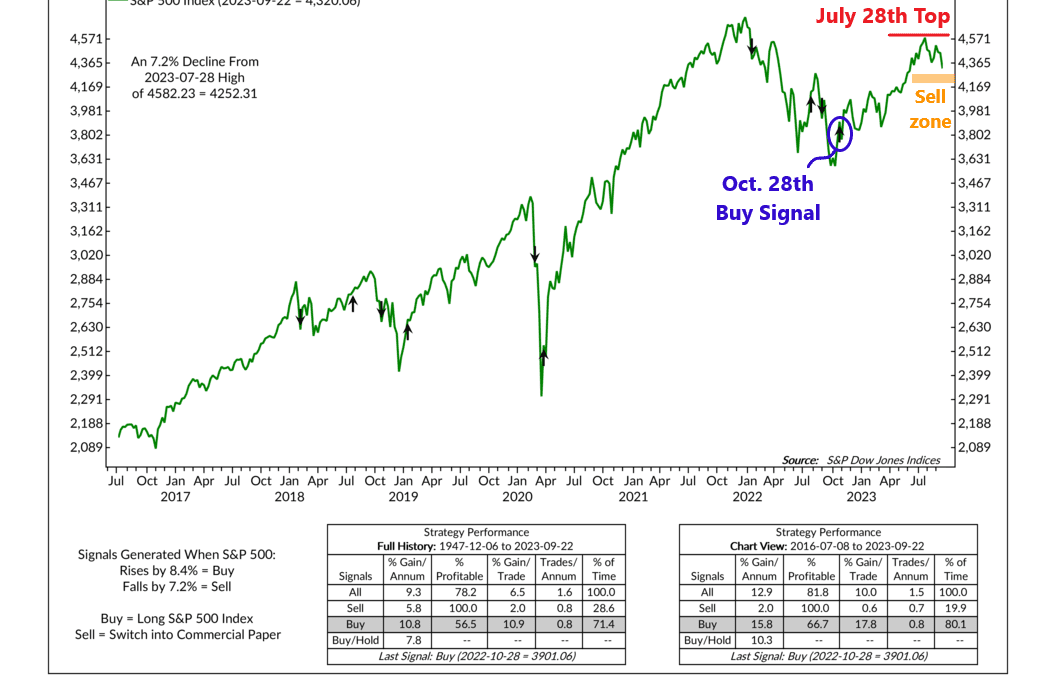

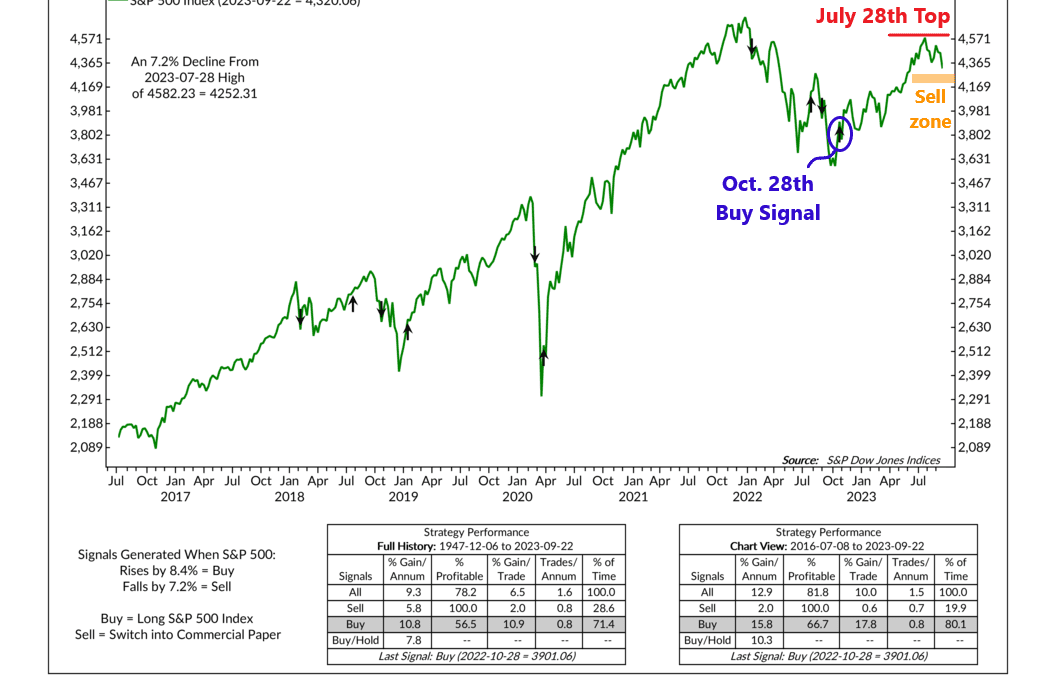

July 28th, 2023. That was the day the S&P 500 index reached its highest level of the year (so far). Since then, the market has tumbled. As of this writing, the S&P 500 index is down roughly 7% from its summer high. After two months of a down market,...

