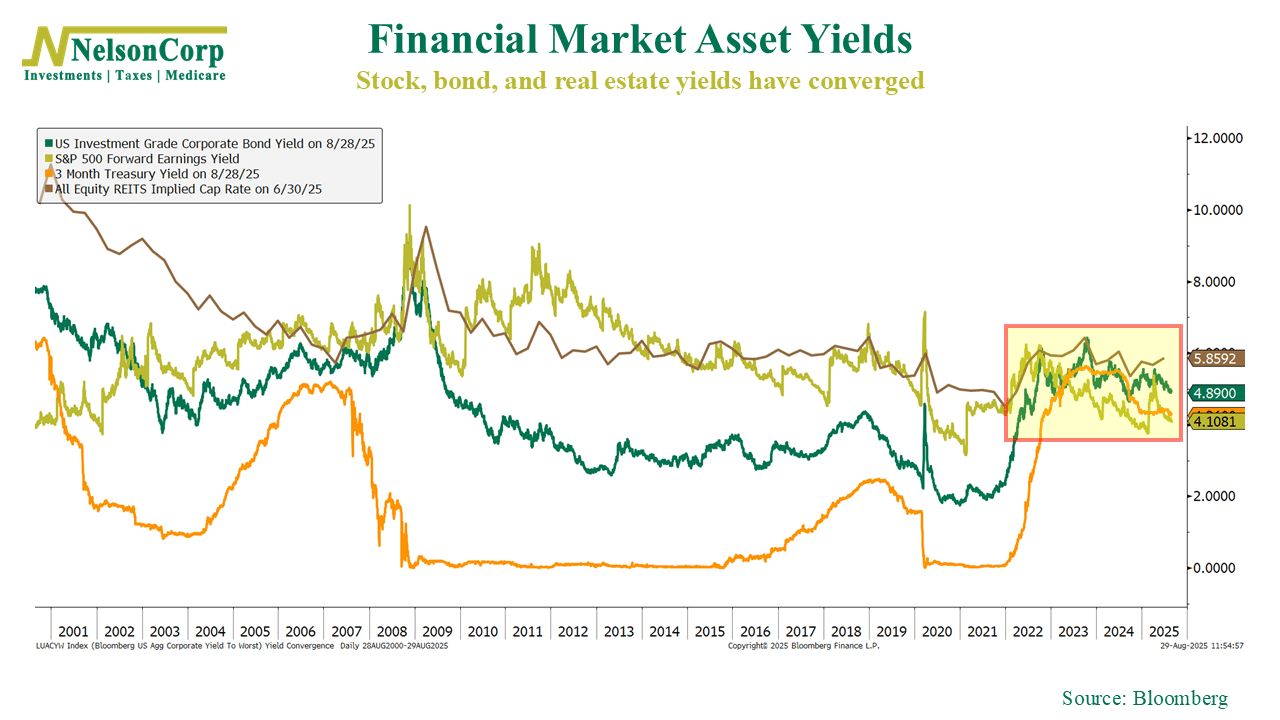

Something a bit unusual is happening in financial markets right now. The income, or “yield,” you can earn from stocks, bonds, and even real estate (REITs) has all started to look the same. That doesn’t happen very often.

This week’s chart shows what I mean. Each line tracks the yield from a different type of investment—stocks, bonds, and REITs. Normally, these lines are spread apart. Stocks and real estate sit higher because they’re riskier; bonds sit lower because they’re safer. But today, the lines have all converged.

One way to read this is confusion. Investors aren’t sure where growth, inflation, or Fed policy is headed, so the rewards for risk have bunched together.

Why does that matter? When yields across different investments all look alike, investors aren’t really being rewarded for taking on extra risk. It’s a sign the market is still trying to make sense of an uncertain future.

For investors, the takeaway is simple: even though markets may feel calm, the environment underneath is unsettled. When the usual signals aren’t clear, having a disciplined process to guide decisions becomes even more important.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.