We’re about halfway through 2025, and the stock market is singing a different tune compared to the past two years: more participation.

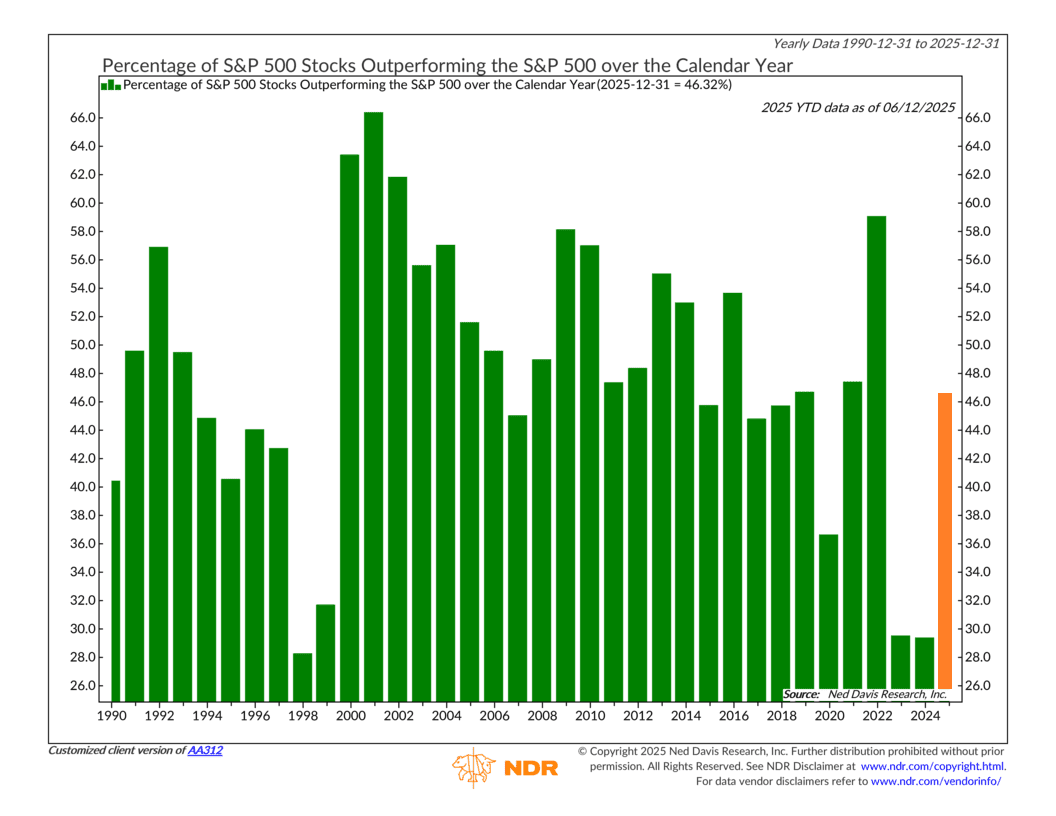

This week’s chart highlights the percentage of S&P 500 stocks outperforming the index year-to-date. In 2023 and 2024, that number was unusually low. Back then, most of the market’s gains came from the so-called “Magnificent Seven” tech stocks. It made for great headlines, but under the surface, most companies were actually lagging. In fact, 2024 saw the lowest breadth in 25 years.

But this year looks different. We had a hiccup back in April, but since then, the market has recovered. As of June 12, roughly 46% of S&P 500 companies have outpaced the index’s 1.8% year-to-date gain—much closer to the long-term average of 48%.

Why does this matter? Because broader participation often signals healthier market conditions. In years when stock market breadth is increasing, it usually coincides with bull markets or early-cycle recoveries, like after the dot-com bust (early 2000s), the financial crisis (2009–2010), or the post-Covid rally.

The bottom line? An expanding number of stocks doing well—a broader market—is a better market.