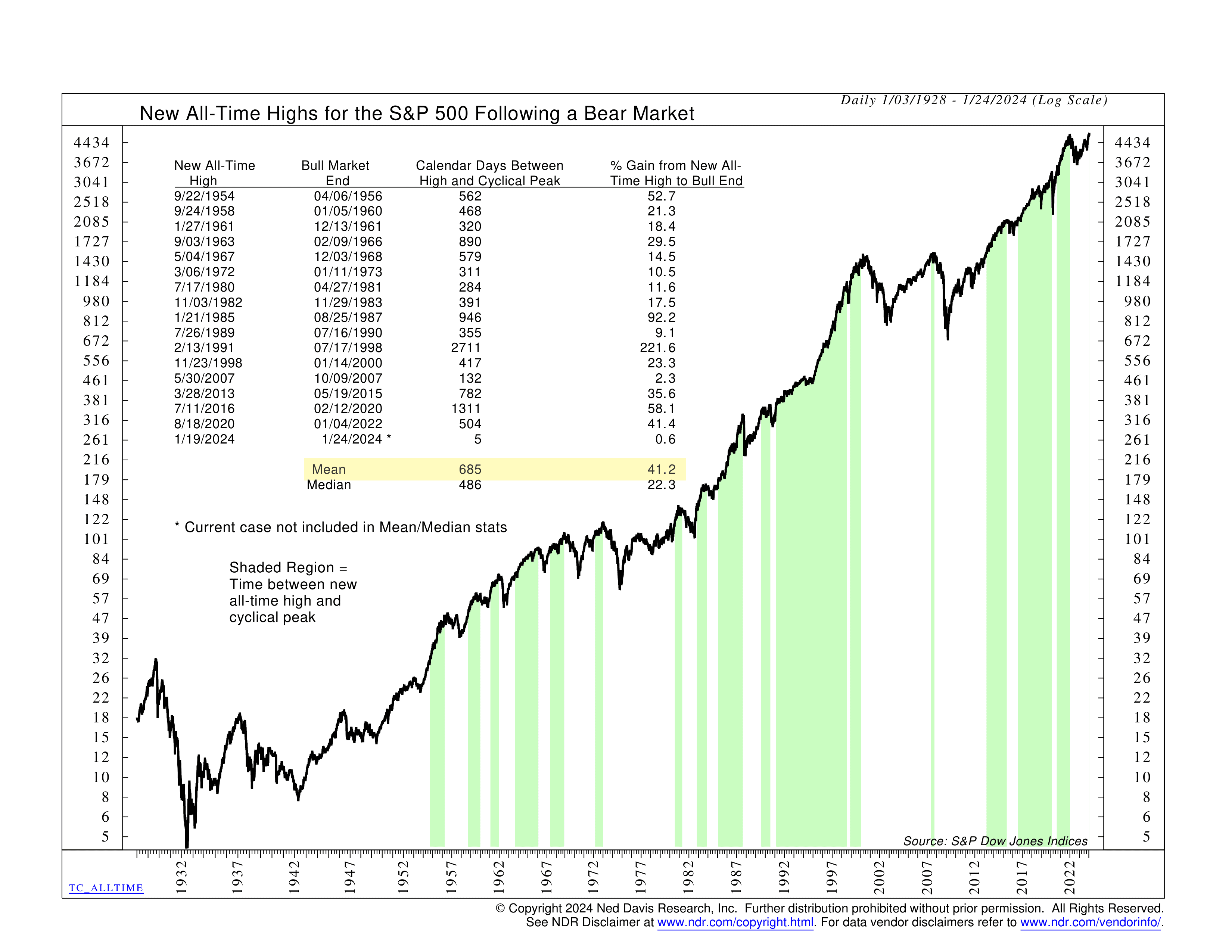

The U.S. stock market has climbed its way back to new all-time highs. But now that we’re at the summit, what does it mean for stocks going forward?

If history is any guide, the outlook is likely positive. This week’s featured chart illustrates the S&P 500 Index’s performance after hitting a new all-time high following a bear market. Of the 16 cases since the 1950s (highlighted in green), the average gain from the first new high to the next cyclical peak has been about 41%. More so, the average length of that period has been 685 days or nearly two years!

Granted, the worst period was in 2007, when the market finally reached a new high after the Dot-Com Bust seven years earlier, only to turn around and plummet a few months later during the Great Financial Crisis. But more likely than not, such a scenario is more of an exception than a rule.

The bottom line? It may seem counterintuitive, but being at all-time highs is typically a bullish scenario for the stock market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.