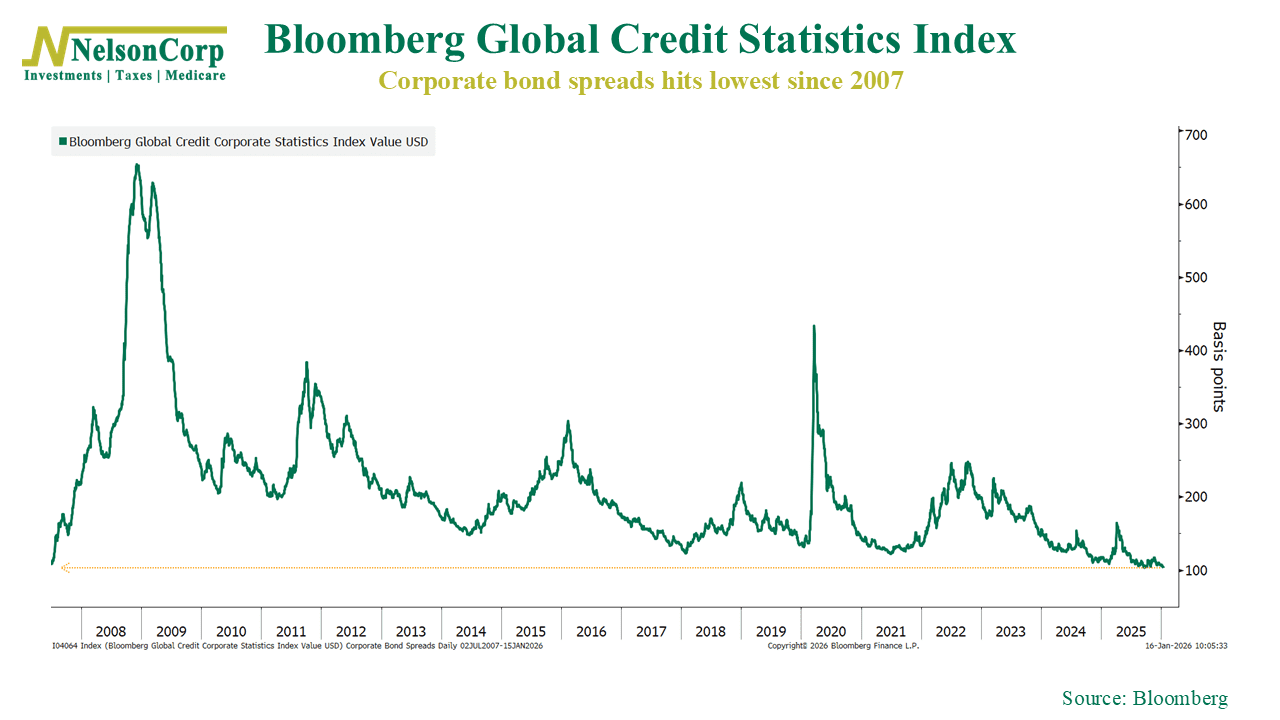

How do we know when investors are gearing up to embrace risk? We look at credit spreads, the featured metric in this week’s chart shown above.

What are credit spreads? Simply put, they are the extra interest investors earn for lending money to companies instead of the government. On the chart, the higher the line, the higher the rates on global corporate bonds versus government bonds, and vice versa.

As you can see, those spreads are very tight right now. They are currently near the lowest level we’ve seen in roughly 20 years. Investors are only demanding about 100 basis points, or 1 percentage point, of extra yield to invest in corporate bonds instead of government bonds.

In a way, this is a sign of complacency. There are a growing number of risks out there, from unpredictable U.S. policy to geopolitical tensions and other company-specific risks. But money managers don’t want to miss out, so they are increasingly willing to accept smaller amounts of compensation.

In the near term, though, we see this mostly as a positive development, at least as far as our modeling process is concerned. Tighter credit spreads mean investors are embracing risk, which generally creates a supportive backdrop for stronger equity returns. If that trend starts to reverse and spreads begin to widen, then we would start to see warning signs that the mood in the market has shifted for the worse.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.