by NelsonCorp Wealth Management | Sep 21, 2023 | Indicator Insights

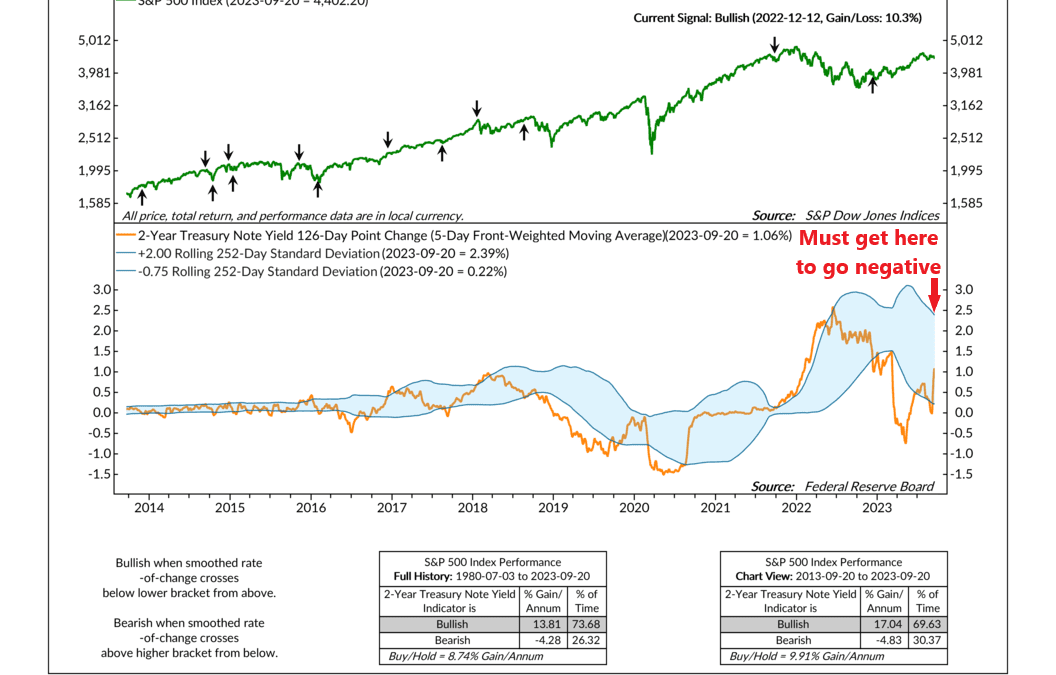

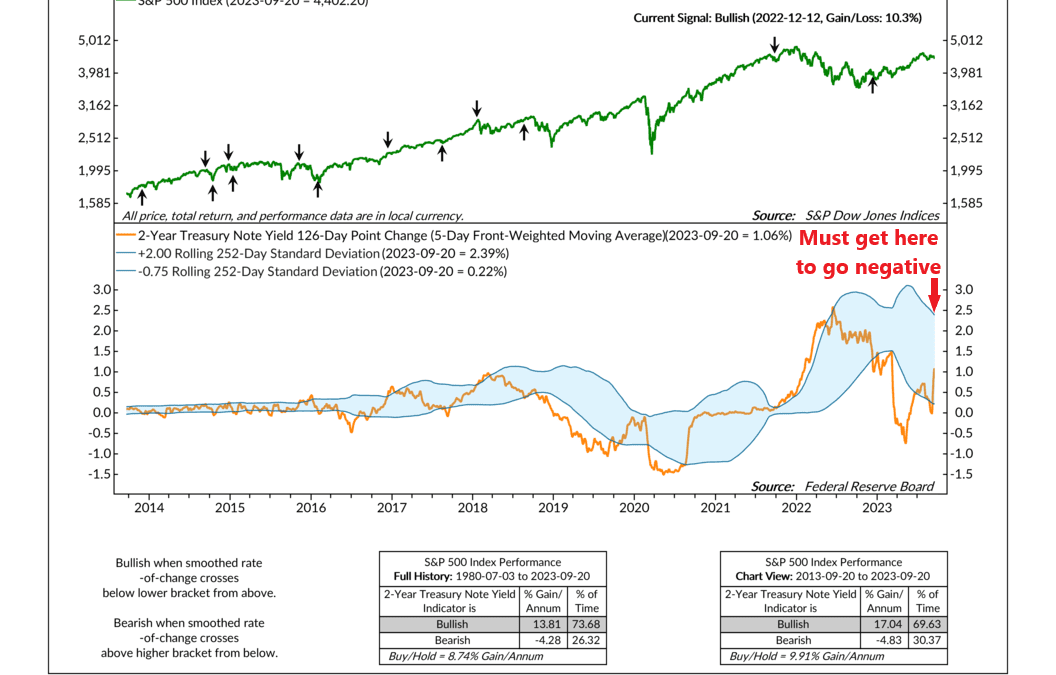

Short-term rates are on fire. The 2-year Treasury rate—a rough proxy for where the market thinks the Fed is headed with interest rates—rose to its highest level in 17 years this week. This is significant because sharp increases in short-term interest rates have...